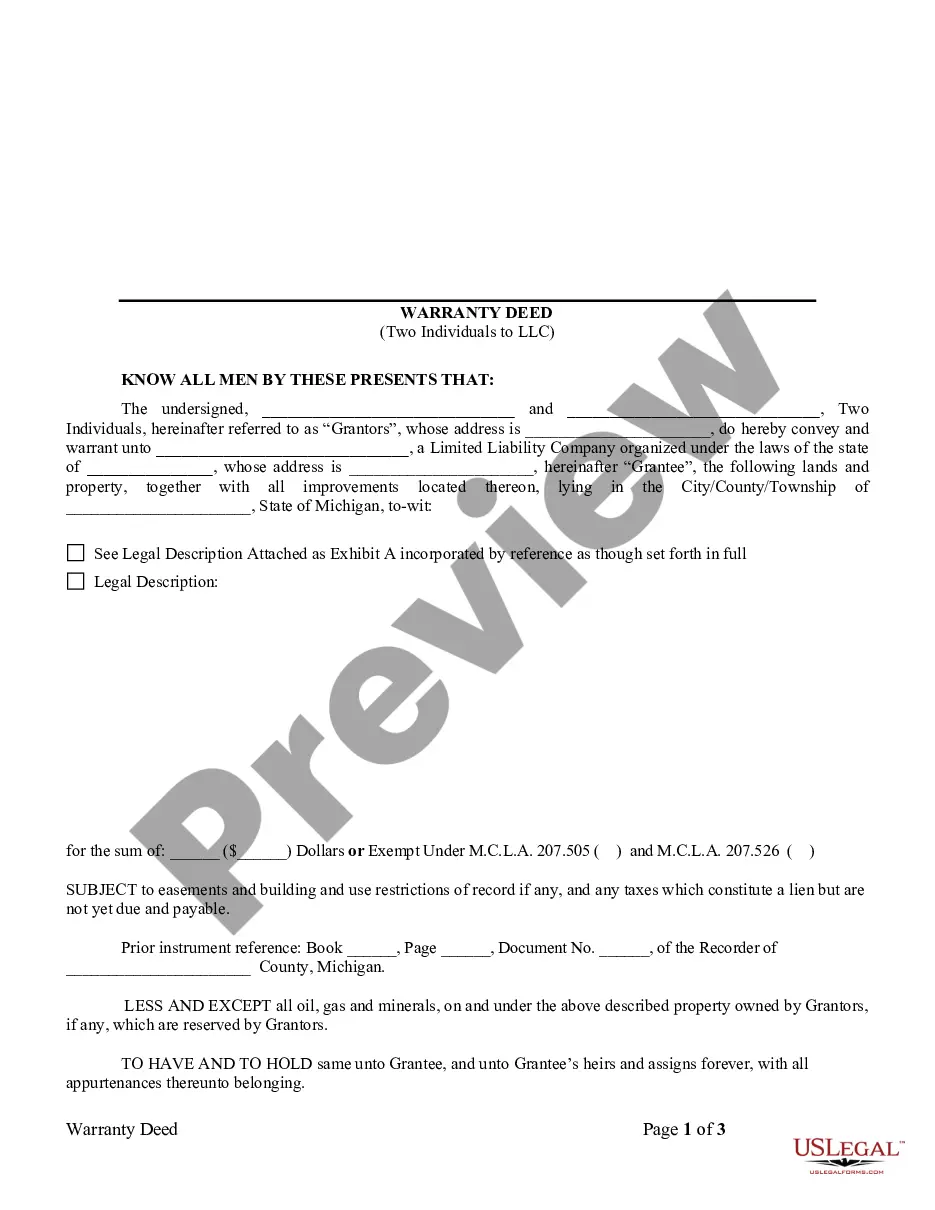

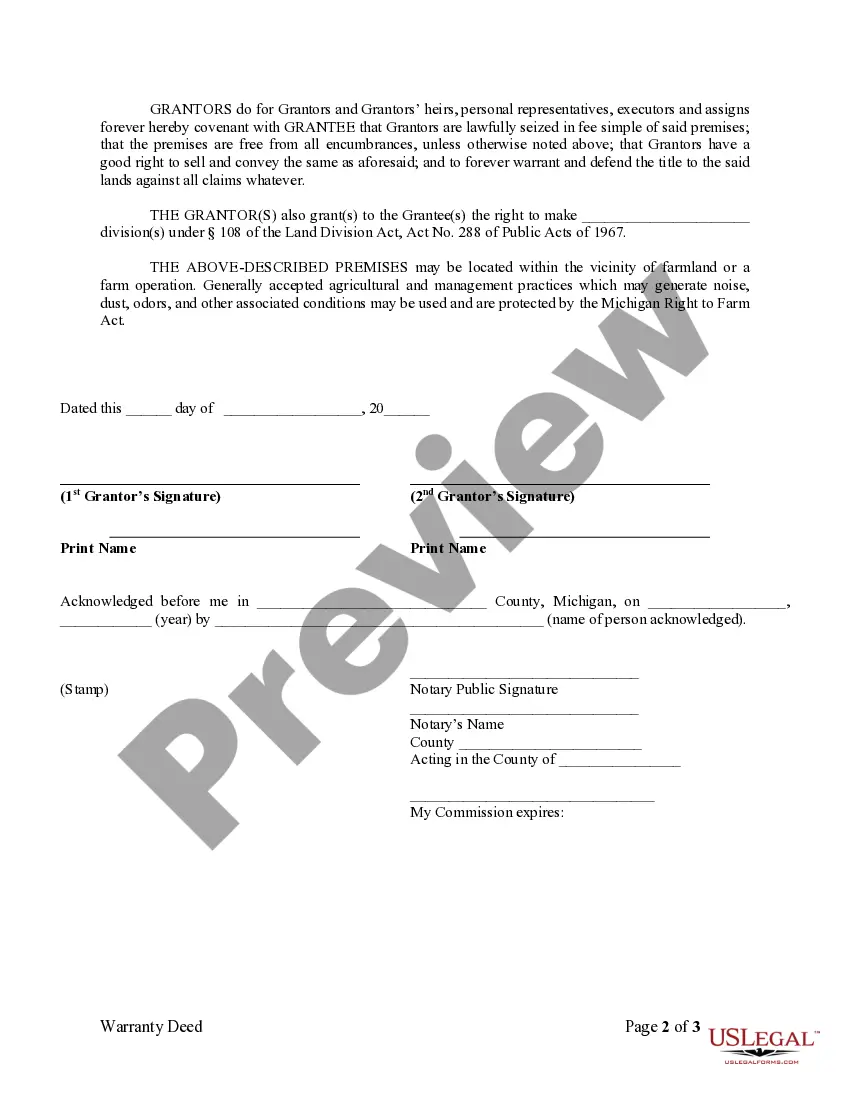

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Wayne Michigan Warranty Deed from two Individuals to an LLC is a legal document that facilitates the transfer of property ownership from two individuals to a Limited Liability Company (LLC) in Wayne County, Michigan. This particular type of deed offers a guarantee, or warranty, from the sellers (granters) to the LLC (grantee) that they have clear title to the property and that there are no undisclosed liens, claims, or encumbrances. In Wayne County, Michigan, there are several variations of a Warranty Deed that are commonly used: 1. General Warranty Deed: This is the most common type of warranty deed used in Wayne County, Michigan. It provides the highest level of protection to the buyer by ensuring that the sellers will defend their title against any claims that may arise, even if the issue existed before they acquired the property. 2. Special Warranty Deed: This type of warranty deed is similar to the general warranty deed, but the guarantee is limited to any claims or encumbrances that may have arisen during the sellers' ownership of the property. It does not provide protection against potential issues that existed prior to their ownership. 3. Bargain and Sale Deed: A bargain and sale deed is another type of deed used in Wayne County, Michigan, but it does not contain any warranty or guarantee. Sellers using this deed only convey whatever right, title, or interest they have in the property without providing any promises of clear title or protection against claims. When transferring ownership from two individuals to an LLC using any of these warranty deeds, the document should include pertinent information such as: — The names and addresses of thgrantersrs (individual sellers) and the grantee (LLC). — An accurate legal description of the property being transferred, including the parcel number, lot number, or any other identification details. — The purchase price or consideration for the transfer. — Any legal or financial conditions set forth for the transfer. — Signatures of thgrantersrs, notarization, and witnessing as required by Michigan law. — Filing and recording information, including the county and date of recording. It is crucial to consult with a real estate attorney or experienced professional when preparing or executing a Warranty Deed in Wayne County, Michigan, to ensure compliance with local laws and regulations.