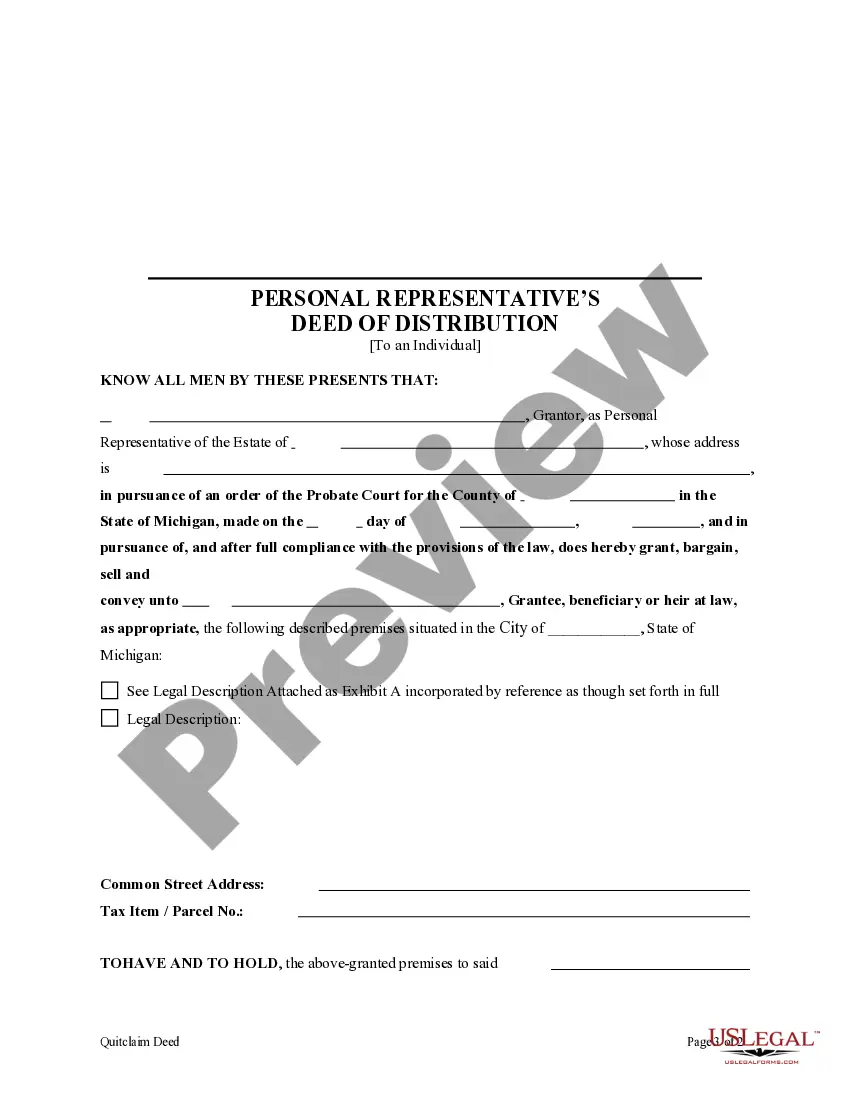

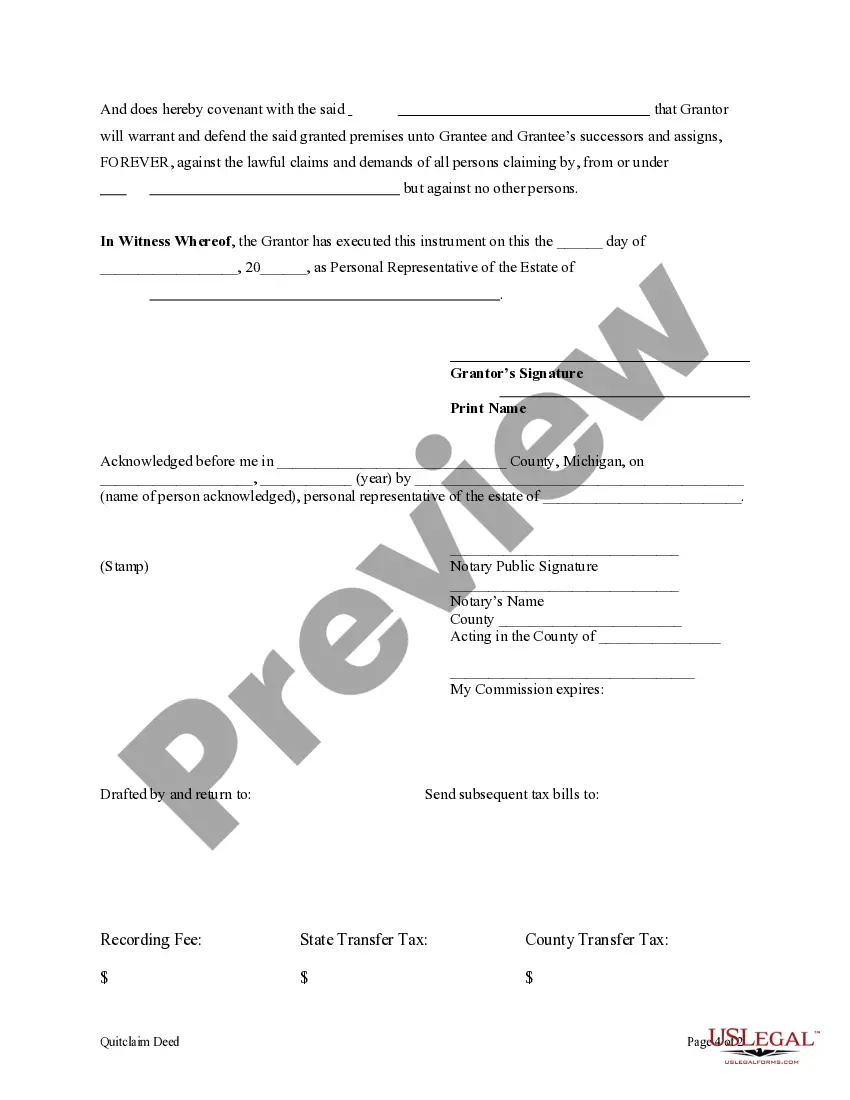

This form is a Personal Representative's Deed where the grantor is the individual appointed as Personal Represenative of an estate and the grantee is the beneficiary or heir at law of the real property from the estate. Grantor conveys the described property to grantee and only covenants that the transfer is authorized by the Court, that the grantor has done nothing while serving as administrator to encumber the property, an dthat the Grantor will defend title but only as to individuals claimanting by, through and under Grantor. This deed complies with all state statutory laws.

Ann Arbor Michigan Personal Representative's Deed of Distribution to an Individual

Description

How to fill out Michigan Personal Representative's Deed Of Distribution To An Individual?

Regardless of social or occupational rank, completing legal documents is a regrettable requirement in modern society.

Frequently, it’s nearly impossible for an individual lacking any legal expertise to generate such documents from scratch, primarily because of the intricate jargon and legal nuances they entail.

This is where US Legal Forms can come to the rescue. Our service offers an extensive assortment with over 85,000 ready-to-use state-specific forms that cater to nearly any legal scenario.

Click 'Buy now' and select the subscription plan that best suits your needs, logging in with your account or creating a new one.

Select the payment processor and proceed to download the Ann Arbor Michigan Personal Representative's Deed of Distribution to an Individual once the payment is confirmed.

- Whether you need the Ann Arbor Michigan Personal Representative's Deed of Distribution to an Individual or another type of documentation that is appropriate for your state or region, US Legal Forms has everything readily available.

- To quickly obtain the Ann Arbor Michigan Personal Representative's Deed of Distribution to an Individual using our dependable service, if you are already a registered customer, you can proceed to Log In to your account to access the required form.

- However, if you are not acquainted with our collection, please ensure to follow these instructions prior to downloading the Ann Arbor Michigan Personal Representative's Deed of Distribution to an Individual.

- Confirm that the document you have located is appropriate for your region since the laws of one state or area do not apply to another.

- Examine the document and read a brief summary (if available) of situations the form can be utilized for.

- If the form you selected does not meet your requirements, you can restart and search for the correct document.

