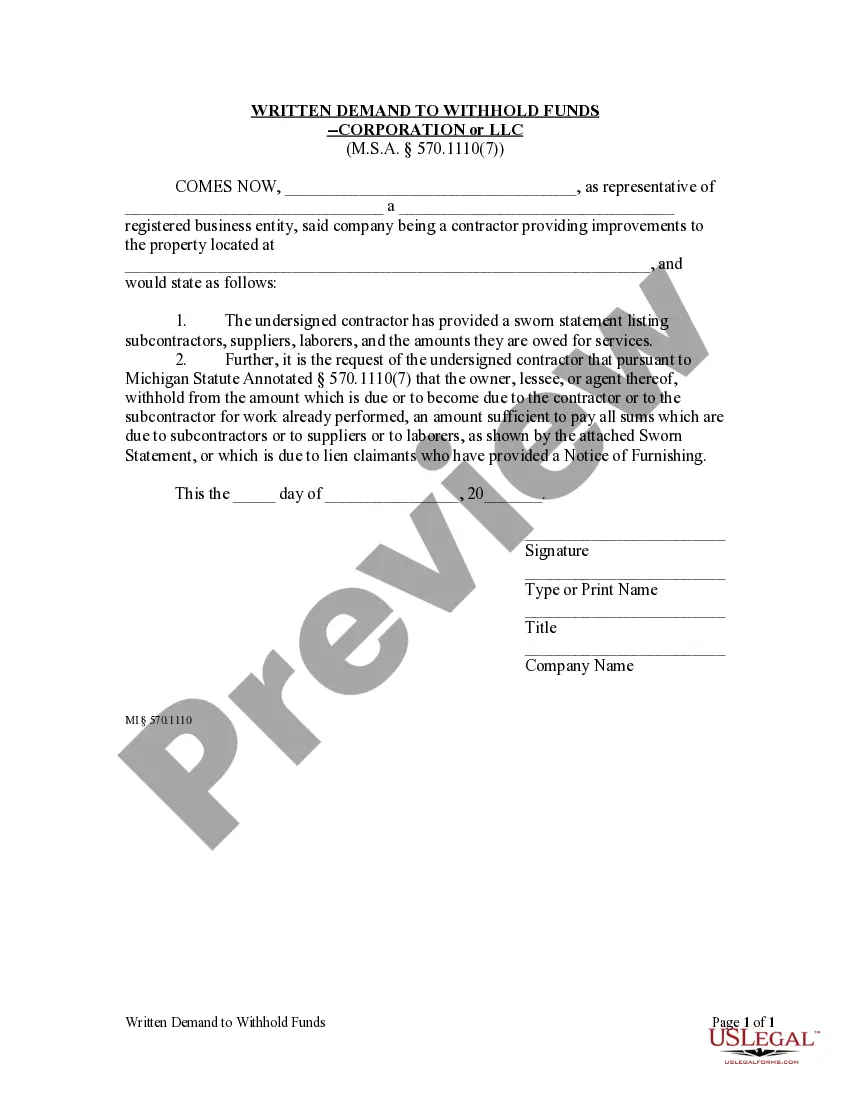

After the corporate or LLC contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

The term "Detroit Michigan Request to Withhold Funds — Corporation or LLC" refers to a legal process where a corporation or limited liability company (LLC) based in Detroit, Michigan, seeks to request the withholding of funds for various purposes. This request is usually made to a third-party financial institution, such as a bank, and involves freezing or holding certain funds to satisfy a specific claim or obligation. There are several types of Detroit Michigan requests to withhold funds for corporations or LCS. These types can be broadly categorized into: 1. Detroit Michigan Request to Withhold Funds for Debt Collection: This type of request is typically made when a corporation or LLC owes a debt to a creditor, such as a lender, supplier, or service provider. The creditor, through legal means, can request the withholding of funds from the debtor's accounts, ensuring that the debt is partially or fully satisfied before releasing the remaining funds to the debtor. 2. Detroit Michigan Request to Withhold Funds for Legal Proceedings: In the event of a legal dispute involving a corporation or LLC, one party may request the court to issue an order to withhold funds in order to secure potential damages or costs. This ensures that sufficient funds are available to satisfy any potential judgment or settlement. 3. Detroit Michigan Request to Withhold Funds for Tax Liabilities: If a corporation or LLC has outstanding tax liabilities to the government, the Detroit Michigan Department of Treasury or Internal Revenue Service (IRS) may issue a request to withhold funds, effectively freezing certain accounts to collect the unpaid taxes. This is typically done to ensure compliance with tax obligations and to prevent the dissipation of assets. 4. Detroit Michigan Request to Withhold Funds for Administrative Actions: Governmental agencies, such as the Secretary of State or the Department of Licensing and Regulatory Affairs, may issue requests to withhold funds on a corporation or LLC's bank accounts due to regulatory violations or administrative actions. This ensures that the entity does not continue operating with unpaid fees or unresolved compliance issues. In any of these scenarios, a corporation or LLC must follow the appropriate legal processes, ensuring that all necessary paperwork, including a detailed explanation of the reason for the request, supporting documentation, and any court orders or judgments, are provided in the request. It's important to note that the specific requirements and procedures for requesting the withholding of funds may vary depending on the nature of the request and the involved parties. Therefore, it is advisable to consult with legal professionals or seek guidance from relevant governmental agencies for precise instructions.The term "Detroit Michigan Request to Withhold Funds — Corporation or LLC" refers to a legal process where a corporation or limited liability company (LLC) based in Detroit, Michigan, seeks to request the withholding of funds for various purposes. This request is usually made to a third-party financial institution, such as a bank, and involves freezing or holding certain funds to satisfy a specific claim or obligation. There are several types of Detroit Michigan requests to withhold funds for corporations or LCS. These types can be broadly categorized into: 1. Detroit Michigan Request to Withhold Funds for Debt Collection: This type of request is typically made when a corporation or LLC owes a debt to a creditor, such as a lender, supplier, or service provider. The creditor, through legal means, can request the withholding of funds from the debtor's accounts, ensuring that the debt is partially or fully satisfied before releasing the remaining funds to the debtor. 2. Detroit Michigan Request to Withhold Funds for Legal Proceedings: In the event of a legal dispute involving a corporation or LLC, one party may request the court to issue an order to withhold funds in order to secure potential damages or costs. This ensures that sufficient funds are available to satisfy any potential judgment or settlement. 3. Detroit Michigan Request to Withhold Funds for Tax Liabilities: If a corporation or LLC has outstanding tax liabilities to the government, the Detroit Michigan Department of Treasury or Internal Revenue Service (IRS) may issue a request to withhold funds, effectively freezing certain accounts to collect the unpaid taxes. This is typically done to ensure compliance with tax obligations and to prevent the dissipation of assets. 4. Detroit Michigan Request to Withhold Funds for Administrative Actions: Governmental agencies, such as the Secretary of State or the Department of Licensing and Regulatory Affairs, may issue requests to withhold funds on a corporation or LLC's bank accounts due to regulatory violations or administrative actions. This ensures that the entity does not continue operating with unpaid fees or unresolved compliance issues. In any of these scenarios, a corporation or LLC must follow the appropriate legal processes, ensuring that all necessary paperwork, including a detailed explanation of the reason for the request, supporting documentation, and any court orders or judgments, are provided in the request. It's important to note that the specific requirements and procedures for requesting the withholding of funds may vary depending on the nature of the request and the involved parties. Therefore, it is advisable to consult with legal professionals or seek guidance from relevant governmental agencies for precise instructions.