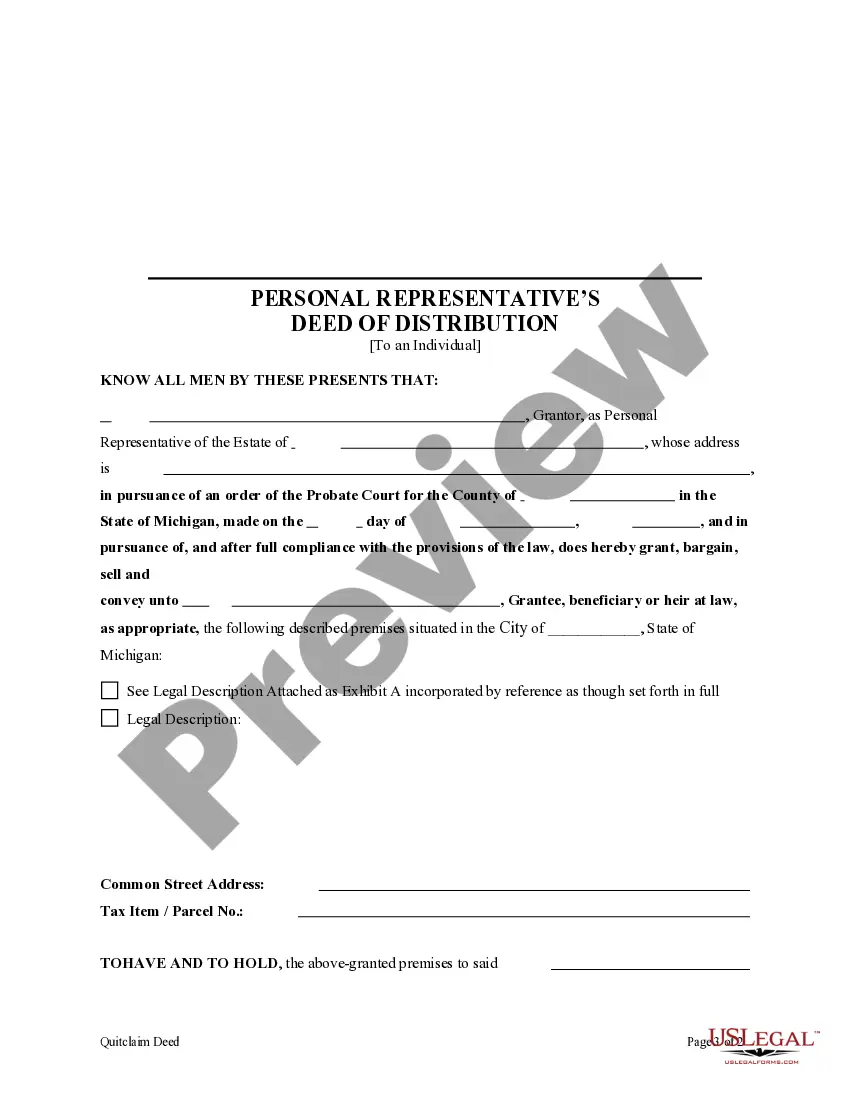

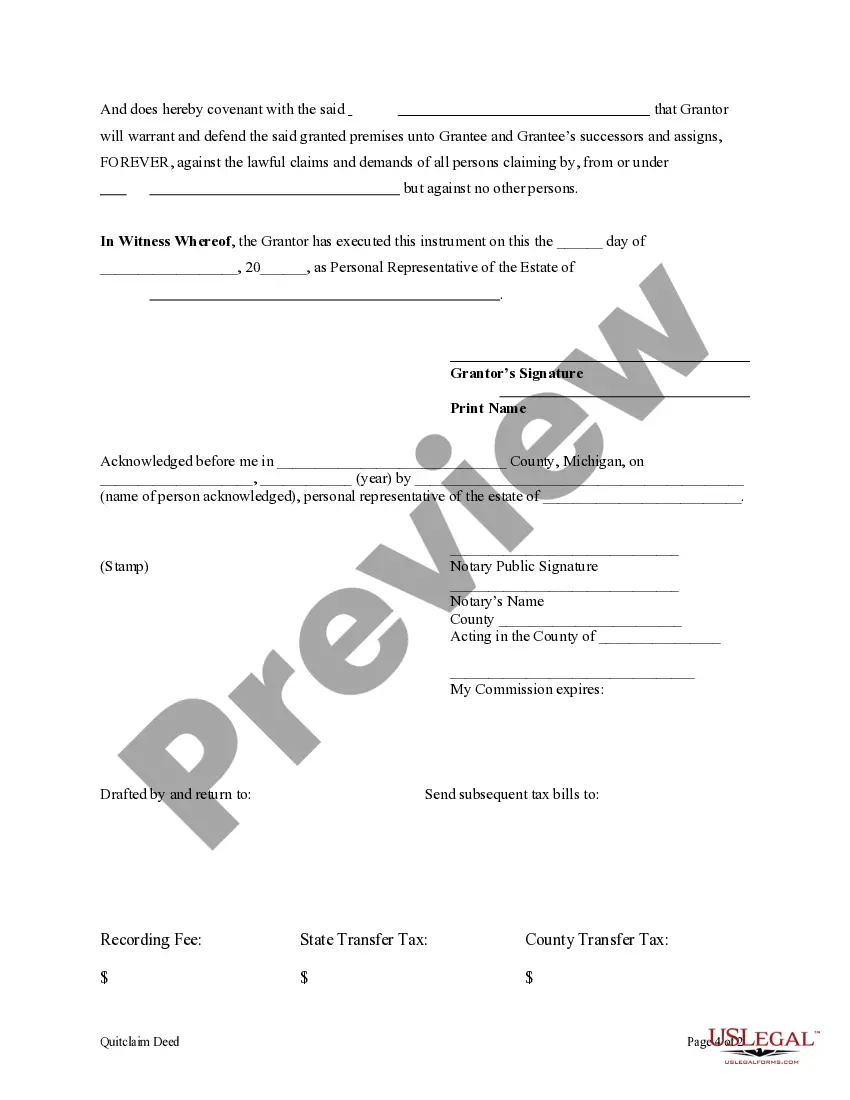

This form is a Personal Representative's Deed where the grantor is the individual appointed as Personal Represenative of an estate and the grantee is the beneficiary or heir at law of the real property from the estate. Grantor conveys the described property to grantee and only covenants that the transfer is authorized by the Court, that the grantor has done nothing while serving as administrator to encumber the property, an dthat the Grantor will defend title but only as to individuals claimanting by, through and under Grantor. This deed complies with all state statutory laws.

Grand Rapids Michigan Personal Representative's Deed of Distribution to an Individual is a legal document that outlines the transfer of assets or property from an estate to a specific individual, also known as the distributed or beneficiary. This deed is typically prepared by the personal representative or executor appointed by the court to administer the estate. Keywords: Grand Rapids Michigan, Personal Representative's Deed, Distribution, Individual, Estate, Assets, Property, Beneficiary, Executor, Court. Different types of Grand Rapids Michigan Personal Representative's Deed of Distribution to an Individual may include: 1. Real Estate Deed of Distribution: This type of deed transfers ownership of real estate property from the estate to the named beneficiary. 2. Financial Asset Deed of Distribution: This deed handles the transfer of financial assets such as bank accounts, investments, stocks, or bonds to the designated individual. 3. Personal Property Deed of Distribution: This document facilitates the transfer of personal belongings, such as furniture, vehicles, artwork, or jewelry, from the estate to the beneficiary. 4. Business Interest Deed of Distribution: In the case where the deceased individual had business ownership or shares, this deed ensures the seamless transfer of business interests to the specified individual. 5. Inheritance Tax Deed of Distribution: This deed is specific to inheritance tax matters, ensuring compliance with relevant tax regulations when transferring assets to the beneficiary. 