Form popularity

FAQ

(g) That, if the estate is not settled within 1 year after the personal representative's appointment, within 28 days after the anniversary of the appointment, the personal representative must file with the court and send to each interested person a notice that the estate remains under administration and must specify

When someone dies without a will they are said to have died 'intestate' and no one has immediate authority to act as their personal representative. Instead, one of their relatives needs to apply to the Probate Registry for a grant of letters of administration.

A PR deed includes information about the probated estate, including the decedent's name, county in which probate is open, probate file number, and source of authorization for the conveyance. All requirements of form and content for instruments pertaining to real property must be met.

If you want to be the personal representative, complete the Application for Informal Probate and/ or Appointment of Personal Representative form. File the form, the decedent's will (if there is one), and a certified copy of the death certificate with the county probate court where the decedent lived.

Who can be a Personal Representative? A person named in the decedent's will as personal representative. A surviving spouse if he or she is beneficiary under the will. Other beneficiaries under the will. The surviving spouse if he or she is not a beneficiary under the will. Other heirs of the decedent.

Who Can Serve As A Personal Representative? An individual appointed as Personal Representative in the decedent's Will. The surviving spouse, if the spouse is a beneficiary under the Will. Other beneficiaries of the Will. The surviving spouse if he or she is not a beneficiary under the Will. Other heirs of the decedent.

If you want to be the personal representative, complete the Application for Informal Probate and/ or Appointment of Personal Representative form. File the form, the decedent's will (if there is one), and a certified copy of the death certificate with the county probate court where the decedent lived.

The personal representative is the person in charge of administering the estate. The beneficiaries are decedent's heirs and those who benefit from the estate's assets. When it comes to administering the estate or distributing estate property, beneficiaries and personal representatives don't always see eye to eye.

A personal representative is under a duty to settle and distribute the decedent's estate in accordance with the terms of a probated and effective will and this act, and as expeditiously and efficiently as is consistent with the best interests of the estate.