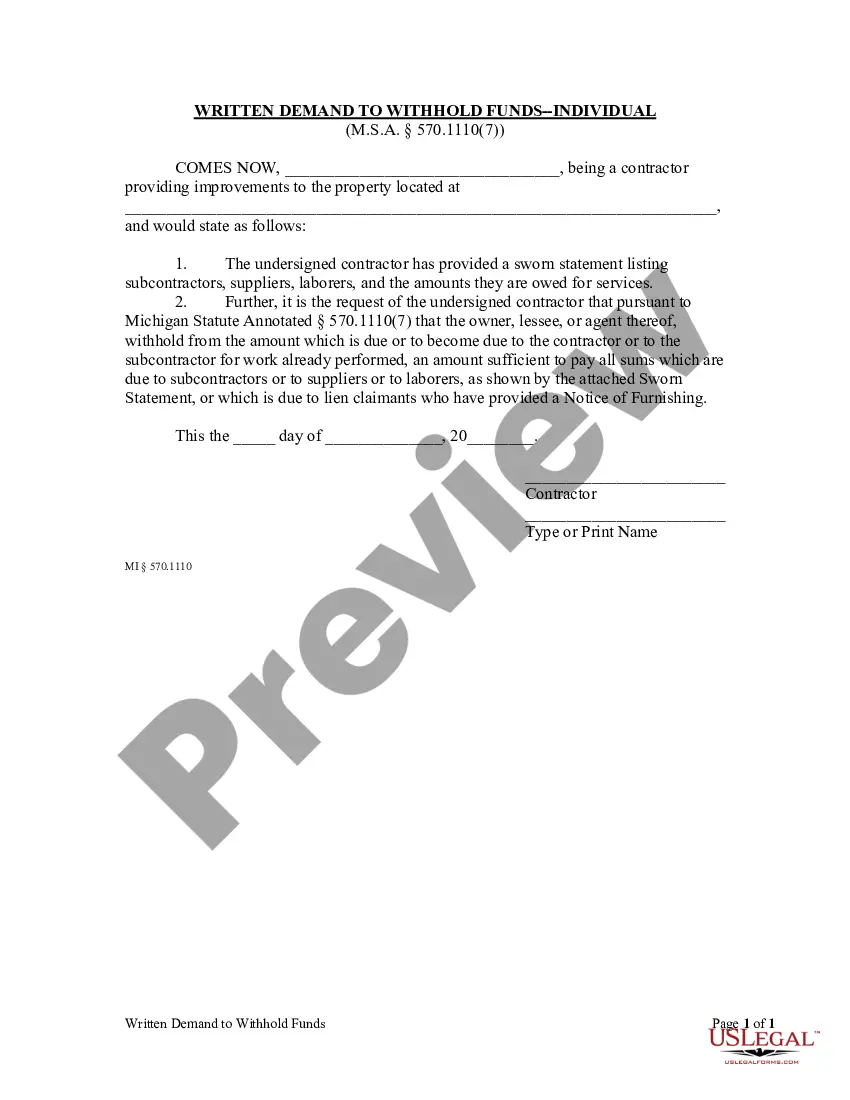

After the contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

Title: Understanding Lansing Michigan Request to Withhold Funds — Individual: Types, Process, and Requirements Description: If you have found yourself in a situation that requires you to withhold funds in Lansing, Michigan, it is crucial to acquaint yourself with the relevant details surrounding this process. Whether you are an individual seeking to understand how Lansing Michigan Request to Withhold Funds works or a business dealing with such requests, this detailed description will enlighten you on the various aspects, types, process, and requirements involved. Types of Lansing Michigan Request to Withhold Funds — Individual: 1. Child Support-Withholding: When ordered by the court, individuals are required to withhold a portion of their income for child support obligations. Understanding the procedures and documentation necessary for this type of withholding is crucial. 2. Tax Withholding: In some cases, individuals may receive a Lansing Michigan Request to Withhold Funds for tax purposes. Familiarizing oneself with the specific tax laws, exemptions, and the process of fulfilling these withholding obligations is essential. 3. Garnishment: Individuals facing legal obligations, such as outstanding debts or court-ordered payment, may encounter requests to withhold funds through garnishment. It is important to understand your rights and responsibilities when it comes to garnishment. Process of Lansing Michigan Request to Withhold Funds — Individual: 1. Notification: Individuals who need to withhold funds are typically notified through a court order or an official communication from relevant authorities. This communication will outline the reasons for the request, including the type of withholding and the required amount. 2. Documentation and Verification: Upon receiving the request, individuals must provide the necessary documentation to verify their financial situation and determine the withholding amount. This may include income statements, tax returns, or any other relevant financial records. 3. Compliance: Once the documentation and verification process is complete, individuals must comply with the withholding order. Failure to comply may result in legal consequences. Requirements for Lansing Michigan Request to Withhold Funds — Individual: 1. Proper Documentation: Individuals must possess the necessary documentation, such as court orders, tax documents, or other relevant legal papers, to support their withholding request. 2. Transparency: It is crucial to provide accurate and honest information about your financial situation. Any attempts to deceive or hide assets may lead to severe penalties. 3. Timely Response: Individuals should respond promptly to any requests or inquiries related to the withholding process. Failure to do so may delay the process or lead to legal complications. Understanding how Lansing Michigan Request to Withhold Funds — Individual works is essential for individuals involved in various types of fund withholding scenarios. By familiarizing yourself with the specific types, processes, and requirements, you can ensure compliance and manage your financial obligations effectively. Remember, seeking professional legal advice is always