This form is a Personal Representative's Deed where the grantor is the individual appointed as Personal Represenative of an estate and the grantee is the beneficiary or heir at law of the real property from the estate. Grantor conveys the described property to grantee and only covenants that the transfer is authorized by the Court, that the grantor has done nothing while serving as administrator to encumber the property, an dthat the Grantor will defend title but only as to individuals claimanting by, through and under Grantor. This deed complies with all state statutory laws.

Detroit Michigan Personal Representative's Deed of Distribution to an Individual

Description

How to fill out Michigan Personal Representative's Deed Of Distribution To An Individual?

Locating authenticated templates tailored to your local laws can be difficult unless you utilize the US Legal Forms database.

This is an online repository of over 85,000 legal documents catering to both personal and professional needs across various real-world scenarios.

All documents are accurately sorted by category and jurisdictional areas, making it simple and straightforward to find the Detroit Michigan Personal Representative's Deed of Distribution to an Individual.

Maintaining organized paperwork that adheres to legal standards is crucial. Leverage the US Legal Forms library to have vital document templates readily available for your needs!

- Review the Preview mode and form description.

- Ensure that you have chosen the correct form that fits your needs and complies with your local legal standards.

- Look for another template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one.

- If it meets your requirements, proceed to the next step.

Form popularity

FAQ

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.

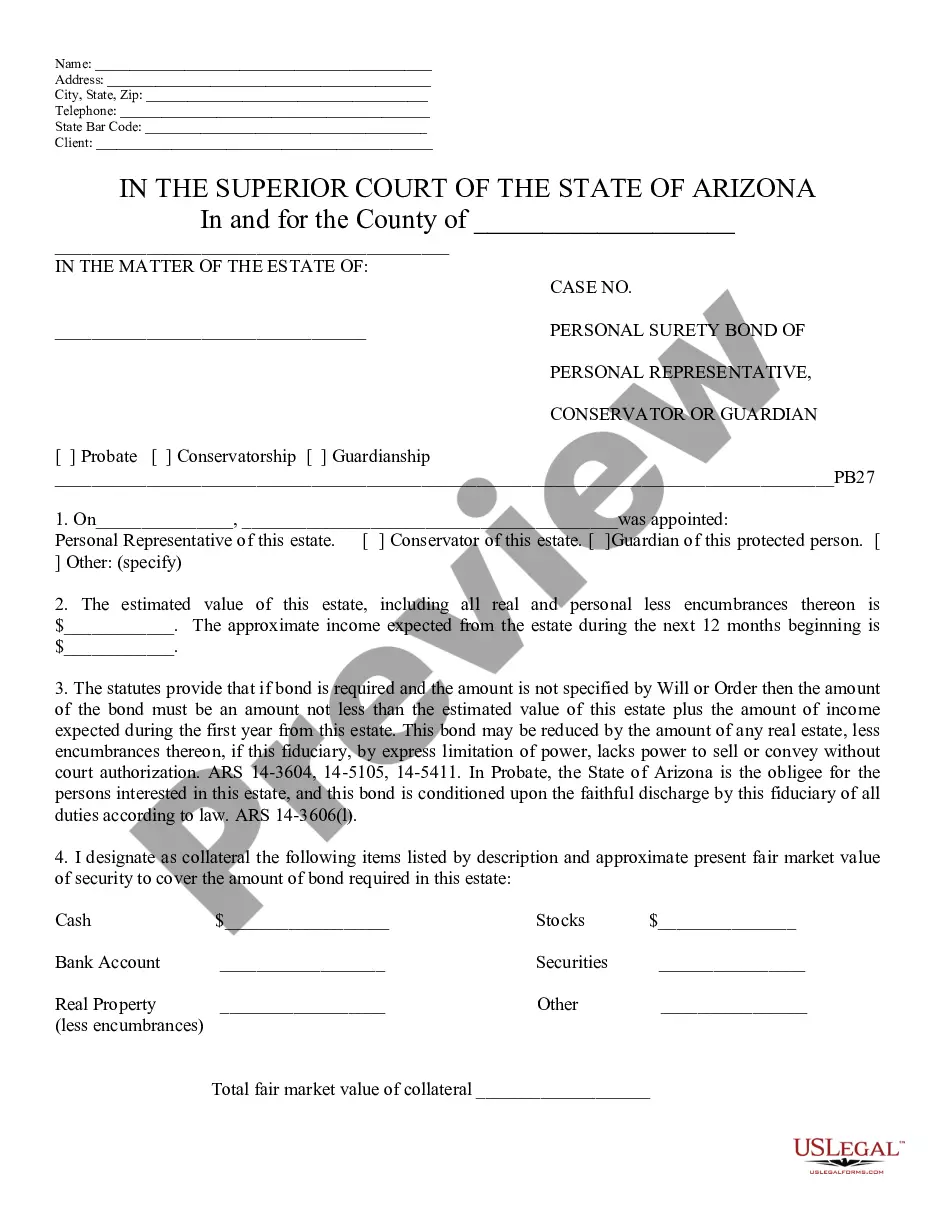

Once the Grant has been received the personal representative has a duty to collect in the assets of the deceased, pay the liabilities and distribute the estate to the beneficiaries. They have many powers to assist them when dealing with an estate e.g. power to sell property, insure property and invest monies, etc.

