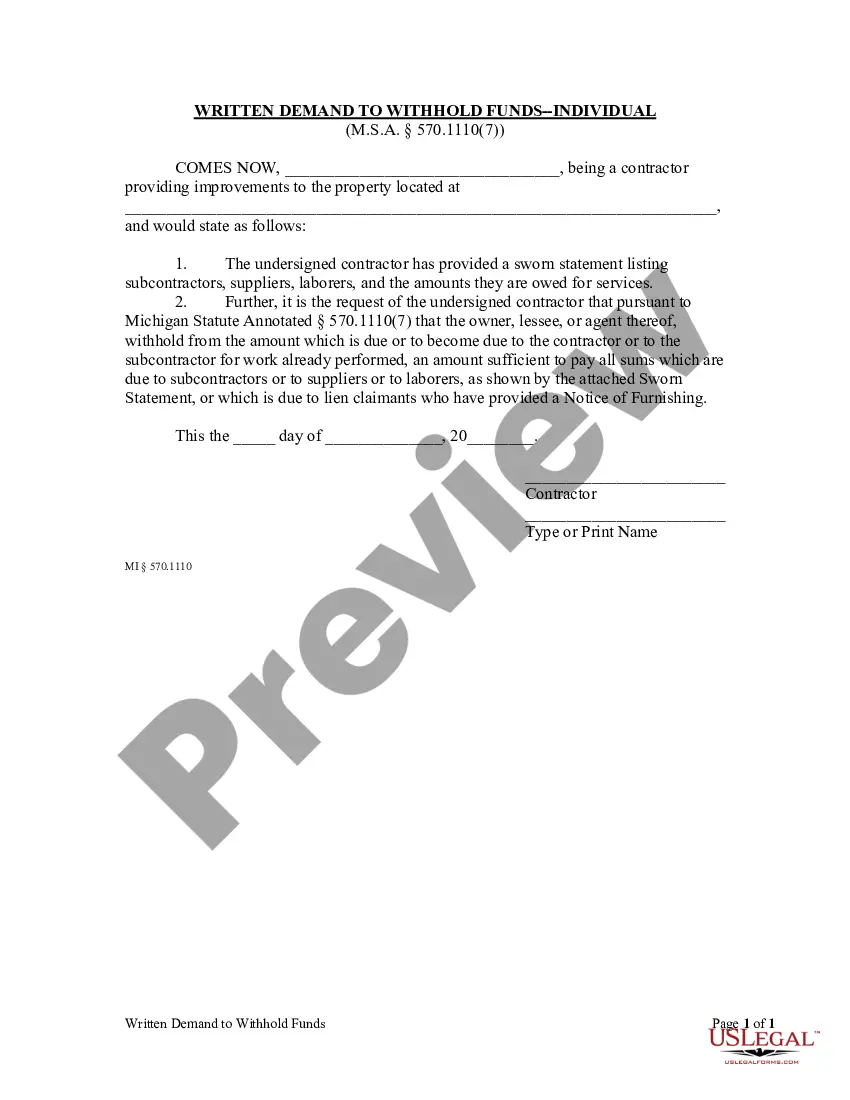

After the contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

Title: Ann Arbor Michigan Request to Withhold Funds — Individual: A Comprehensive Guide Introduction: In Ann Arbor, Michigan, individuals can utilize a Request to Withhold Funds to ensure that certain amounts are held back for specific purposes. This document serves as a legally binding agreement for withholding funds, providing protection and clarity for individuals. This article will provide a detailed description of the Ann Arbor Michigan Request to Withhold Funds — Individual, including its usage, types, and key information. 1. Understanding Request to Withhold Funds — Individual: The Request to Withhold Funds — Individual in Ann Arbor, Michigan, is a legal instrument used to protect individuals' interests by authorizing a designated party, such as an employer or financial institution, to withhold a specific amount from a particular payment or account. This procedure ensures compliance with legal or contractual obligations and safeguards the individual's rights. 2. Types of Ann Arbor Michigan Request to Withhold Funds — Individual: a) Child Support Withholding: This type of request is commonly used to meet child support obligations. It authorizes an employer to deduct a predetermined amount from an individual's income, ensuring regular support payments for the child. b) Tax Withholding: Individuals can request to withhold funds from their earnings to cover income taxes. By doing so, they ensure they meet their tax obligations promptly and avoid penalties or surprises at the end of the tax year. c) Court-Ordered Withholding: In cases of legal disputes or judgments, individuals may request to withhold funds to satisfy court-ordered payments. This could include settlements, fines, or restitution. 3. Key Information Required: To complete the Ann Arbor Michigan Request to Withhold Funds — Individual, the following information is usually required: a) Personal Details: Full name, address, contact information, social security number, and relevant identification data. b) Recipient Details: Information about the individual, organization, or agency authorized to receive the withheld funds. c) Financial Institution Information: If applicable, details of the bank or financial institution where funds will be withheld and transferred. d) Amount and Duration: The specific amount (fixed or percentage-based) to be withheld and the duration or termination conditions of the withholding. 4. Legal Considerations: It is essential to consult with legal professionals or refer to relevant regulations to ensure compliance with all laws and regulations governing the Request to Withhold Funds — Individual in Ann Arbor, Michigan. Understanding the legal implications, rights, and responsibilities associated with the request is crucial to avoid any potential legal complications. Conclusion: The Ann Arbor Michigan Request to Withhold Funds — Individual provides individuals with the necessary framework to protect their rights and meet various financial obligations. Whether it pertains to child support, taxes, or court-ordered payments, understanding the types, required information, and legal considerations is important. Using this document properly ensures a transparent and legally binding arrangement between all parties