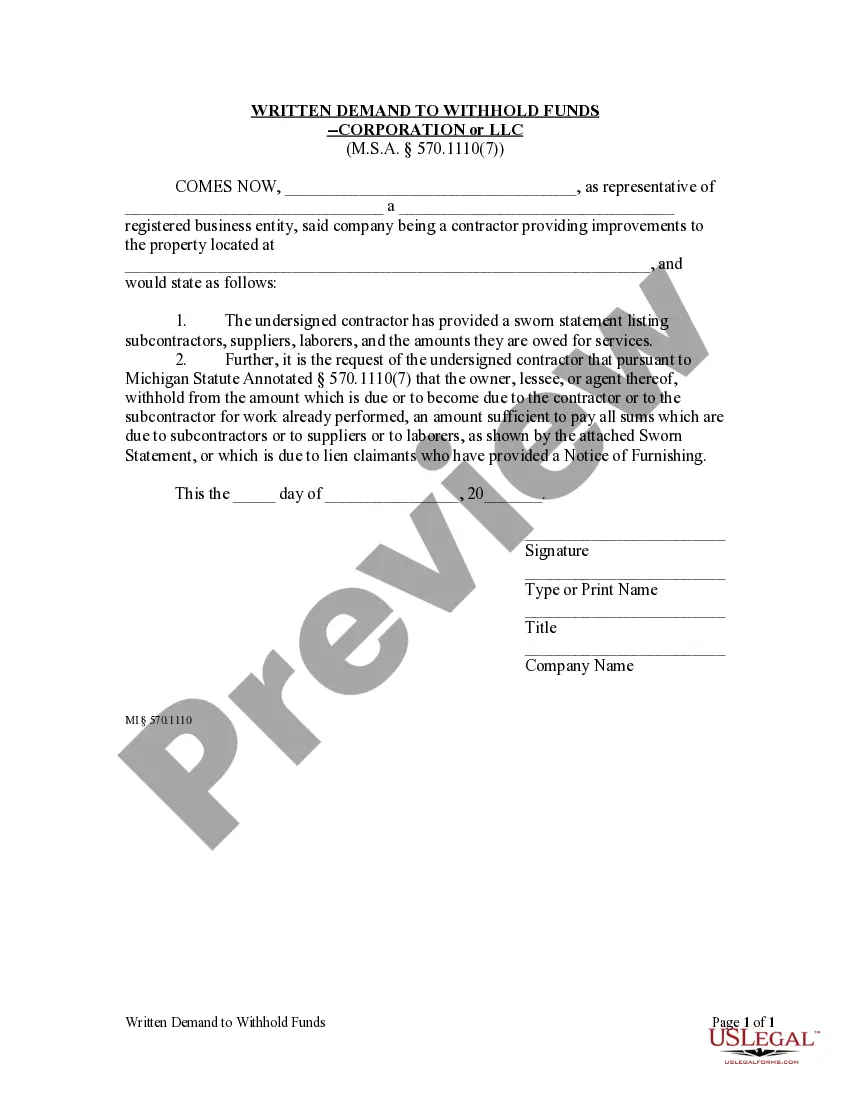

After the corporate or LLC contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

A Grand Rapids Michigan Requests to Withhold Funds — Corporation or LLC is a legal document that seeks to temporarily freeze funds belonging to a corporation or limited liability company (LLC) based in Grand Rapids, Michigan. This request is typically made when there is a dispute or pending legal action involving the corporation or LLC, and there is a need to protect or preserve funds that may be used to satisfy a potential judgment or settlement. When a Grand Rapids corporation or LLC is faced with a potential legal challenge, such as a lawsuit or contractual dispute, it may find it necessary to make a Request to Withhold Funds. This legal action helps ensure that the entity's assets are not dissipated or transferred out of reach, making it more difficult for the opposing party to recover damages or enforce a judgment. The Grand Rapids Michigan Requests to Withhold Funds — Corporation or LLC can be classified into different types based on the specific situation or reason behind the request. These types may include: 1. Prejudgment Withholding of Funds: This type of request is filed when a corporation or LLC anticipates a judgment against it. By freezing funds before a judgment is entered, the entity seeks to protect its assets from being seized or diminished. 2. Post-judgment Withholding of Funds: After a judgment has been rendered against the corporation or LLC, this type of request is made to prevent the dissipation of funds that the opposing party may be entitled to as part of the judgment. It ensures that funds are available for potential satisfaction or settlement. 3. Bankruptcy Stay or Garnishment Withholding: In the event of bankruptcy proceedings, a corporation or LLC may file a Request to Withhold Funds to pause any garnishment or collection efforts against the entity's assets. This provides temporary relief while the bankruptcy case is being resolved. 4. Contractual Withholding of Funds: Sometimes, a dispute arises between the corporation or LLC and another party regarding payment or performance under a contract. In this scenario, the entity may seek to withhold funds as a means of resolving the dispute or negotiating a settlement. To make a Grand Rapids Michigan Requests to Withhold Funds — Corporation or LLC, certain information and documentation will be required. This typically includes the full legal name and contact details of the entity making the request, details regarding the dispute or legal action, the specific funds or assets to be withheld, and any supporting evidence or documentation. It is essential to consult with a qualified legal professional in Grand Rapids, Michigan, when preparing and submitting a Request to Withhold Funds — Corporation or LLC. They can guide the entity through the legal process and ensure that all relevant laws and regulations are