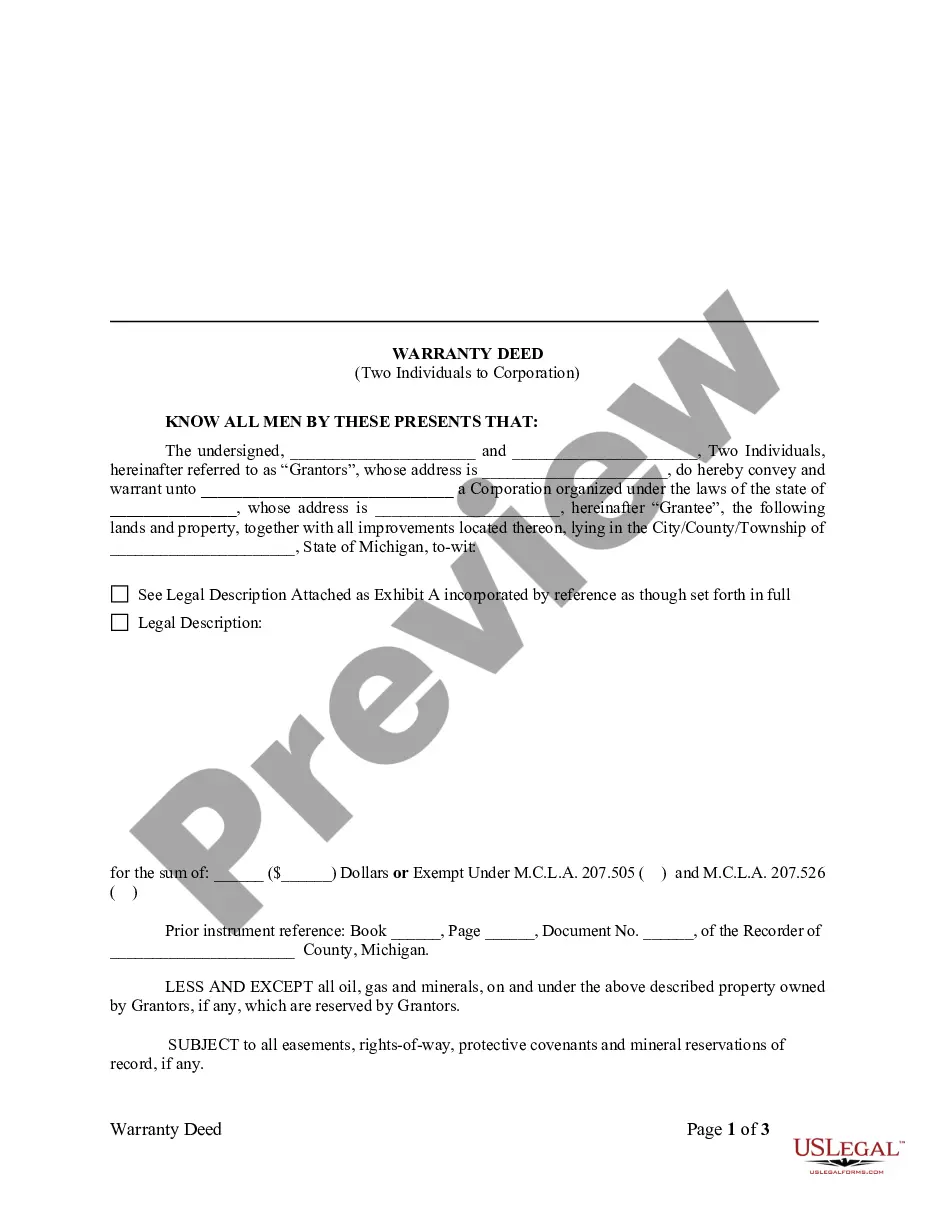

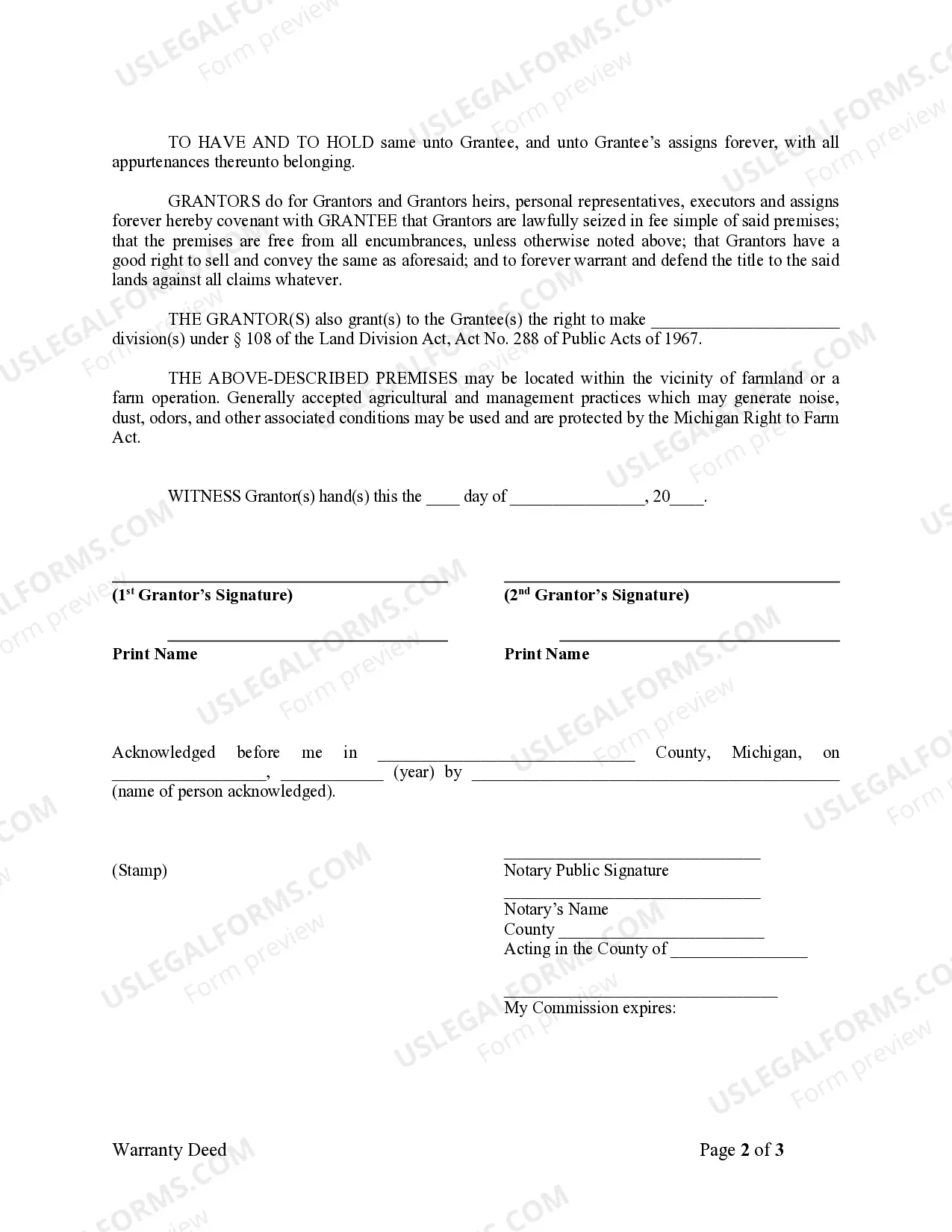

This Warranty Deed from two Individuals to Corporation form is a Warranty Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Detroit Michigan Warranty Deed from two Individuals to Corporation is a legal document that transfers ownership of a property from two individuals to a corporation while also guaranteeing that the property is free from any undisclosed encumbrances or defects. This type of deed ensures that the corporation receiving the property has a clear and marketable title. The warranty deed includes several key elements. First, it identifies the names and addresses of the two individuals selling the property (granters) and the corporation purchasing it (grantee). It also provides a legal description of the property, including its boundaries and any relevant parcel numbers. This description must be accurate and detailed to avoid any future disputes. Additionally, the deed contains covenants, warranties, and guarantees. The granters, as the sellers, warrant that they legally own the property and have the right to transfer it. They also guarantee that the property is free from any undisclosed encumbrances, such as liens or easements, which could affect its value or use. This ensures that the corporation receiving the property can take possession of it without any legal complications. There may be different types of Detroit Michigan Warranty Deeds from two Individuals to Corporation, depending on the specific circumstances and agreements between the parties involved. Some common types include: 1. General Warranty Deed: This is the most common type of warranty deed and provides the highest level of protection for the grantee. It guarantees that the granter will defend the title against any claims or challenges, even if the claim originated before the granter acquired the property. 2. Special Warranty Deed: In a special warranty deed, the granter warrants only against defects or encumbrances that occurred during their ownership. This type of deed offers a lesser level of protection compared to a general warranty deed. 3. Quitclaim Deed: While not a warranty deed, a quitclaim deed is sometimes used in situations where the granters are not making any warranties regarding the title. It transfers whatever interest the granters may have in the property to the grantee, without any guarantee as to the validity of the title. In summary, a Detroit Michigan Warranty Deed from two Individuals to Corporation is a legally binding document that transfers property ownership from two individuals to a corporation, guaranteeing that the property has a clear and marketable title. It can come in various forms, such as general warranty deeds, special warranty deeds, or quitclaim deeds, each offering different levels of protection and guarantees.