recommended when dealing with complex financial matters.Title: Understanding Lansing Michigan Request to Withhold Funds — Individual: Types, Process, and Requirements Description: If you have found yourself in a situation that requires you to withhold funds in Lansing, Michigan, it is crucial to acquaint yourself with the relevant details surrounding this process. Whether you are an individual seeking to understand how Lansing Michigan Request to Withhold Funds works or a business dealing with such requests, this detailed description will enlighten you on the various aspects, types, process, and requirements involved. Types of Lansing Michigan Request to Withhold Funds — Individual: 1. Child Support-Withholding: When ordered by the court, individuals are required to withhold a portion of their income for child support obligations. Understanding the procedures and documentation necessary for this type of withholding is crucial. 2. Tax Withholding: In some cases, individuals may receive a Lansing Michigan Request to Withhold Funds for tax purposes. Familiarizing oneself with the specific tax laws, exemptions, and the process of fulfilling these withholding obligations is essential. 3. Garnishment: Individuals facing legal obligations, such as outstanding debts or court-ordered payment, may encounter requests to withhold funds through garnishment. It is important to understand your rights and responsibilities when it comes to garnishment. Process of Lansing Michigan Request to Withhold Funds — Individual: 1. Notification: Individuals who need to withhold funds are typically notified through a court order or an official communication from relevant authorities. This communication will outline the reasons for the request, including the type of withholding and the required amount. 2. Documentation and Verification: Upon receiving the request, individuals must provide the necessary documentation to verify their financial situation and determine the withholding amount. This may include income statements, tax returns, or any other relevant financial records. 3. Compliance: Once the documentation and verification process is complete, individuals must comply with the withholding order. Failure to comply may result in legal consequences. Requirements for Lansing Michigan Request to Withhold Funds — Individual: 1. Proper Documentation: Individuals must possess the necessary documentation, such as court orders, tax documents, or other relevant legal papers, to support their withholding request. 2. Transparency: It is crucial to provide accurate and honest information about your financial situation. Any attempts to deceive or hide assets may lead to severe penalties. 3. Timely Response: Individuals should respond promptly to any requests or inquiries related to the withholding process. Failure to do so may delay the process or lead to legal complications. Understanding how Lansing Michigan Request to Withhold Funds — Individual works is essential for individuals involved in various types of fund withholding scenarios. By familiarizing yourself with the specific types, processes, and requirements, you can ensure compliance and manage your financial obligations effectively. Remember, seeking professional legal advice is always recommended when dealing with complex financial matters.