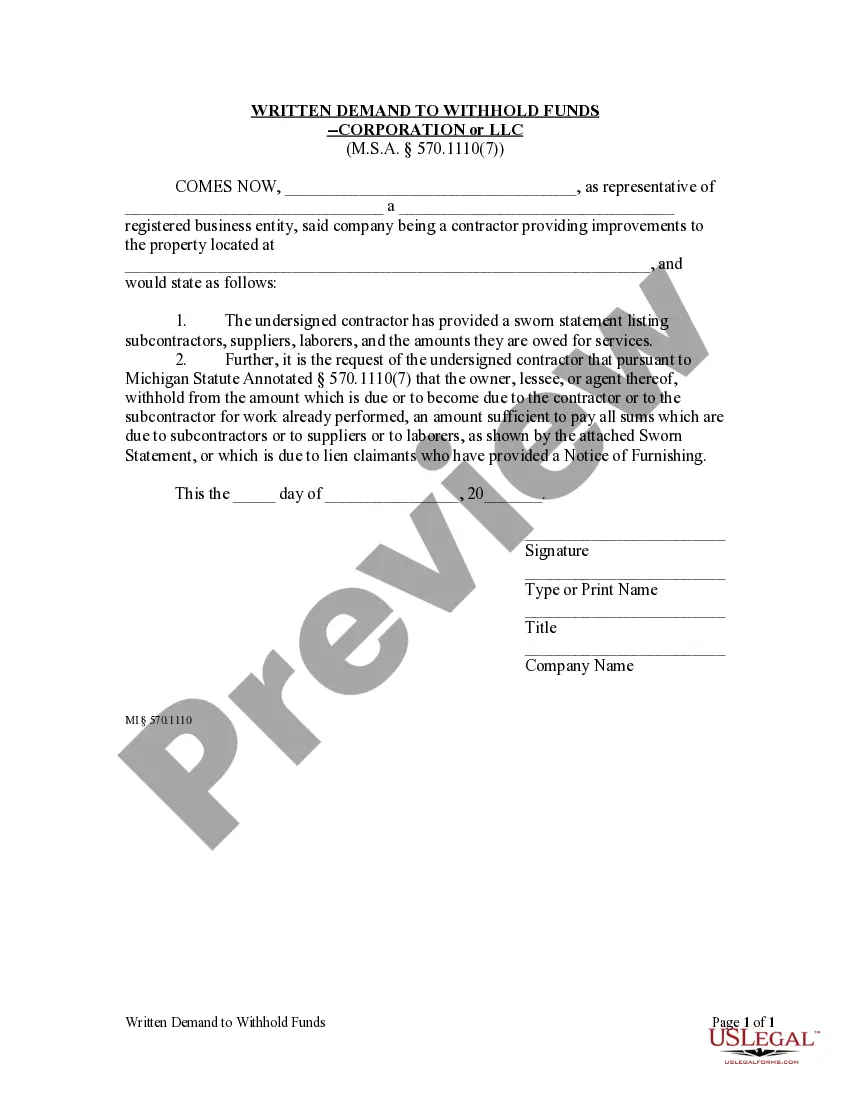

After the corporate or LLC contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

Lansing, Michigan Request to Withhold Funds — Corporation or LLC A Lansing, Michigan Request to Withhold Funds is a legal procedure that allows corporations or limited liability companies (LCS) operating in Lansing to request the withholding of funds for various purposes. This request is typically made to a financial institution, such as a bank or credit union, and serves as a means to protect the interests of the corporation or LLC. There are different types of Lansing, Michigan Request to Withhold Funds applicable to both corporations and LCS. These requests may vary depending on the specific circumstances and requirements of the business. Some common types are: 1. Vendor or Creditor Payment Withholding: This type of request allows a corporation or LLC to withhold funds owed to a vendor or creditor. It may occur when there is a dispute, breach of contract, or quality issue, and the business wants to ensure that the funds are not released until the matter is resolved. It provides a legal avenue for the company to negotiate or litigate a solution without the fear of payment being made prematurely. 2. Tax Withholding: A Lansing, Michigan Request to Withhold Funds can also pertain to tax obligations. In this case, a corporation or LLC may request the withholding of funds to cover unpaid taxes, penalties, or any potential liabilities. This type of request helps the business maintain compliance with tax authorities and prevents any negative consequences, such as levies or liens. 3. Legal or Regulatory Hold: For legal or regulatory matters, a corporation or LLC may utilize a Request to Withhold Funds. This may include situations where the company is under investigation, facing legal disputes, or subject to regulatory actions. By requesting the withholding of funds, the business can safeguard its financial resources and ensure they are available for potential settlements, fines, or legal fees. 4. Escrow or Reserve Fund: Corporations or LCS often establish escrow or reserve funds for specific purposes, such as acquisitions, real estate transactions, or legal proceedings. A Request to Withhold Funds allows the business to prevent the release of these funds until predetermined conditions are met. It provides assurance to the involved parties that the funds will be held securely until the agreed-upon requirements are satisfied. Regardless of the specific type of Lansing, Michigan Request to Withhold Funds — Corporation or LLC, it is crucial for businesses to follow the appropriate legal procedures and requirements. Seeking guidance from legal professionals or consulting relevant regulations can ensure compliance and protect the interests of the corporation or LLC.Lansing, Michigan Request to Withhold Funds — Corporation or LLC A Lansing, Michigan Request to Withhold Funds is a legal procedure that allows corporations or limited liability companies (LCS) operating in Lansing to request the withholding of funds for various purposes. This request is typically made to a financial institution, such as a bank or credit union, and serves as a means to protect the interests of the corporation or LLC. There are different types of Lansing, Michigan Request to Withhold Funds applicable to both corporations and LCS. These requests may vary depending on the specific circumstances and requirements of the business. Some common types are: 1. Vendor or Creditor Payment Withholding: This type of request allows a corporation or LLC to withhold funds owed to a vendor or creditor. It may occur when there is a dispute, breach of contract, or quality issue, and the business wants to ensure that the funds are not released until the matter is resolved. It provides a legal avenue for the company to negotiate or litigate a solution without the fear of payment being made prematurely. 2. Tax Withholding: A Lansing, Michigan Request to Withhold Funds can also pertain to tax obligations. In this case, a corporation or LLC may request the withholding of funds to cover unpaid taxes, penalties, or any potential liabilities. This type of request helps the business maintain compliance with tax authorities and prevents any negative consequences, such as levies or liens. 3. Legal or Regulatory Hold: For legal or regulatory matters, a corporation or LLC may utilize a Request to Withhold Funds. This may include situations where the company is under investigation, facing legal disputes, or subject to regulatory actions. By requesting the withholding of funds, the business can safeguard its financial resources and ensure they are available for potential settlements, fines, or legal fees. 4. Escrow or Reserve Fund: Corporations or LCS often establish escrow or reserve funds for specific purposes, such as acquisitions, real estate transactions, or legal proceedings. A Request to Withhold Funds allows the business to prevent the release of these funds until predetermined conditions are met. It provides assurance to the involved parties that the funds will be held securely until the agreed-upon requirements are satisfied. Regardless of the specific type of Lansing, Michigan Request to Withhold Funds — Corporation or LLC, it is crucial for businesses to follow the appropriate legal procedures and requirements. Seeking guidance from legal professionals or consulting relevant regulations can ensure compliance and protect the interests of the corporation or LLC.