properly followed to maximize the chances of a successful outcome.A Grand Rapids Michigan Requests to Withhold Funds — Corporation or LLC is a legal document that seeks to temporarily freeze funds belonging to a corporation or limited liability company (LLC) based in Grand Rapids, Michigan. This request is typically made when there is a dispute or pending legal action involving the corporation or LLC, and there is a need to protect or preserve funds that may be used to satisfy a potential judgment or settlement. When a Grand Rapids corporation or LLC is faced with a potential legal challenge, such as a lawsuit or contractual dispute, it may find it necessary to make a Request to Withhold Funds. This legal action helps ensure that the entity's assets are not dissipated or transferred out of reach, making it more difficult for the opposing party to recover damages or enforce a judgment. The Grand Rapids Michigan Requests to Withhold Funds — Corporation or LLC can be classified into different types based on the specific situation or reason behind the request. These types may include: 1. Prejudgment Withholding of Funds: This type of request is filed when a corporation or LLC anticipates a judgment against it. By freezing funds before a judgment is entered, the entity seeks to protect its assets from being seized or diminished. 2. Post-judgment Withholding of Funds: After a judgment has been rendered against the corporation or LLC, this type of request is made to prevent the dissipation of funds that the opposing party may be entitled to as part of the judgment. It ensures that funds are available for potential satisfaction or settlement. 3. Bankruptcy Stay or Garnishment Withholding: In the event of bankruptcy proceedings, a corporation or LLC may file a Request to Withhold Funds to pause any garnishment or collection efforts against the entity's assets. This provides temporary relief while the bankruptcy case is being resolved. 4. Contractual Withholding of Funds: Sometimes, a dispute arises between the corporation or LLC and another party regarding payment or performance under a contract. In this scenario, the entity may seek to withhold funds as a means of resolving the dispute or negotiating a settlement. To make a Grand Rapids Michigan Requests to Withhold Funds — Corporation or LLC, certain information and documentation will be required. This typically includes the full legal name and contact details of the entity making the request, details regarding the dispute or legal action, the specific funds or assets to be withheld, and any supporting evidence or documentation. It is essential to consult with a qualified legal professional in Grand Rapids, Michigan, when preparing and submitting a Request to Withhold Funds — Corporation or LLC. They can guide the entity through the legal process and ensure that all relevant laws and regulations are properly followed to maximize the chances of a successful outcome.