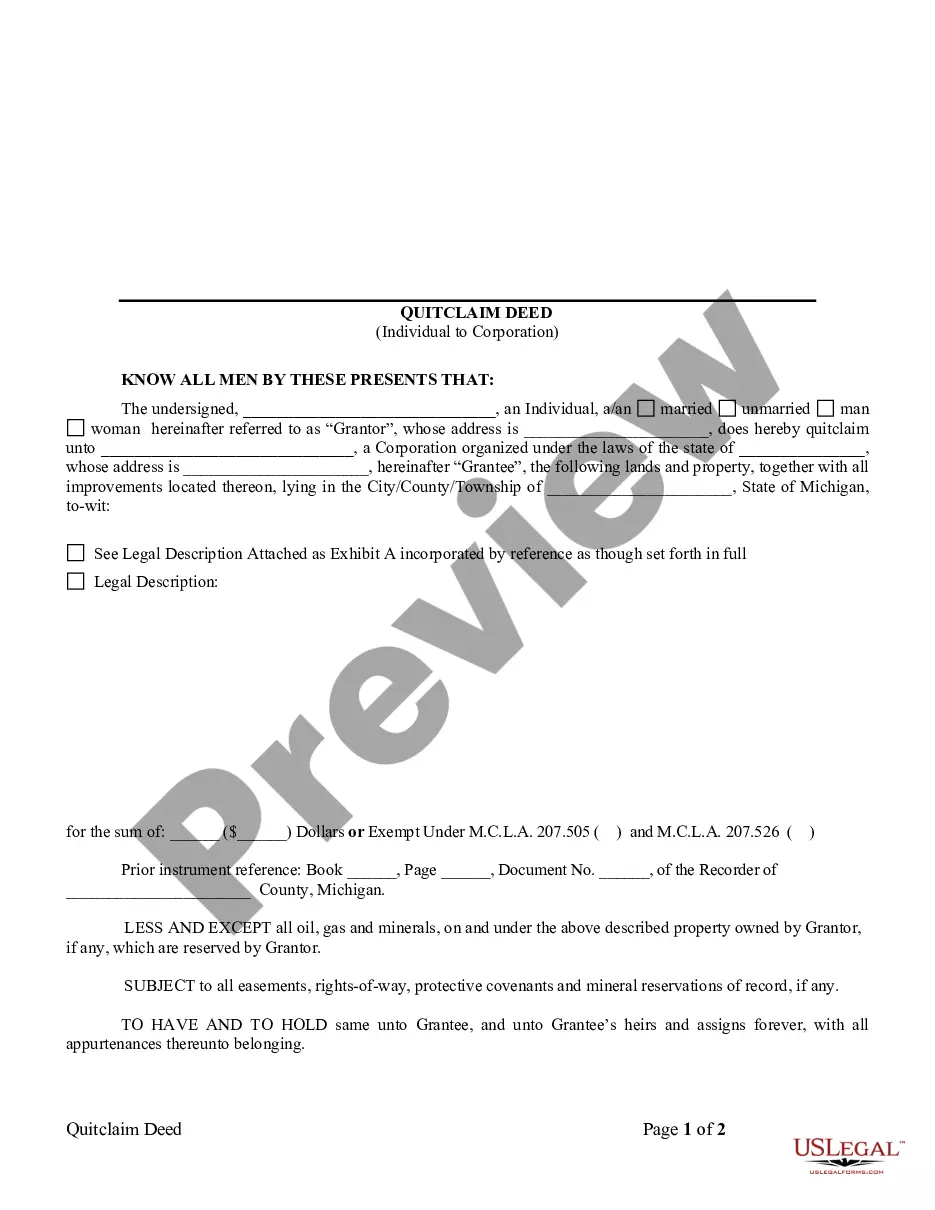

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Grand Rapids Michigan Quitclaim Deed from Individual to Corporation

Description

How to fill out Michigan Quitclaim Deed From Individual To Corporation?

We consistently strive to reduce or avert legal complications when engaging with intricate law-related or financial matters.

To achieve this, we enlist legal assistance that is typically very expensive.

However, not all legal issues are equally intricate. Most can be managed independently.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from the My documents section.

- Our platform empowers you to take control of your affairs without relying on an attorney.

- We provide access to legal document templates that are not always accessible to the public.

- Our templates are specific to states and regions, which significantly eases the search process.

- Make use of US Legal Forms whenever you need to locate and download the Grand Rapids Michigan Quitclaim Deed from Individual to Corporation or any other document quickly and securely.

Form popularity

FAQ

To fill out a Michigan quit claim deed, start by identifying the parties involved, including the granter and grantee. Clearly describe the property being transferred, including its legal description, which can be found on the tax statement or deed. Ensure you sign the deed in front of a notary public, as this is a crucial step in the process. If you are dealing with a Grand Rapids Michigan quitclaim deed from an individual to a corporation, take extra care to include the full legal name of the corporation and ensure all the information is accurate to avoid any legal complications.