6. Trust Asset Deed of Distribution: If the estate had assets held in a trust, this deed coordinates the distribution of those assets to the beneficiary, as stipulated in the trust agreement. It is important to consult an experienced estate planning or probate attorney in Grand Rapids, Michigan, to ensure the accurate preparation and execution of the Personal Representative's Deed of Distribution to an Individual, as it involves legal complexities and compliance with state laws.Grand Rapids Michigan Personal Representative's Deed of Distribution to an Individual is a legal document that outlines the transfer of assets or property from an estate to a specific individual, also known as the distributed or beneficiary. This deed is typically prepared by the personal representative or executor appointed by the court to administer the estate. Keywords: Grand Rapids Michigan, Personal Representative's Deed, Distribution, Individual, Estate, Assets, Property, Beneficiary, Executor, Court. Different types of Grand Rapids Michigan Personal Representative's Deed of Distribution to an Individual may include: 1. Real Estate Deed of Distribution: This type of deed transfers ownership of real estate property from the estate to the named beneficiary. 2. Financial Asset Deed of Distribution: This deed handles the transfer of financial assets such as bank accounts, investments, stocks, or bonds to the designated individual. 3. Personal Property Deed of Distribution: This document facilitates the transfer of personal belongings, such as furniture, vehicles, artwork, or jewelry, from the estate to the beneficiary. 4. Business Interest Deed of Distribution: In the case where the deceased individual had business ownership or shares, this deed ensures the seamless transfer of business interests to the specified individual. 5. Inheritance Tax Deed of Distribution: This deed is specific to inheritance tax matters, ensuring compliance with relevant tax regulations when transferring assets to the beneficiary. 6. Trust Asset Deed of Distribution: If the estate had assets held in a trust, this deed coordinates the distribution of those assets to the beneficiary, as stipulated in the trust agreement. It is important to consult an experienced estate planning or probate attorney in Grand Rapids, Michigan, to ensure the accurate preparation and execution of the Personal Representative's Deed of Distribution to an Individual, as it involves legal complexities and compliance with state laws.