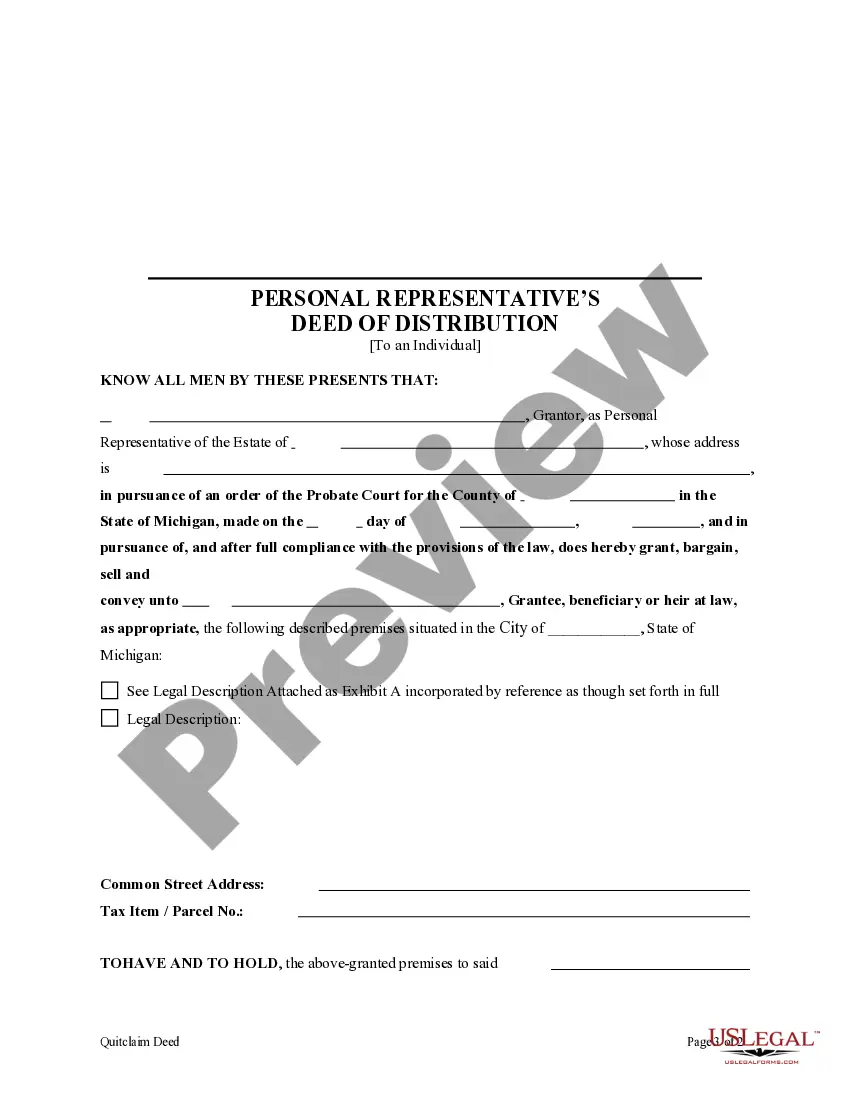

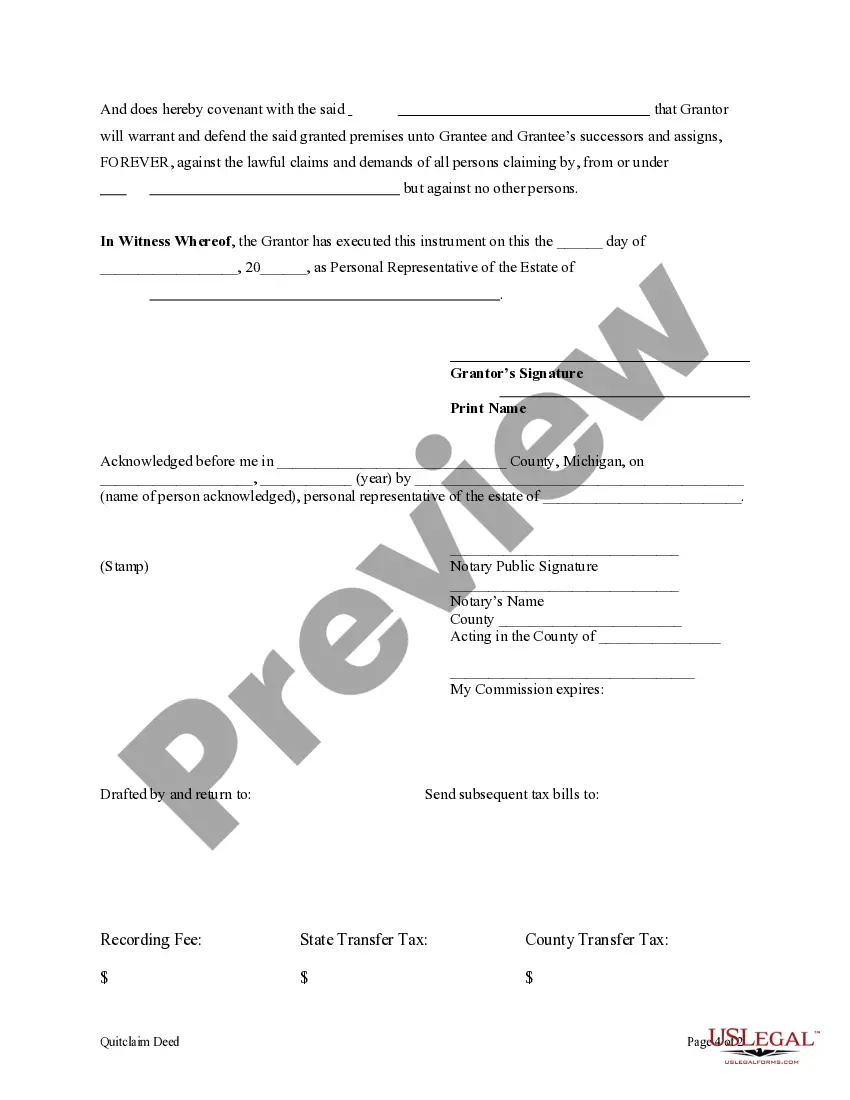

This form is a Personal Representative's Deed where the grantor is the individual appointed as Personal Represenative of an estate and the grantee is the beneficiary or heir at law of the real property from the estate. Grantor conveys the described property to grantee and only covenants that the transfer is authorized by the Court, that the grantor has done nothing while serving as administrator to encumber the property, an dthat the Grantor will defend title but only as to individuals claimanting by, through and under Grantor. This deed complies with all state statutory laws.

Oakland Michigan Personal Representative's Deed of Distribution to an Individual

Description

How to fill out Michigan Personal Representative's Deed Of Distribution To An Individual?

Irrespective of social or professional standing, completing law-related documents is a regrettable requirement in today’s workplace. More often than not, it’s nearly impossible for individuals lacking any legal experience to create this type of paperwork from the ground up, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms can be a game changer. Our platform offers an extensive catalog with over 85,000 ready-to-utilize state-specific documents suitable for nearly any legal matter. US Legal Forms also represents an outstanding resource for associates or legal advisors who wish to conserve time by using our DIY papers.

Whether you need the Oakland Michigan Personal Representative's Deed of Distribution to an Individual or another document that will be recognized in your state or county, with US Legal Forms, everything is readily available. Here’s how you can obtain the Oakland Michigan Personal Representative's Deed of Distribution to an Individual in minutes using our reliable service. If you are already a current customer, you may proceed to Log In to download the required form.

You’re ready! Now you can move ahead and print the form or complete it online. Should any issues arise with acquiring your purchased forms, you can easily retrieve them in the My documents section.

Whatever circumstance you’re endeavoring to address, US Legal Forms has got you covered. Test it out today and witness the difference.

- Confirm that the form you have located is appropriate for your jurisdiction since the laws of one state or county may not apply to another state or county.

