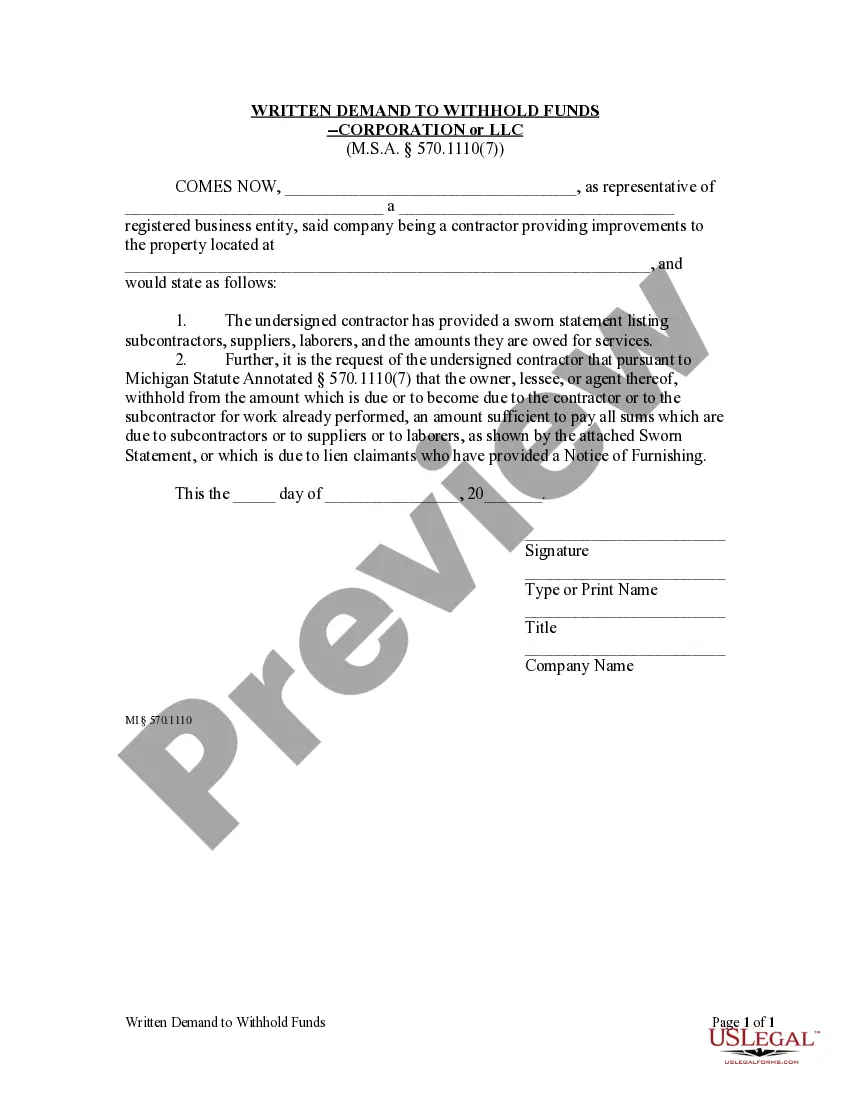

After the corporate or LLC contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

Sterling Heights, Michigan, offers a comprehensive request to withhold funds for corporations and limited liability companies (LCS). Whether you are a corporation or an LLC, this process allows you to safeguard your financial interests and protect your assets. By filing a specific request to withhold funds, you can ensure that your financial security remains intact. The Sterling Heights Request to Withhold Funds for Corporations or LCS is a legal procedure that allows businesses to designate certain funds as protected from being seized or transferred. This process offers a level of financial security and control, ensuring that your company's assets are not jeopardized in any way. There are various scenarios in which a business may consider filing a request to withhold funds in Sterling Heights, Michigan. These include instances like potential legal disputes, outstanding debts, pending litigation, or ongoing investigations. By initiating this request, businesses gain an added layer of protection against any potential financial risks and uncertainties. Corporations and LCS in Sterling Heights may have different types of requests to withhold funds available to them. These types can vary depending on the specific circumstances and needs of the business. Some common variations of a Sterling Heights Request to Withhold Funds for Corporations or LCS may include: 1. Prejudgment Attachment: A request filed before any formal judgment is made, aiming to prevent the transfer of funds that could hinder the claimant's ability to collect what they are owed. 2. Postjudgment Attachment: A request initiated after a judgment has been obtained, allowing the successful party to secure the funds owed to them to ensure payment. 3. Dissolution Withholding: A request filed during the dissolution process of a corporation or LLC, aimed at protecting assets and funds until all outstanding obligations and debts are settled. 4. Civil Litigation Withholding: A request filed during the course of civil litigation, where funds are withheld to prevent the depletion of assets during the legal proceedings. To initiate a Sterling Heights Request to Withhold Funds for Corporations or LCS, business owners must follow specific procedures and complete the necessary documentation required by the local court system. It is essential to consult with a qualified attorney or legal professional to ensure compliance with all relevant laws and regulations. By filing a request to withhold funds in Sterling Heights, Michigan, corporations and LCS can safeguard their financial interests and protect their assets from potential risks. This process helps businesses maintain stability, control, and fiscal security in the face of legal or financial challenges.Sterling Heights, Michigan, offers a comprehensive request to withhold funds for corporations and limited liability companies (LCS). Whether you are a corporation or an LLC, this process allows you to safeguard your financial interests and protect your assets. By filing a specific request to withhold funds, you can ensure that your financial security remains intact. The Sterling Heights Request to Withhold Funds for Corporations or LCS is a legal procedure that allows businesses to designate certain funds as protected from being seized or transferred. This process offers a level of financial security and control, ensuring that your company's assets are not jeopardized in any way. There are various scenarios in which a business may consider filing a request to withhold funds in Sterling Heights, Michigan. These include instances like potential legal disputes, outstanding debts, pending litigation, or ongoing investigations. By initiating this request, businesses gain an added layer of protection against any potential financial risks and uncertainties. Corporations and LCS in Sterling Heights may have different types of requests to withhold funds available to them. These types can vary depending on the specific circumstances and needs of the business. Some common variations of a Sterling Heights Request to Withhold Funds for Corporations or LCS may include: 1. Prejudgment Attachment: A request filed before any formal judgment is made, aiming to prevent the transfer of funds that could hinder the claimant's ability to collect what they are owed. 2. Postjudgment Attachment: A request initiated after a judgment has been obtained, allowing the successful party to secure the funds owed to them to ensure payment. 3. Dissolution Withholding: A request filed during the dissolution process of a corporation or LLC, aimed at protecting assets and funds until all outstanding obligations and debts are settled. 4. Civil Litigation Withholding: A request filed during the course of civil litigation, where funds are withheld to prevent the depletion of assets during the legal proceedings. To initiate a Sterling Heights Request to Withhold Funds for Corporations or LCS, business owners must follow specific procedures and complete the necessary documentation required by the local court system. It is essential to consult with a qualified attorney or legal professional to ensure compliance with all relevant laws and regulations. By filing a request to withhold funds in Sterling Heights, Michigan, corporations and LCS can safeguard their financial interests and protect their assets from potential risks. This process helps businesses maintain stability, control, and fiscal security in the face of legal or financial challenges.