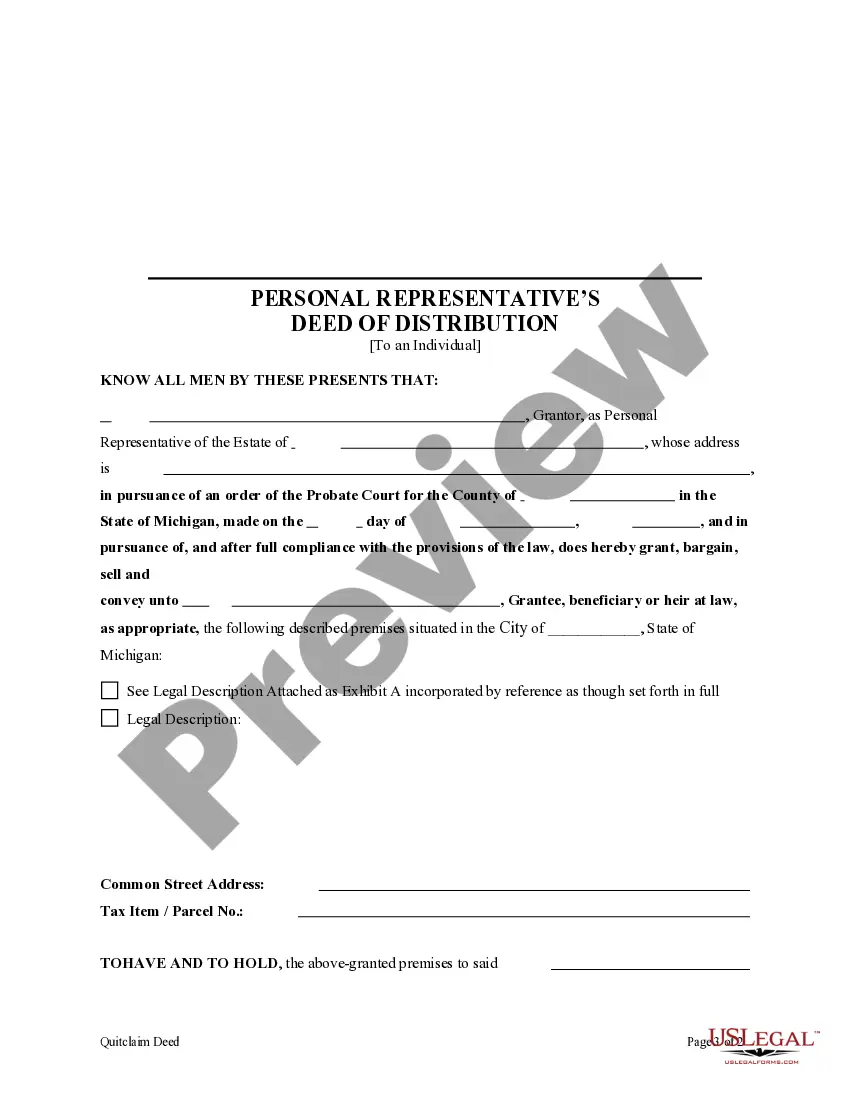

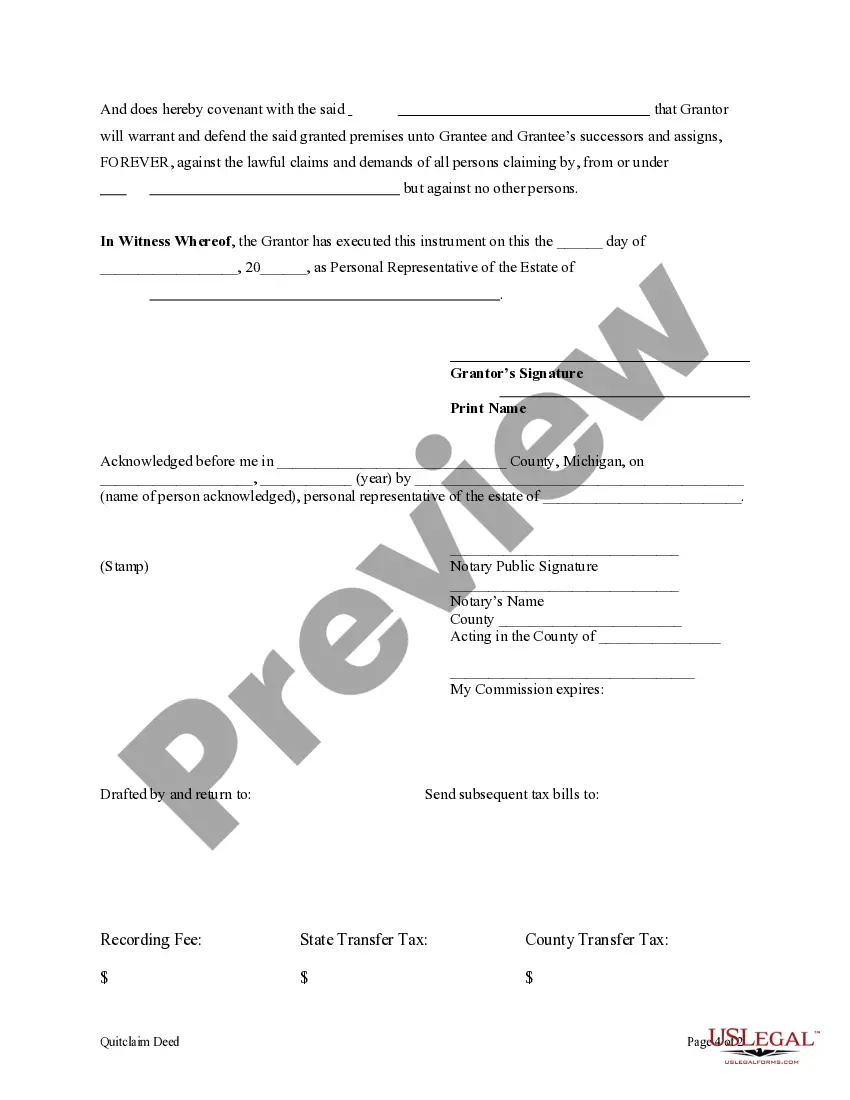

This form is a Personal Representative's Deed where the grantor is the individual appointed as Personal Represenative of an estate and the grantee is the beneficiary or heir at law of the real property from the estate. Grantor conveys the described property to grantee and only covenants that the transfer is authorized by the Court, that the grantor has done nothing while serving as administrator to encumber the property, an dthat the Grantor will defend title but only as to individuals claimanting by, through and under Grantor. This deed complies with all state statutory laws.

A Personal Representative's Deed of Distribution in Sterling Heights, Michigan is an important legal document that transfers the ownership of real estate assets to an individual(s). This deed serves as proof that the personal representative of an estate has distributed the property to its rightful beneficiaries or heirs. It is crucial to understand the various types of Personal Representative's Deed of Distribution to an Individual in Sterling Heights, Michigan to ensure the property transfer is legally valid. Some common types of Deeds of Distribution include: 1. General Personal Representative's Deed of Distribution: This type of deed is used when the beneficiaries or heirs are specifically named, and the personal representative distributes the property according to the decedent's will or probate laws. The deed ensures a smooth transfer of ownership to the intended individuals. 2. Special Personal Representative's Deed of Distribution: In certain situations, a personal representative may need to distribute the property to an individual who is not a direct beneficiary or heir. This special deed is used to transfer ownership to such individuals, and it requires specific legal justification and court approval. 3. Personal Representative's Deed of Distribution without Court Confirmation: If all the beneficiaries or heirs unanimously agree on the property distribution, and there are no disputes or objections, this type of deed can be used. It avoids the need for court confirmation, making the transfer process more efficient. 4. Personal Representative's Deed of Distribution with Court Confirmation: In some cases, court confirmation is required for the property distribution. This type of deed is used to transfer ownership after the court approves the personal representative's proposed distribution plan, ensuring compliance with probate laws. A Sterling Heights, Michigan Personal Representative's Deed of Distribution to an Individual contains essential information such as the names of the deceased, the personal representative, the beneficiaries or heirs, a detailed legal description of the property, and the transfer date. The deed must be signed by the personal representative, notarized, and recorded in the appropriate county clerk's office to finalize the transfer of ownership. It is crucial to seek legal advice or consult an experienced real estate attorney to ensure compliance with all applicable laws and regulations when drafting and executing a Personal Representative's Deed of Distribution in Sterling Heights, Michigan.