- Examine the form and read a brief summary (if available) of the cases for which the document can be utilized.

- If the selected document doesn’t satisfy your requirements, you can restart and search for the appropriate form.

- Click Buy now and select the subscription plan that best suits your needs.

- Access an account {using your credentials or register for one from scratch.

- Select the payment method and proceed to download the Oakland Michigan Personal Representative's Deed of Distribution to an Individual as soon as the payment is processed.

Form popularity

FAQ

Who can be a Personal Representative? A person named in the decedent's will as personal representative. A surviving spouse if he or she is beneficiary under the will. Other beneficiaries under the will. The surviving spouse if he or she is not a beneficiary under the will. Other heirs of the decedent.

Definition of a personal representative If the person who has died left a valid will: The person named on the grant of Probate (or Letters of Administration with will annexed) or. If Probate was not granted to the will, the executor named in the will, or.

(g) That, if the estate is not settled within 1 year after the personal representative's appointment, within 28 days after the anniversary of the appointment, the personal representative must file with the court and send to each interested person a notice that the estate remains under administration and must specify

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

A PR deed includes information about the probated estate, including the decedent's name, county in which probate is open, probate file number, and source of authorization for the conveyance. All requirements of form and content for instruments pertaining to real property must be met.

The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

Executor Fees in Michigan For example, if in the last year, executor fees were typically 1.5%, then 1.5% would be considered reasonable and 3% may be unreasonable. But the court can take into account other factors such as how complicated the estate is to administer and may increase or decrease the amount from there.

A personal representative is under a duty to settle and distribute the decedent's estate in accordance with the terms of a probated and effective will and this act, and as expeditiously and efficiently as is consistent with the best interests of the estate.