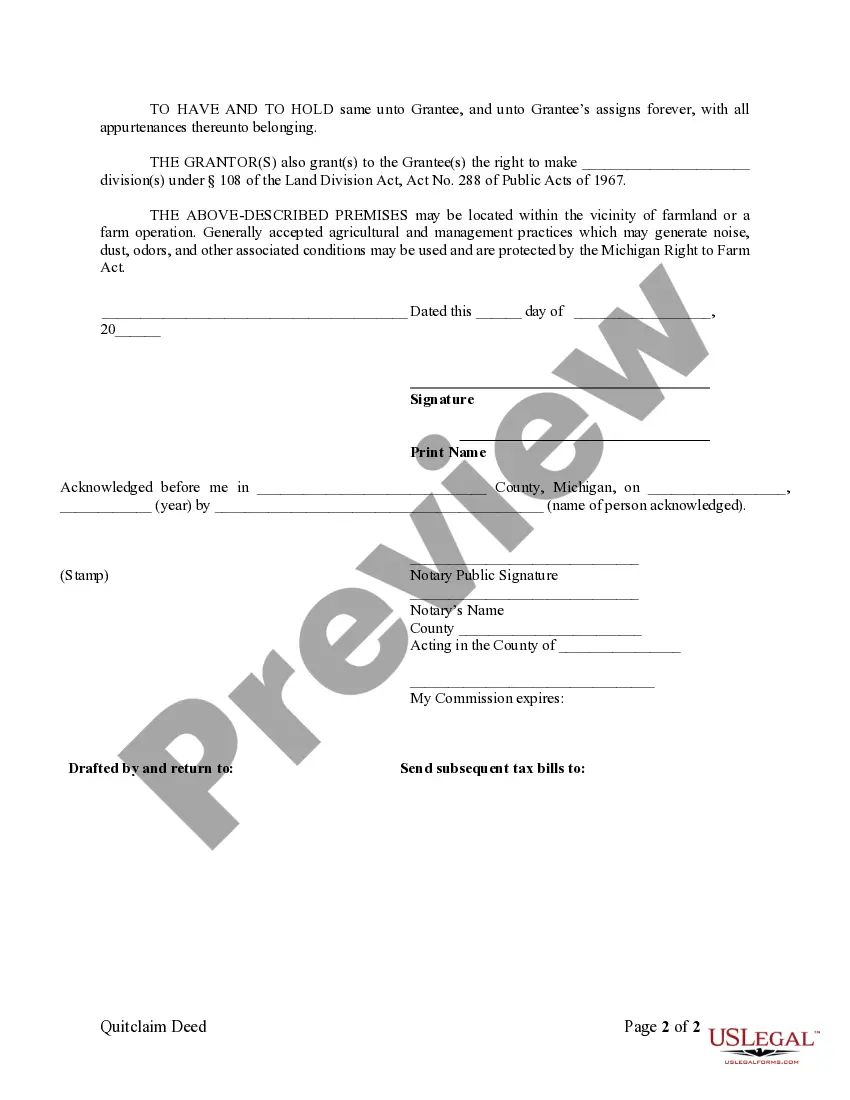

To transfer a Grand Rapids Michigan Quitclaim Deed from Individual to Corporation, you must first prepare the deed form accurately. Next, ensure that the deed includes the legal description of the property and the names of both the grantor and the grantee. Once completed, the deed must be signed in front of a notary public, and then filed with the county register of deeds. Utilizing platforms like US Legal Forms can simplify this process by providing templates and guidance for your specific needs.

Yes, a quitclaim deed can transfer ownership of property in Michigan, but it does so without any guarantees. When creating a Grand Rapids Michigan Quitclaim Deed from Individual to Corporation, understand that it conveys only the interest the grantor has in the property. This means that if there are no existing claims, the deed gives ownership; however, if there are issues, the new owner may have limited recourse. Therefore, it’s wise to conduct thorough research or consult a legal expert before proceeding.

Michigan law dictates specific statutes regarding quit claim deeds, including the requirement that the document clearly identifies the property and the parties involved. When drafting a Grand Rapids Michigan Quitclaim Deed from Individual to Corporation, it's essential to comply with these statutes. They ensure that the deed is legally enforceable and properly recorded with the county. Understanding these laws can help prevent future issues with property ownership.

Yes, under Michigan law, a Grand Rapids Michigan Quitclaim Deed from Individual to Corporation must be notarized to be valid. This requirement ensures authenticity and provides a layer of protection for all parties involved. Notarization involves having a qualified notary public witness the signing of the deed. This step is crucial to prevent disputes and establish a clear record of ownership transfer.

The signature of the grantor is mandatory on the quit claim deed to transfer the property. The grantee is not required to sign the deed in Michigan. The quit claim deed must be signed in front of a notary public, who attests to the fact that you are who you claim to be and that you signed the document.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

You can find out if transfer taxes will be due in the Do-It-Yourself Quitclaim Deed (after Divorce) tool. If you are the person keeping the property, take the deed to the Register of Deeds and record it after your ex-spouse has signed it and delivered it to you. There will be a $30 recording fee.

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.

Getting the name changed on your deeds is an easy process and you do not need to involve a solicitor. Generally there is no fee to pay either. You simply need to send a letter to the Land Registry office requesting the name change, together with either the original or a certified copy of your marriage certificate.