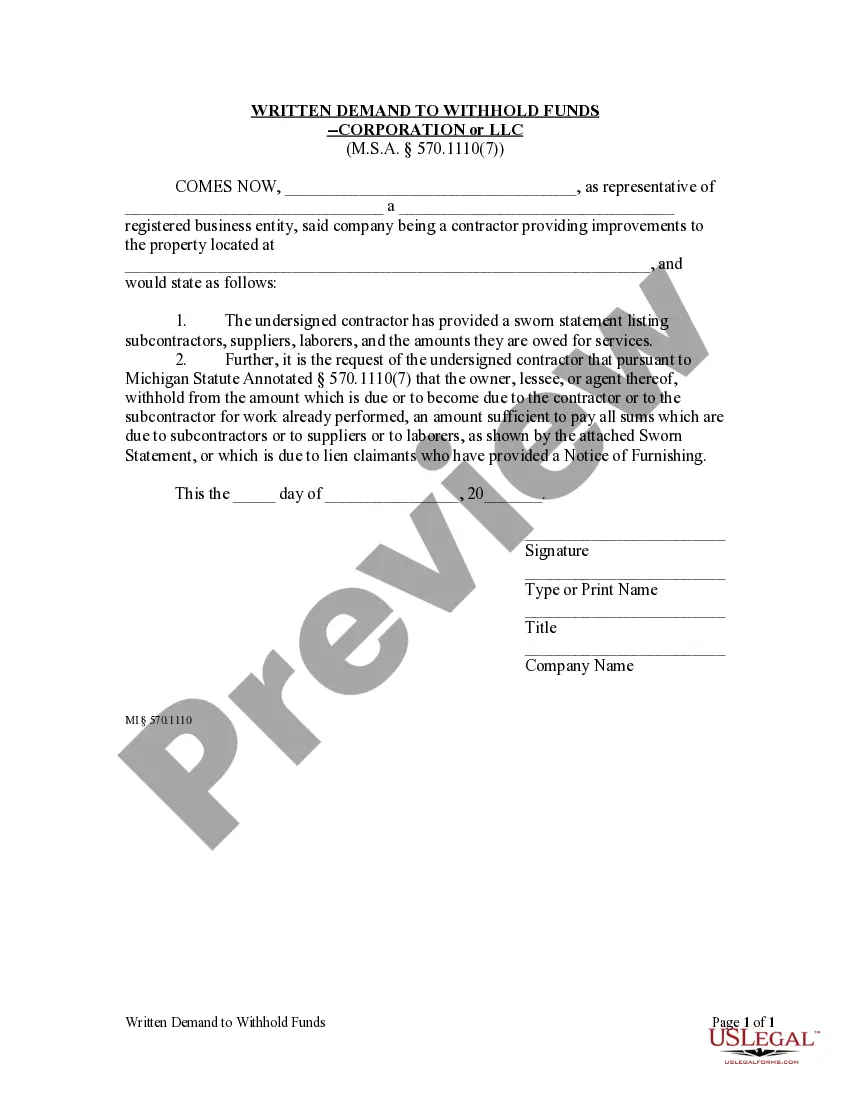

After the corporate or LLC contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

Title: Oakland Michigan Request to Withhold Funds — Corporation or LLC: Detailed Description and Types Introduction: In Oakland County, Michigan, corporations or Limited Liability Companies (LCS) may encounter situations where they need to request to withhold funds. This process allows these entities to prevent the transfer of funds to another party, either temporarily or permanently, in specific situations. In this article, we will provide an extensive overview of the Oakland Michigan Request to Withhold Funds for both corporations and LCS, including its purpose, procedure, and different types. I. Request to Withhold Funds — Corporation or LLC: A request to withhold funds is a formal legal action taken by corporations or LCS, aiming to prevent the transfer or payment of funds to a particular party or account due to specific circumstances. By initiating this request, the entity intends to safeguard its financial interests and address potential issues promptly. II. Purpose of Request to Withhold Funds: 1. Dispute Resolution: A common purpose of requesting to withhold funds is to resolve disputes or disagreements between two or more parties involved in a business transaction, partnership, or contractual arrangement. 2. Debt Recovery: Corporations or LCS may request to withhold funds when attempting to recover outstanding debts or compensations owed to them. 3. Legal Proceedings: In certain situations, entities may need to withhold funds to comply with ongoing legal proceedings, judgments, or court orders. 4. Contractual Obligations: A request to withhold funds may be made to ensure compliance with contractual terms or to enforce clauses related to payments or performance obligations. III. Procedure for Request to Withhold Funds: 1. Consultation: Before initiating the request, it is advisable for the corporation or LLC to consult with its legal counsel to assess the feasibility and legality of the proposed action. 2. Prepared Documentation: The entity should prepare a comprehensive written request outlining the purpose, detailed circumstances, supporting evidence, and the exact amount of funds to be withheld. 3. Submitting the Request: The request to withhold funds, accompanied by all relevant documentation, should be submitted to the appropriate entity or authority for review and consideration. 4. Review and Decision: The request will be thoroughly reviewed to evaluate its validity, adherence to applicable laws, and potential impact on all parties involved. The reviewing entity will then make a decision based on the provided information, ensuring a fair and just outcome. 5. Notification: Once a decision is reached, the corporation or LLC will be notified of the approval or denial of their request. In case of approval, further instructions on the procedures to withhold funds will be communicated. IV. Types of Request to Withhold Funds — Corporation or LLC: 1. Temporary Withholding: This type of request involves the temporary freeze or hold of funds until a specific event, condition, or issue is resolved. 2. Permanent Withholding: In cases where there is a compelling reason to permanently prevent the transfer of funds, corporations or LCS may request a permanent withholding. This is generally utilized when disputes remain unresolved, debts are owed, or contractual obligations are breached. Conclusion: Requesting to withhold funds is a strategic step for corporations or LCS in Oakland County, Michigan, to protect their financial interests and ensure fair resolution of disputes or compliance with legal and contractual obligations. Understanding the purpose, procedure, and different types of Oakland Michigan Request to Withhold Funds is essential