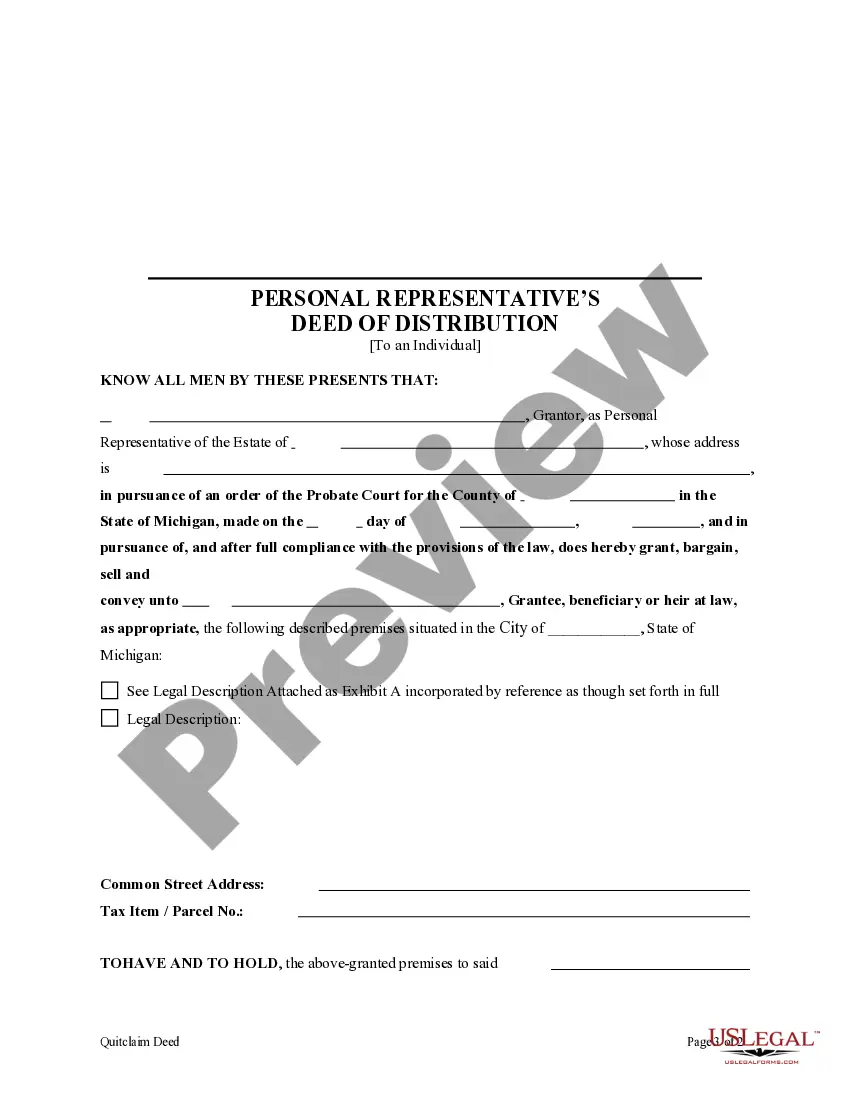

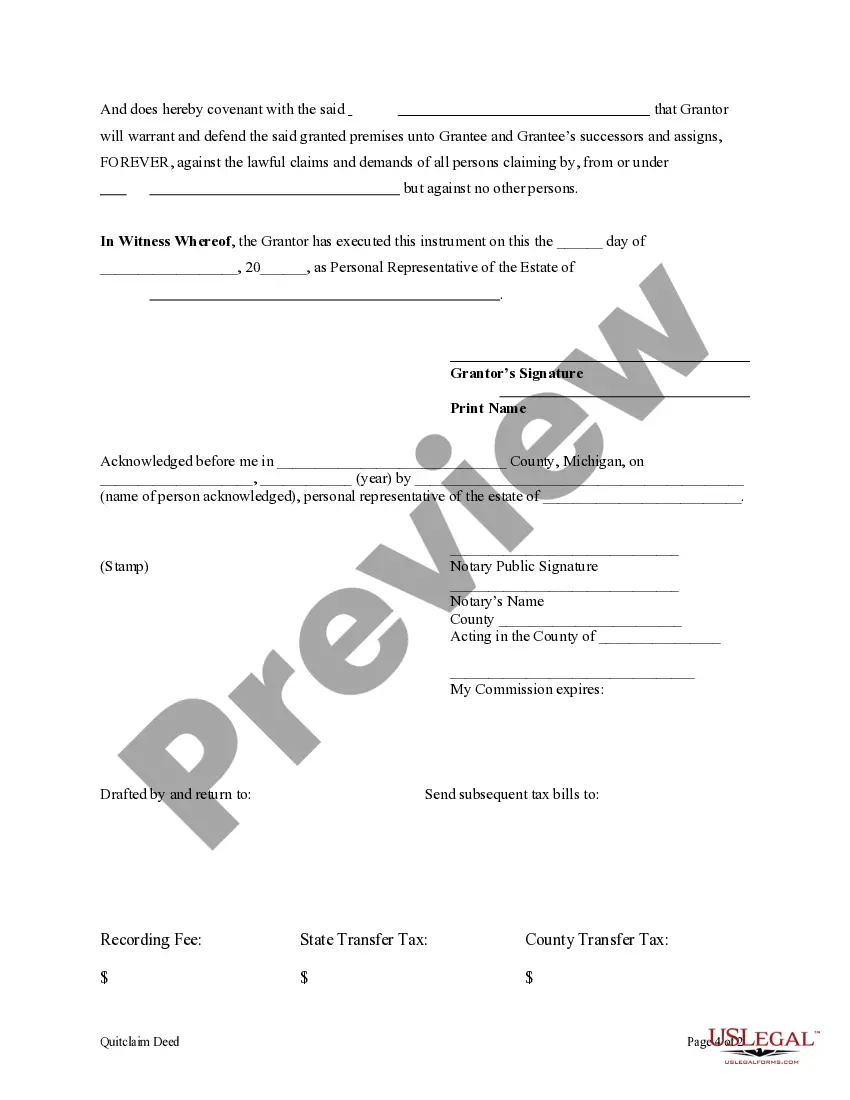

This form is a Personal Representative's Deed where the grantor is the individual appointed as Personal Represenative of an estate and the grantee is the beneficiary or heir at law of the real property from the estate. Grantor conveys the described property to grantee and only covenants that the transfer is authorized by the Court, that the grantor has done nothing while serving as administrator to encumber the property, an dthat the Grantor will defend title but only as to individuals claimanting by, through and under Grantor. This deed complies with all state statutory laws.

The Wayne Michigan Personal Representative's Deed of Distribution to an Individual is a legal document that outlines the process through which an estate's assets are distributed to specific individual beneficiaries by the personal representative or executor of the deceased person's estate. This deed of distribution holds significant importance in probate proceedings in Wayne County, Michigan, as it provides an authoritative record of the assets being transferred to the designated beneficiary or beneficiaries. It ensures a smooth transfer of ownership rights from the estate to the individual, safeguarding their legal interests. In Wayne County, Michigan, the Personal Representative's Deed of Distribution may come in various forms depending on the nature of the assets being transferred. Some common types include: 1. Real Estate Deed of Distribution: This type of deed is commonly used when the deceased person owned real property, such as a house, land, or commercial building. It outlines the detailed legal description of the property and identifies the individual who will receive ownership of it upon completion of the probate process. 2. Financial Asset Deed of Distribution: This form of the deed applies to financial assets like bank accounts, stocks, bonds, or investment portfolios held in the deceased person's name. The personal representative will identify the specific financial institutions involved and the individual who will inherit these assets. 3. Tangible Personal Property Deed of Distribution: It is used to distribute physical belongings like furniture, jewelry, artwork, vehicles, or any other personal possessions exclusive of real estate or financial assets. The deed will specify the details of each item being transferred and the individual who will receive them. Each type of deed of distribution is highly specific, ensuring the appropriate assets are properly transferred to the rightful individual beneficiary. These documents prevent potential disputes and legal complications, assuring a respectful and seamless transition of the deceased person's assets to the intended recipients. It is crucial to consult an attorney experienced in