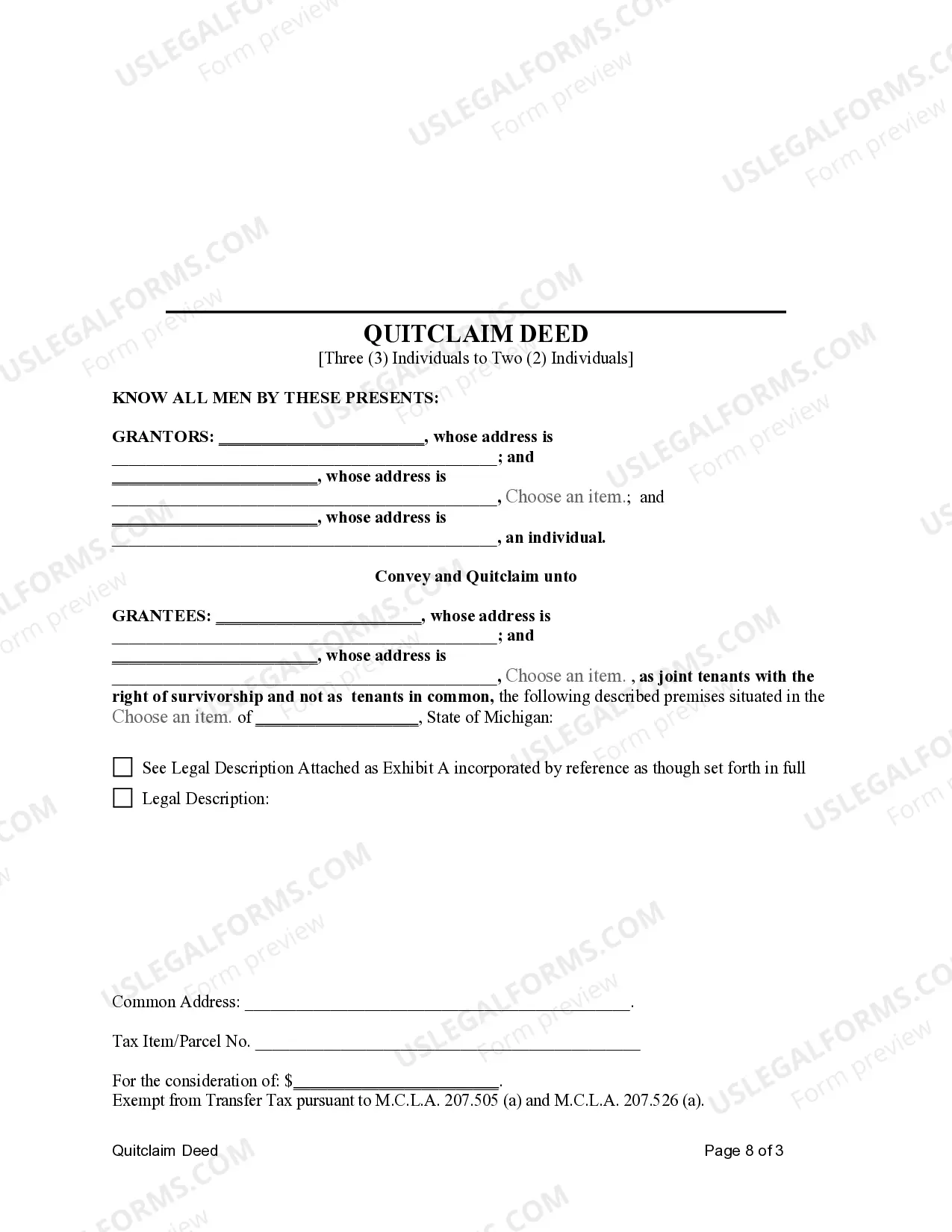

This form is a Quitclaim Deed where the Grantors are Husband and Wife and an Individual and the Grantees are two Individuals. Grantors convey and quitclaim the described property to Grantees. This deed complies with all state statutory laws.

Detroit Michigan Quitclaim Deed from Three Individuals to Two Individuals

Description

How to fill out Michigan Quitclaim Deed From Three Individuals To Two Individuals?

We consistently endeavor to minimize or eliminate legal complications when handling intricate legal or financial situations.

To achieve this, we enroll in legal services that are often prohibitively expensive.

Nonetheless, not every legal challenge is equally complicated; the majority of them can be resolved independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and requests for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from the My documents section. The procedure is equally uncomplicated if you are not familiar with the website! You can set up your account within minutes. Ensure to verify whether the Detroit Michigan Quitclaim Deed from Three Individuals to Two Individuals complies with the laws and regulations of your state and locality. Additionally, it’s essential to review the form’s outline (if available), and if you notice any inconsistencies with your initial expectations, look for an alternative template. Once you confirm that the Detroit Michigan Quitclaim Deed from Three Individuals to Two Individuals suits your needs, you can select a subscription plan and proceed to payment. You can then download the document in any preferred file format. For over 24 years in the industry, we’ve assisted millions of individuals by offering ready-to-customize and current legal documents. Make the most of US Legal Forms now to conserve your time and resources!

- Our collection empowers you to manage your issues without the need for an attorney.

- We provide access to legal document templates that are not universally available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you need to acquire and download the Detroit Michigan Quitclaim Deed from Three Individuals to Two Individuals or any other form with ease and security.

Form popularity

FAQ

If you are the person keeping the property, take the deed to the Register of Deeds and record it after your ex-spouse has signed it and delivered it to you. There will be a $30 recording fee.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

You cannot simply add someone to the deed in most cases, and it will require a change in the form of the deed on the property. You will have to file a quitclaim deed and then file a new deed with joint ownership.

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.

To successfully execute a quitclaim deed in Michigan, the property owner needs to complete a quitclaim deed form and sign it in front of a notary. Then they pay any transfer taxes due and record the deed in the land recorder's office in the county in which the property is located.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Quitclaim deeds transfer only the part of the property the grantor actually owns, so if the grantor owns one-fourth of the property, that's all he can transfer to the grantee. If you're the grantee, be mindful that quitclaim deeds can be risky if you don't know or trust the grantor or know the property's history.

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

Yes you can. This is called a transfer of equity but you will need the permission of your lender.