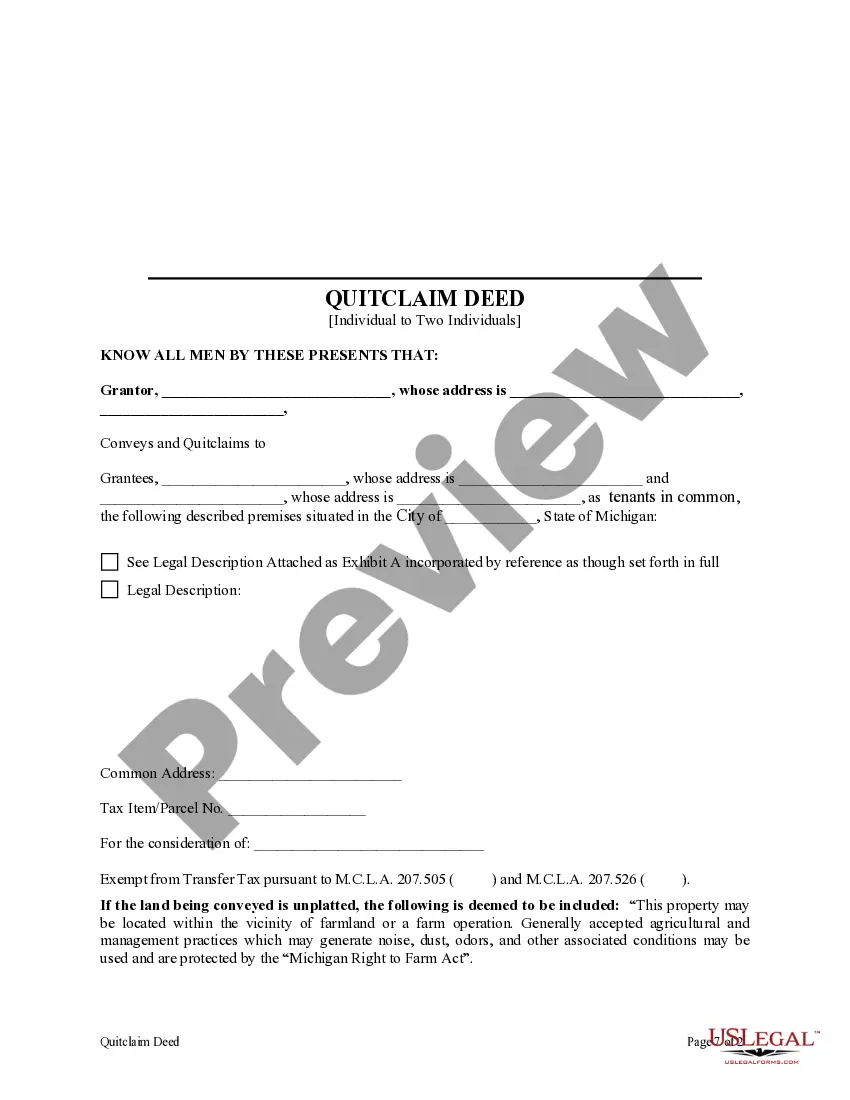

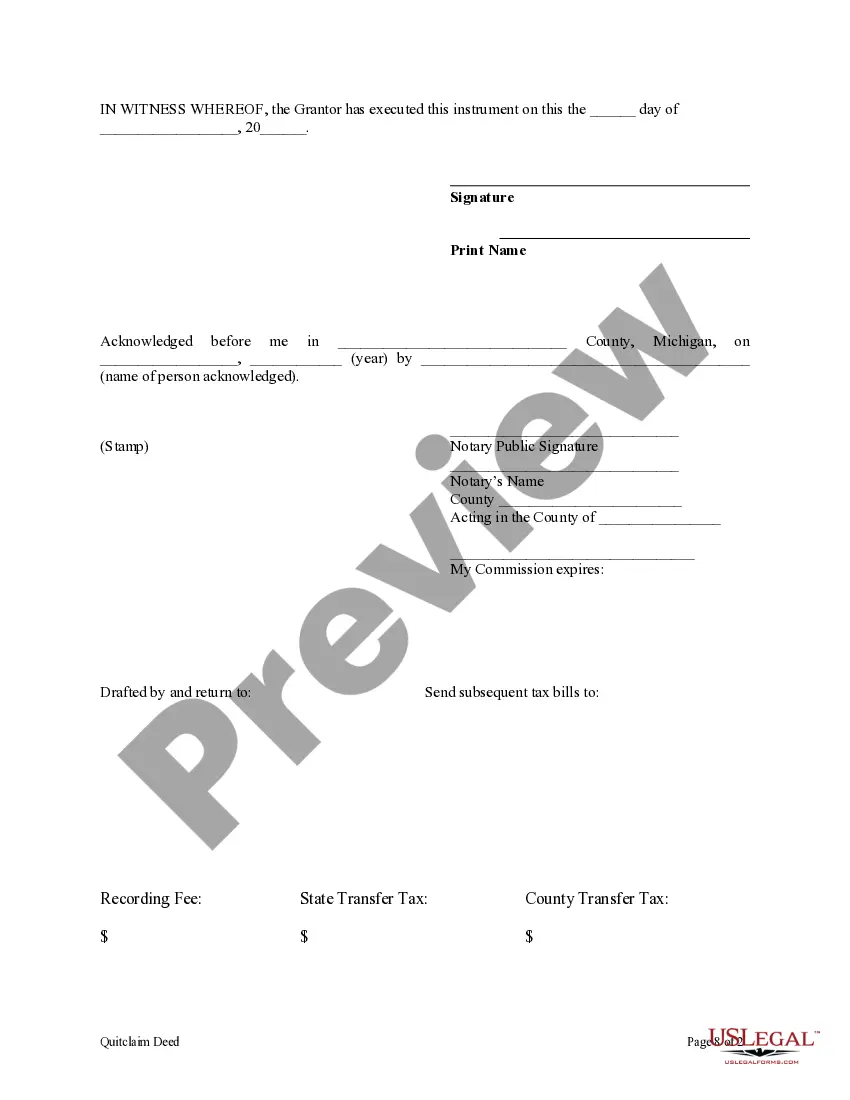

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees. Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

The Oakland Michigan Quitclaim Deed from Individual Granter to Two Individual Grantees is a legal document that transfers the ownership of a property from an individual granter to two separate individual grantees. This type of deed is commonly used when the granter wants to transfer their interest in a property without making any warranties regarding the property's title. In Oakland County, Michigan, there are multiple types of Quitclaim Deeds available depending on the specific situation or circumstances. Some common variants include: 1. Joint Tenant with Rights of Survivorship: This type of quitclaim deed allows the granter to transfer the property to two grantees who will hold equal shares of ownership. In the event of the death of one grantee, the surviving grantee automatically inherits the deceased grantee's interest. 2. Tenants in Common: This variant of the quitclaim deed allows the granter to transfer the property to two grantees, but unlike joint tenancy, they may hold unequal shares of ownership. Each grantee has the right to transfer, sell, or mortgage their individual shares without the consent of the other. 3. Husband and Wife: Specifically designed for married couples, this variation transfers the property from the granter spouse to both spouses as grantees. It provides joint ownership and allows them to hold the property as tenants by the entirety, which grants certain legal protections in case of a divorce or death. Generally, the Oakland Michigan Quitclaim Deed from Individual Granter to Two Individual Grantees includes crucial information such as the names and addresses of the granter and grantees, the legal description of the property being transferred, the consideration (if any) exchanged for the transfer, and the signatures of all parties involved. It is essential to consult an attorney or real estate professional to ensure the correct documentation and transfer process in accordance with applicable laws and regulations.