involved, promoting financial security and compliance.Title: Ann Arbor Michigan Request to Withhold Funds — Individual: A Comprehensive Guide Introduction: In Ann Arbor, Michigan, individuals can utilize a Request to Withhold Funds to ensure that certain amounts are held back for specific purposes. This document serves as a legally binding agreement for withholding funds, providing protection and clarity for individuals. This article will provide a detailed description of the Ann Arbor Michigan Request to Withhold Funds — Individual, including its usage, types, and key information. 1. Understanding Request to Withhold Funds — Individual: The Request to Withhold Funds — Individual in Ann Arbor, Michigan, is a legal instrument used to protect individuals' interests by authorizing a designated party, such as an employer or financial institution, to withhold a specific amount from a particular payment or account. This procedure ensures compliance with legal or contractual obligations and safeguards the individual's rights. 2. Types of Ann Arbor Michigan Request to Withhold Funds — Individual: a) Child Support Withholding: This type of request is commonly used to meet child support obligations. It authorizes an employer to deduct a predetermined amount from an individual's income, ensuring regular support payments for the child. b) Tax Withholding: Individuals can request to withhold funds from their earnings to cover income taxes. By doing so, they ensure they meet their tax obligations promptly and avoid penalties or surprises at the end of the tax year. c) Court-Ordered Withholding: In cases of legal disputes or judgments, individuals may request to withhold funds to satisfy court-ordered payments. This could include settlements, fines, or restitution. 3. Key Information Required: To complete the Ann Arbor Michigan Request to Withhold Funds — Individual, the following information is usually required: a) Personal Details: Full name, address, contact information, social security number, and relevant identification data. b) Recipient Details: Information about the individual, organization, or agency authorized to receive the withheld funds. c) Financial Institution Information: If applicable, details of the bank or financial institution where funds will be withheld and transferred. d) Amount and Duration: The specific amount (fixed or percentage-based) to be withheld and the duration or termination conditions of the withholding. 4. Legal Considerations: It is essential to consult with legal professionals or refer to relevant regulations to ensure compliance with all laws and regulations governing the Request to Withhold Funds — Individual in Ann Arbor, Michigan. Understanding the legal implications, rights, and responsibilities associated with the request is crucial to avoid any potential legal complications. Conclusion: The Ann Arbor Michigan Request to Withhold Funds — Individual provides individuals with the necessary framework to protect their rights and meet various financial obligations. Whether it pertains to child support, taxes, or court-ordered payments, understanding the types, required information, and legal considerations is important. Using this document properly ensures a transparent and legally binding arrangement between all parties involved, promoting financial security and compliance.