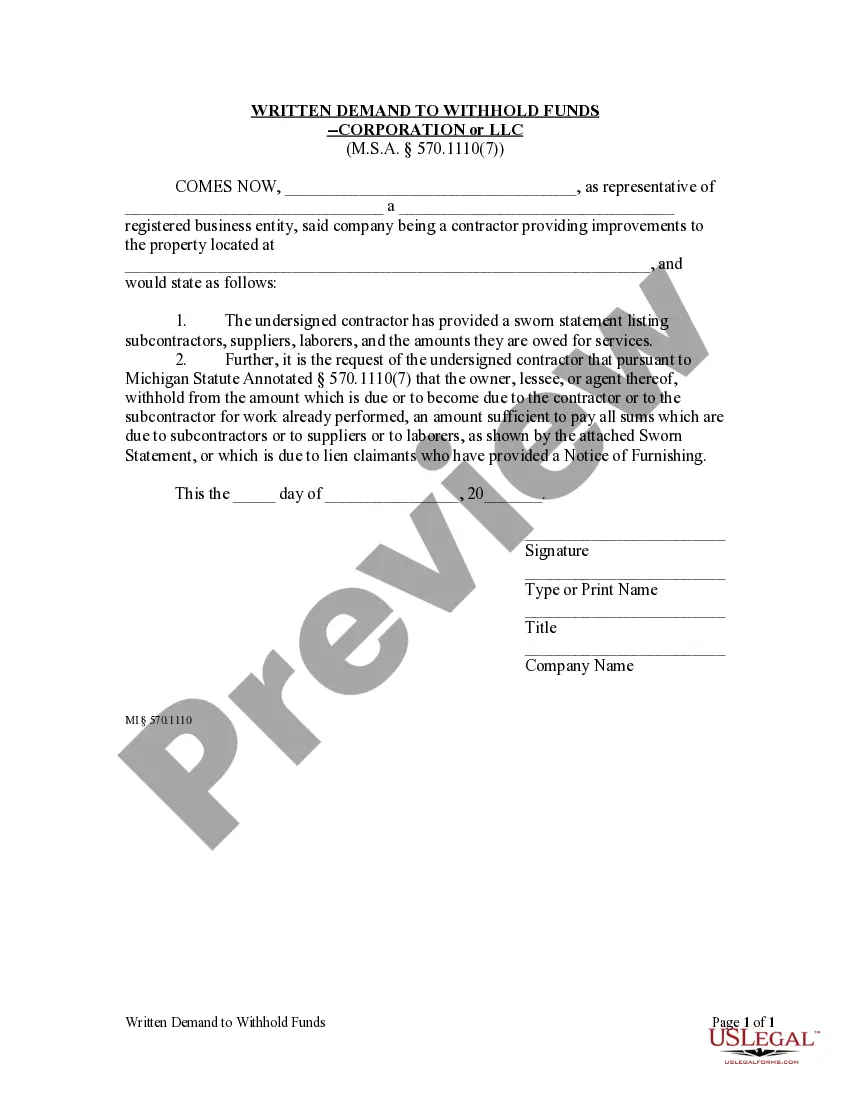

After the corporate or LLC contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

Ann Arbor, Michigan Request to Withhold Funds — Corporation or LLC Keywords: Ann Arbor, Michigan, request to withhold funds, corporation, LLC Introduction: Ann Arbor, Michigan is a vibrant city renowned for its eclectic culture, educational institutions, and thriving business community. In cases where funds need to be withheld by a corporation or limited liability company (LLC), a specific request procedure must be followed. This article aims to provide a detailed description of the process involved in the Ann Arbor, Michigan Request to Withhold Funds for both corporations and LCS. Types of Ann Arbor, Michigan Request to Withhold Funds: 1. Corporation Request: When a corporation operating in Ann Arbor, Michigan needs to withhold funds, it must adhere to certain protocols and file the necessary documentation. Such a request typically arises when there is a legal dispute, outstanding debts, or pending legal obligations. The corporation needs to submit a formal request to withhold funds to maintain compliance with local and state regulations. 2. LLC Request: For limited liability companies (LCS) based in Ann Arbor, Michigan, a similar request to withhold funds process applies. LCS operate under different rules and regulations compared to corporations. However, when faced with disputes or legal battles, an LLC may also need to initiate a request to withhold funds. This ensures transparency and fairness while maintaining legal obligations to all parties involved. Procedure for Ann Arbor, Michigan Request to Withhold Funds — Corporation or LLC: 1. Gather Documentation: The first step in the process is to collect all relevant supporting documentation that justifies the need to withhold funds. This may include contracts, legal agreements, court orders, or invoices. 2. Draft Official Letter: Compose an official letter addressed to the pertinent individuals or entities involved in the financial transactions. The letter should clearly state the request to withhold funds, reasons behind it, and reference any applicable laws or agreements. 3. Provide Comprehensive Explanation: Within the letter, provide a comprehensive explanation of the circumstances that necessitate the withholding of funds. This explanation should substantiate the claim and demonstrate that it is lawful and reasonable. 4. Follow Filing Procedures: Depending on the specific situation, Ann Arbor may have filing procedures that must be followed while submitting the request. This may involve submitting the letter, supporting documentation, and any applicable fees to the relevant authority or agency. 5. Await Approval or Response: After submitting the request, the corporation or LLC must await a response from the concerned authority or opposing party. This response may either approve the request to withhold funds or initiate a legal process to determine the validity of the request. Conclusion: When a corporation or LLC in Ann Arbor, Michigan faces financial disputes or legal challenges, a request to withhold funds may become necessary. By following the proper procedure, including gathering documentation, drafting an official letter, providing a comprehensive explanation, and following filing procedures, businesses can address financial concerns while adhering to local and state regulations. It is crucial for both corporations and LCS to navigate this process with caution and