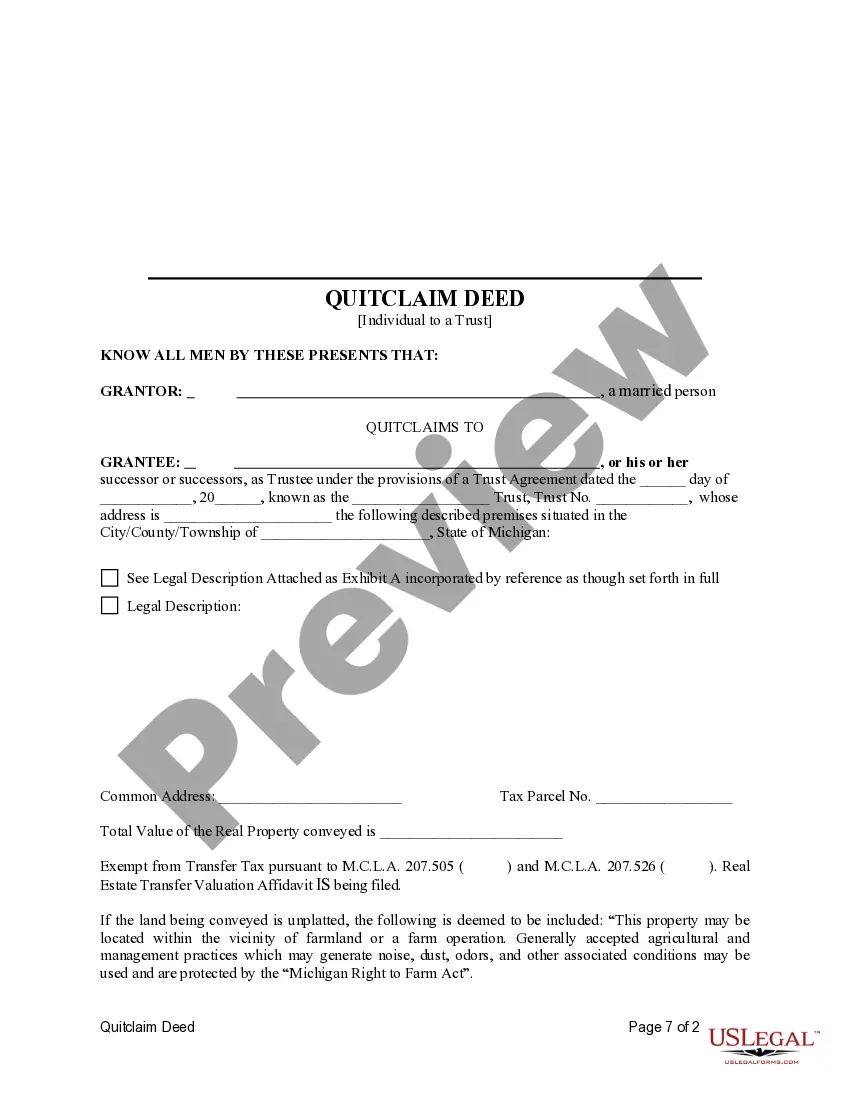

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state laws.

A Sterling Heights Michigan Quitclaim Deed from an Individual to a Trust is a legal document used to transfer ownership of real estate from an individual owner to a trust. This type of deed is commonly utilized in estate planning or asset protection strategies, allowing individuals to establish a trust to hold and manage their property. A quitclaim deed is a commonly used transfer instrument, allowing the owner (granter) to convey their interest or title in the property to the trust (grantee). Unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties regarding the condition of the property title. It simply transfers the granter's interest, if any, to the grantee. In Sterling Heights, Michigan, there are several variations of Quitclaim Deeds that can be utilized when transferring property from an individual to a trust. These include: 1. Individual to Living Trust Quitclaim Deed: This type of quitclaim deed is used when an individual wishes to transfer their real estate ownership to a revocable living trust. A living trust allows the individual to maintain control and benefit from the property during their lifetime, while also facilitating a seamless transfer of ownership upon their death. 2. Individual to Irrevocable Trust Quitclaim Deed: An irrevocable trust is a legal entity that cannot be altered or revoked once established. This type of quitclaim deed is used when an individual wants to transfer property into an irrevocable trust, often for asset protection or tax planning purposes. Once the property is transferred, the individual no longer owns or controls it, providing potential benefits such as protection from creditors. 3. Individual to Charitable Trust Quitclaim Deed: This quitclaim deed is used when an individual intends to donate their property to a charitable trust. By transferring ownership to a charitable trust, the individual can receive certain tax benefits, such as deductions for the fair market value of the property. When executing a Sterling Heights Michigan Quitclaim Deed from an Individual to a Trust, it is crucial to ensure that all legal requirements are met. These may include correctly identifying the property, providing a legal description, obtaining the necessary signatures, and notarizing the document. It is recommended to consult with an attorney or a trusted real estate professional with expertise in estate planning to ensure a smooth and legally sound transfer of property ownership to the trust. In summary, a Sterling Heights Michigan Quitclaim Deed from an Individual to a Trust is a legal document used to transfer ownership of real estate to a trust. This process may involve various types of quitclaim deeds, such as those for living trusts, irrevocable trusts, or charitable trusts. Seeking professional guidance is essential to ensure compliance with applicable laws and to achieve the desired objectives of the property transfer.