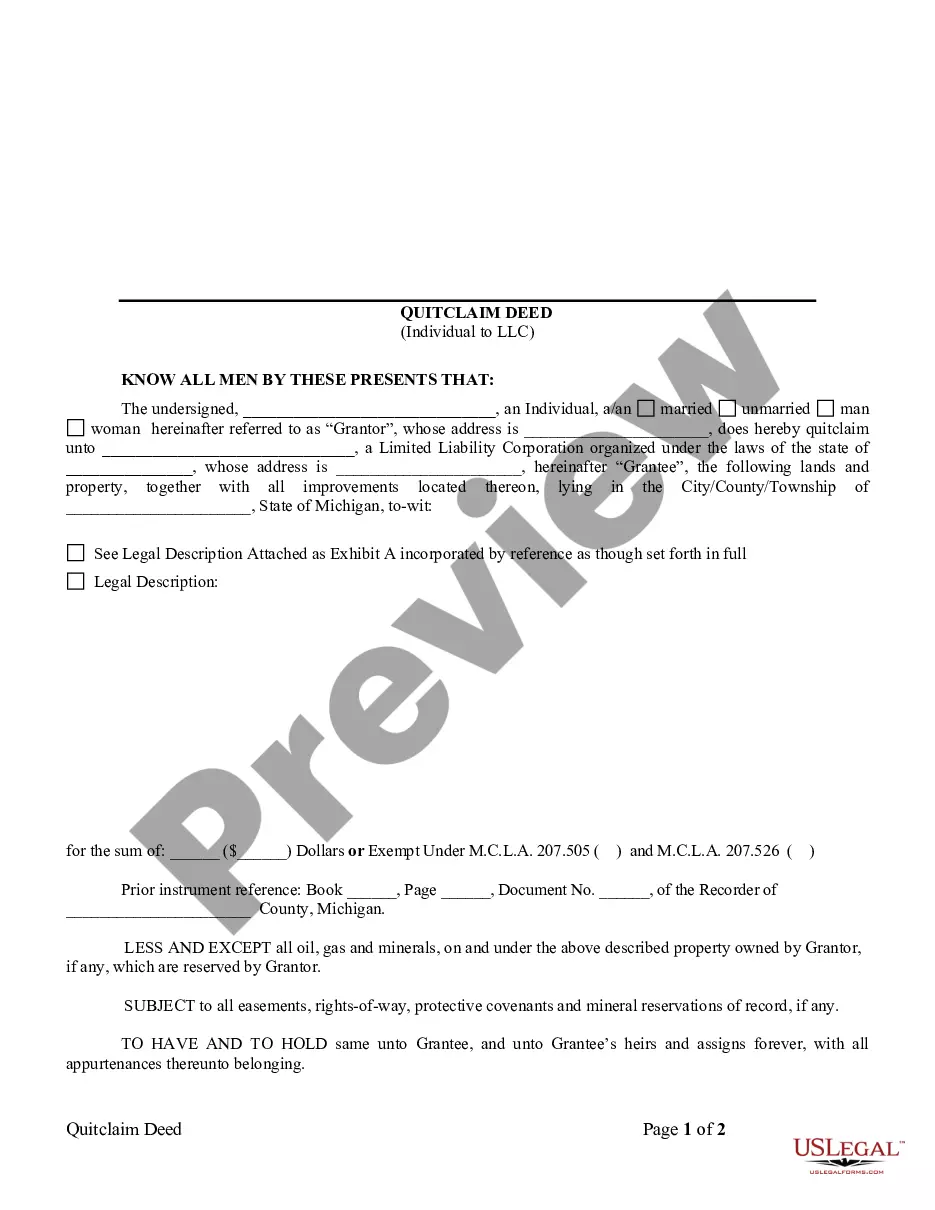

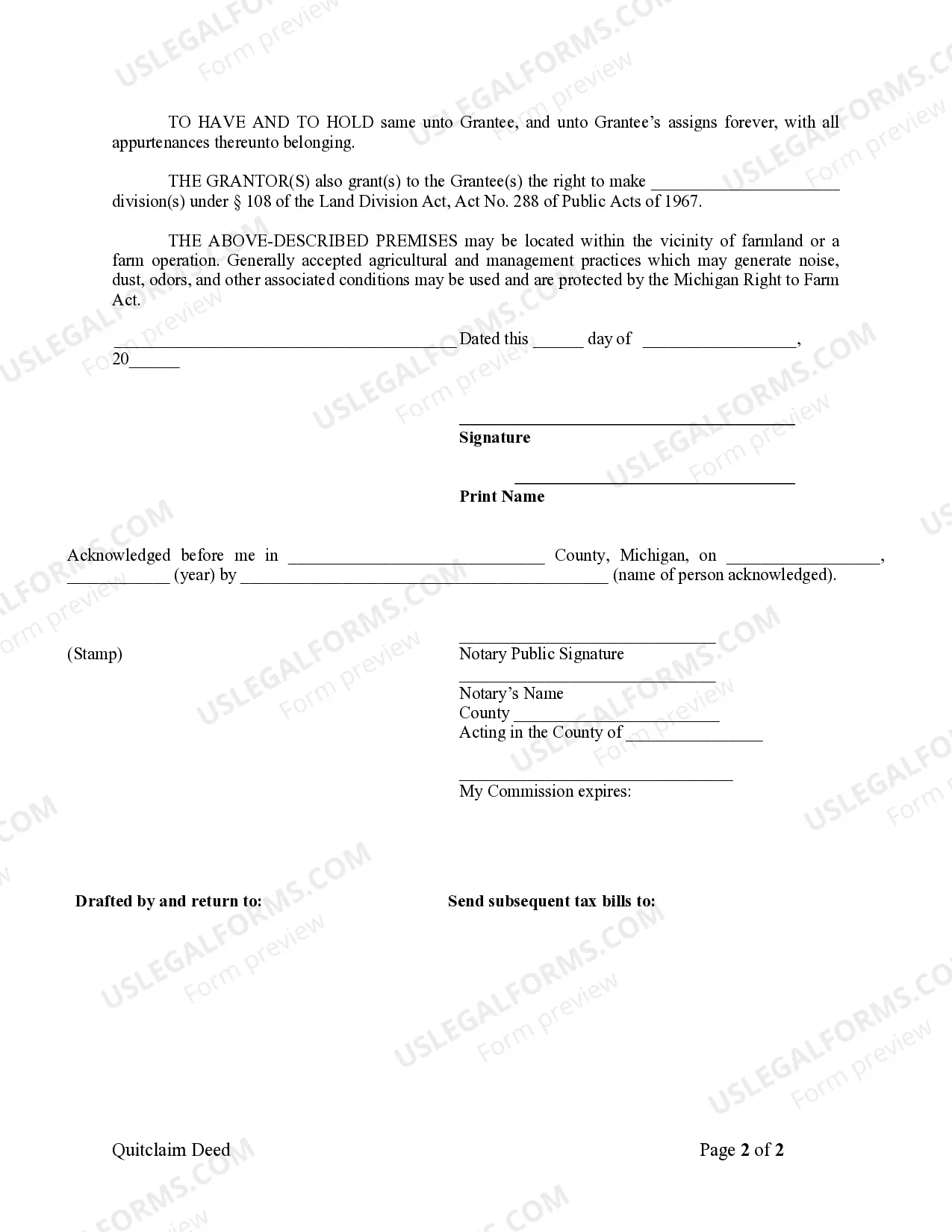

A Grand Rapids Michigan Quitclaim Deed from Individual to LLC is a legal document that transfers ownership of a property from an individual to a limited liability company (LLC) in the vibrant city of Grand Rapids, Michigan. This type of deed is commonly used when an individual wishes to convey their personal property interests to their LLC. A Quitclaim Deed relinquishes any and all claims or ownership the individual has in the property, without providing any guarantees or warranties regarding the property's title. There are several notable types of Grand Rapids Michigan Quitclaim Deeds from Individual to LLC that individuals may encounter, depending on specific circumstances and requirements. Some of these include: 1. Voluntary Quitclaim Deed: This is the most common type of Quitclaim Deed whereby the individual willingly and without coercion transfers their property to an LLC. This can occur for various reasons, such as asset protection, estate planning, or legal restructuring. 2. Gift Quitclaim Deed: This type of deed may occur when an individual wishes to gift their property to their LLC, often for tax planning purposes or to simplify management and operations. It implies that the transfer is a gift, and no consideration is exchanged between the individual and the LLC. 3. Divorce Quitclaim Deed: In cases of divorce or separation, a Quitclaim Deed can be used to transfer property ownership from one spouse (individual) to their LLC, effectively removing any claim the transferring spouse may have on the property as a result of the divorce settlement. 4. Estate Planning Quitclaim Deed: Some individuals may utilize a Quitclaim Deed to transfer their property to their LLC as part of an estate plan. This allows for seamless distribution of property and assets upon the individual's passing, avoiding probate and potential disputes among heirs. Regardless of the specific type of Quitclaim Deed, it is essential to consult with a legal professional experienced in real estate law to ensure compliance with Grand Rapids, Michigan regulations and to protect the interests of both the individual and the LLC involved.

Grand Rapids Michigan Quitclaim Deed from Individual to LLC

Description

How to fill out Grand Rapids Michigan Quitclaim Deed From Individual To LLC?

Do you need a reliable and affordable legal forms supplier to get the Grand Rapids Michigan Quitclaim Deed from Individual to LLC? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, locate the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Grand Rapids Michigan Quitclaim Deed from Individual to LLC conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is good for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Grand Rapids Michigan Quitclaim Deed from Individual to LLC in any available file format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online once and for all.