estate planning and probate law specific to Wayne County, Michigan, to draft and execute the Personal Representative's Deed of Distribution accurately. The attorney will guide the personal representative throughout the probate process, ensuring compliance with all legal requirements and maximizing the efficiency of asset distribution.The Wayne Michigan Personal Representative's Deed of Distribution to an Individual is a legal document that outlines the process through which an estate's assets are distributed to specific individual beneficiaries by the personal representative or executor of the deceased person's estate. This deed of distribution holds significant importance in probate proceedings in Wayne County, Michigan, as it provides an authoritative record of the assets being transferred to the designated beneficiary or beneficiaries. It ensures a smooth transfer of ownership rights from the estate to the individual, safeguarding their legal interests. In Wayne County, Michigan, the Personal Representative's Deed of Distribution may come in various forms depending on the nature of the assets being transferred. Some common types include: 1. Real Estate Deed of Distribution: This type of deed is commonly used when the deceased person owned real property, such as a house, land, or commercial building. It outlines the detailed legal description of the property and identifies the individual who will receive ownership of it upon completion of the probate process. 2. Financial Asset Deed of Distribution: This form of the deed applies to financial assets like bank accounts, stocks, bonds, or investment portfolios held in the deceased person's name. The personal representative will identify the specific financial institutions involved and the individual who will inherit these assets. 3. Tangible Personal Property Deed of Distribution: It is used to distribute physical belongings like furniture, jewelry, artwork, vehicles, or any other personal possessions exclusive of real estate or financial assets. The deed will specify the details of each item being transferred and the individual who will receive them. Each type of deed of distribution is highly specific, ensuring the appropriate assets are properly transferred to the rightful individual beneficiary. These documents prevent potential disputes and legal complications, assuring a respectful and seamless transition of the deceased person's assets to the intended recipients. It is crucial to consult an attorney experienced in estate planning and probate law specific to Wayne County, Michigan, to draft and execute the Personal Representative's Deed of Distribution accurately. The attorney will guide the personal representative throughout the probate process, ensuring compliance with all legal requirements and maximizing the efficiency of asset distribution.