for corporations and LCS to navigate such situations effectively.Title: Oakland Michigan Request to Withhold Funds — Corporation or LLC: Detailed Description and Types Introduction: In Oakland County, Michigan, corporations or Limited Liability Companies (LCS) may encounter situations where they need to request to withhold funds. This process allows these entities to prevent the transfer of funds to another party, either temporarily or permanently, in specific situations. In this article, we will provide an extensive overview of the Oakland Michigan Request to Withhold Funds for both corporations and LCS, including its purpose, procedure, and different types. I. Request to Withhold Funds — Corporation or LLC: A request to withhold funds is a formal legal action taken by corporations or LCS, aiming to prevent the transfer or payment of funds to a particular party or account due to specific circumstances. By initiating this request, the entity intends to safeguard its financial interests and address potential issues promptly. II. Purpose of Request to Withhold Funds: 1. Dispute Resolution: A common purpose of requesting to withhold funds is to resolve disputes or disagreements between two or more parties involved in a business transaction, partnership, or contractual arrangement. 2. Debt Recovery: Corporations or LCS may request to withhold funds when attempting to recover outstanding debts or compensations owed to them. 3. Legal Proceedings: In certain situations, entities may need to withhold funds to comply with ongoing legal proceedings, judgments, or court orders. 4. Contractual Obligations: A request to withhold funds may be made to ensure compliance with contractual terms or to enforce clauses related to payments or performance obligations. III. Procedure for Request to Withhold Funds: 1. Consultation: Before initiating the request, it is advisable for the corporation or LLC to consult with its legal counsel to assess the feasibility and legality of the proposed action. 2. Prepared Documentation: The entity should prepare a comprehensive written request outlining the purpose, detailed circumstances, supporting evidence, and the exact amount of funds to be withheld. 3. Submitting the Request: The request to withhold funds, accompanied by all relevant documentation, should be submitted to the appropriate entity or authority for review and consideration. 4. Review and Decision: The request will be thoroughly reviewed to evaluate its validity, adherence to applicable laws, and potential impact on all parties involved. The reviewing entity will then make a decision based on the provided information, ensuring a fair and just outcome. 5. Notification: Once a decision is reached, the corporation or LLC will be notified of the approval or denial of their request. In case of approval, further instructions on the procedures to withhold funds will be communicated. IV. Types of Request to Withhold Funds — Corporation or LLC: 1. Temporary Withholding: This type of request involves the temporary freeze or hold of funds until a specific event, condition, or issue is resolved. 2. Permanent Withholding: In cases where there is a compelling reason to permanently prevent the transfer of funds, corporations or LCS may request a permanent withholding. This is generally utilized when disputes remain unresolved, debts are owed, or contractual obligations are breached. Conclusion: Requesting to withhold funds is a strategic step for corporations or LCS in Oakland County, Michigan, to protect their financial interests and ensure fair resolution of disputes or compliance with legal and contractual obligations. Understanding the purpose, procedure, and different types of Oakland Michigan Request to Withhold Funds is essential for corporations and LCS to navigate such situations effectively.