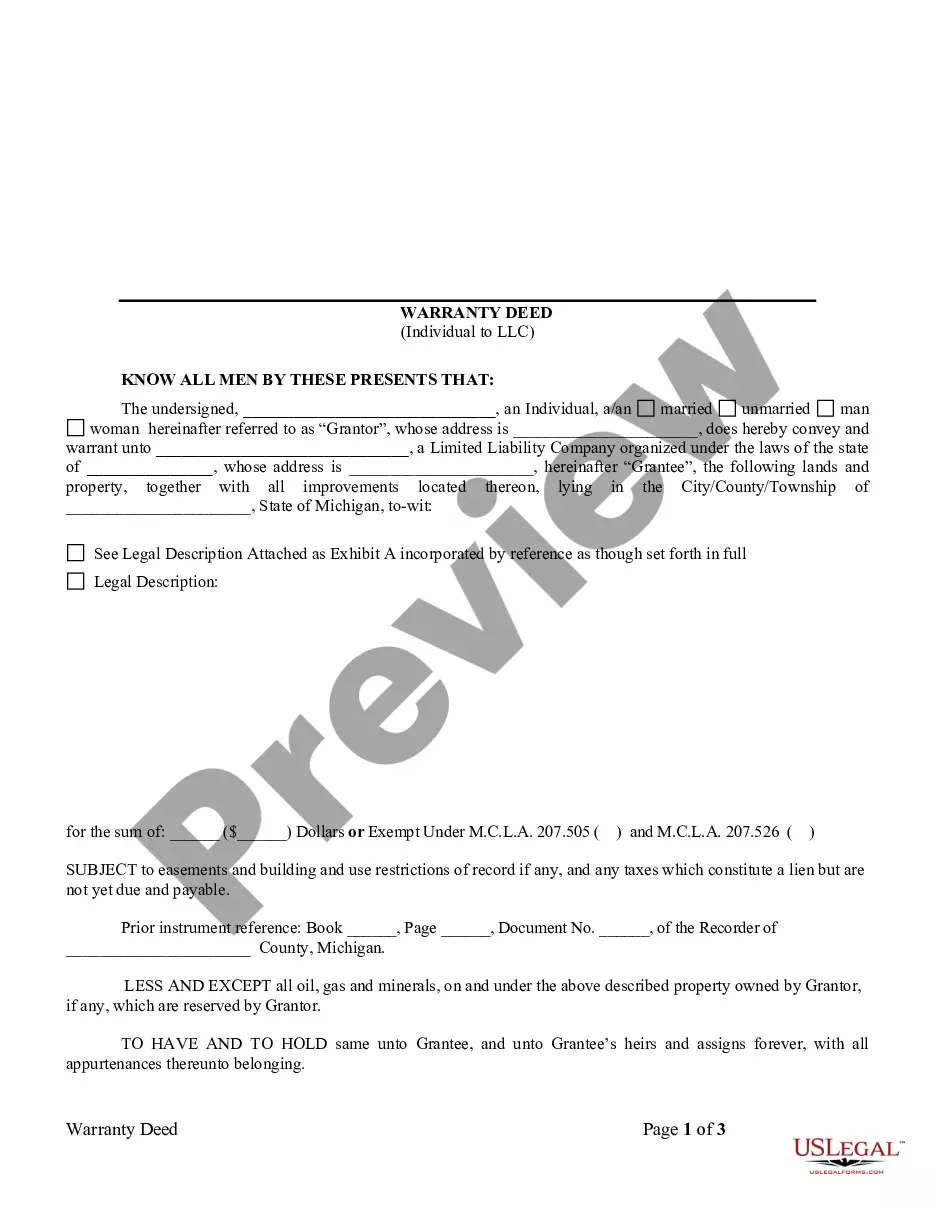

This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Detroit Michigan Warranty Deed from Individual to LLC

Description

How to fill out Michigan Warranty Deed From Individual To LLC?

Utilize the US Legal Forms for prompt access to any document you desire.

Our user-friendly website featuring countless document templates simplifies the process of locating and acquiring nearly any document sample you might require.

You can save, fill out, and sign the Detroit Michigan Warranty Deed from Individual to LLC in mere minutes, rather than spending hours searching online for a suitable template.

Employing our collection is an excellent method to enhance the security of your document submissions.

If you do not yet have an account, follow the steps outlined below.

Access the page containing the template you require. Ensure that it is the template you seek: verify its title and description, and utilize the Preview option if available. If not, use the Search box to find the suitable one.

- Our knowledgeable legal experts routinely review all documents to guarantee that the templates are applicable for specific states and adhere to current laws and regulations.

- How can you secure the Detroit Michigan Warranty Deed from Individual to LLC.

- If you possess an account, simply Log In to your account.

- The Download option will be available for all documents you access.

- You can also retrieve all previously saved files in the My documents section.

Form popularity

FAQ

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

A warranty deed must include the legibly written or printed names of all grantees and grantors, Michigan law states. The deed must identify the property by its address and the legal description recorded in the county where the property is located.

Transfer Tax (Local Treasurer's Office): this tax is for the barter, sale, or any other method of ownership or title of real property transfer, at the maximum rate of 50% of 1%, or 75% of 1% in cities and municipalities within Metro Manila, of a property's worth.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

MICHIGAN REAL ESTATE TRANSFER TAX The tax shall be upon the person who is the seller or the grantor. In the case of an exchange of two properties the deeds transferring title to each are subject to tax, and in each case shall be computed on the basis of the actual value of the property conveyed.

State Transfer Tax Rate ? $3.75 for every $500 of value transferred. County Transfer Tax Rate ? $0.55 for every $500 of value transferred.

MCL 207.505/MCL 207.526 $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.