The Personal Representative may also sell real estate owned by the Decedent. All monies from the sale of these assets are then deposited into a an ?estate? bank account. The Personal Representative must first pay creditor claims, final expenses of the deceased, administration expenses, and other authorized expenses.

Over 18 years of age and ? The surviving spouse of the decedent, ? An adult child of the decedent, ? A parent of the decedent, ? A brother or sister of the decedent, ? A person entitled to property of the decedent, ? A person who was named as personal representative by will, or ? You are a creditor and 45 days have

Letters of Authority: A document issued by the court evidencing the personal representative's authority to act. Nominee: The person seeking to be appointed personal representative. Personal representative: A person at least 18 years of age who has been appointed to administer the estate of the decedent.

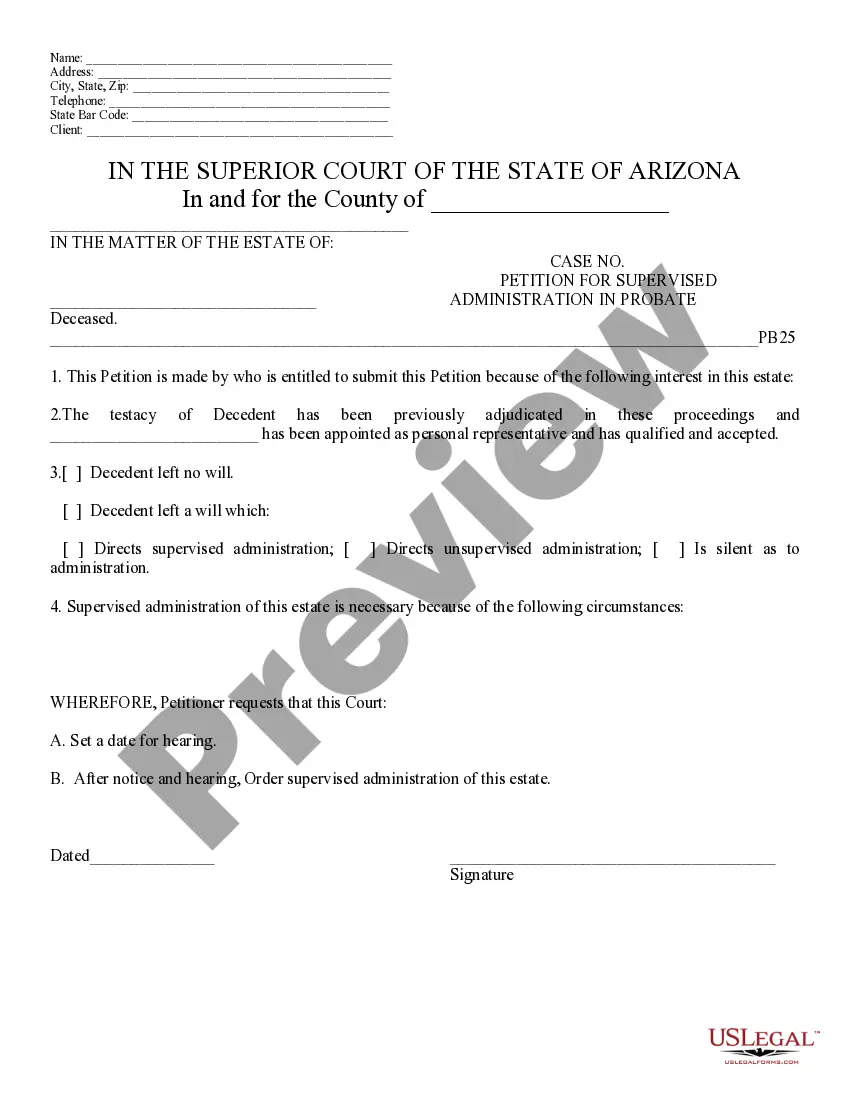

A PR deed includes information about the probated estate, including the decedent's name, county in which probate is open, probate file number, and source of authorization for the conveyance. All requirements of form and content for instruments pertaining to real property must be met.

As long as they meet the legal requirements of being an executor?being of age and capable of carrying out an executor's duties?a beneficiary can be an estate's executor.

Personal representatives administer wills and estates in Colorado. This role comes with several responsibilities. Understanding what those are and how to fulfill them is crucial to efficient estate administration. It's also essential to avoid any allegations that fiduciary duties may have been breached.

The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.