seek legal counsel where necessary to safeguard their interests.Ann Arbor, Michigan Request to Withhold Funds — Corporation or LLC Keywords: Ann Arbor, Michigan, request to withhold funds, corporation, LLC Introduction: Ann Arbor, Michigan is a vibrant city renowned for its eclectic culture, educational institutions, and thriving business community. In cases where funds need to be withheld by a corporation or limited liability company (LLC), a specific request procedure must be followed. This article aims to provide a detailed description of the process involved in the Ann Arbor, Michigan Request to Withhold Funds for both corporations and LCS. Types of Ann Arbor, Michigan Request to Withhold Funds: 1. Corporation Request: When a corporation operating in Ann Arbor, Michigan needs to withhold funds, it must adhere to certain protocols and file the necessary documentation. Such a request typically arises when there is a legal dispute, outstanding debts, or pending legal obligations. The corporation needs to submit a formal request to withhold funds to maintain compliance with local and state regulations. 2. LLC Request: For limited liability companies (LCS) based in Ann Arbor, Michigan, a similar request to withhold funds process applies. LCS operate under different rules and regulations compared to corporations. However, when faced with disputes or legal battles, an LLC may also need to initiate a request to withhold funds. This ensures transparency and fairness while maintaining legal obligations to all parties involved. Procedure for Ann Arbor, Michigan Request to Withhold Funds — Corporation or LLC: 1. Gather Documentation: The first step in the process is to collect all relevant supporting documentation that justifies the need to withhold funds. This may include contracts, legal agreements, court orders, or invoices. 2. Draft Official Letter: Compose an official letter addressed to the pertinent individuals or entities involved in the financial transactions. The letter should clearly state the request to withhold funds, reasons behind it, and reference any applicable laws or agreements. 3. Provide Comprehensive Explanation: Within the letter, provide a comprehensive explanation of the circumstances that necessitate the withholding of funds. This explanation should substantiate the claim and demonstrate that it is lawful and reasonable. 4. Follow Filing Procedures: Depending on the specific situation, Ann Arbor may have filing procedures that must be followed while submitting the request. This may involve submitting the letter, supporting documentation, and any applicable fees to the relevant authority or agency. 5. Await Approval or Response: After submitting the request, the corporation or LLC must await a response from the concerned authority or opposing party. This response may either approve the request to withhold funds or initiate a legal process to determine the validity of the request. Conclusion: When a corporation or LLC in Ann Arbor, Michigan faces financial disputes or legal challenges, a request to withhold funds may become necessary. By following the proper procedure, including gathering documentation, drafting an official letter, providing a comprehensive explanation, and following filing procedures, businesses can address financial concerns while adhering to local and state regulations. It is crucial for both corporations and LCS to navigate this process with caution and seek legal counsel where necessary to safeguard their interests.