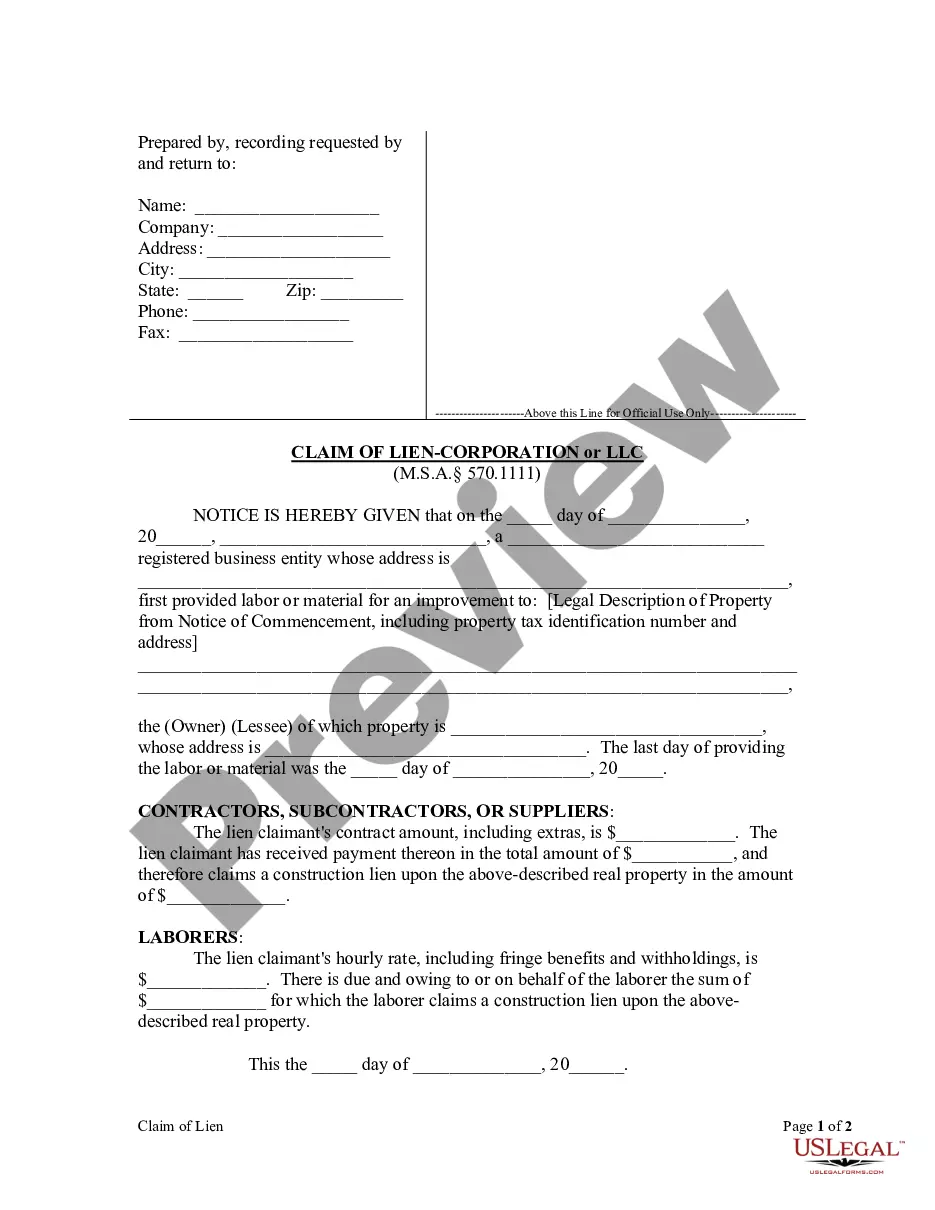

Within ninety (90) days after a corporate or LLC lien claimant's last furnishing of labor or material for the improvement pursuant to the lien claimant's contract, a Claim of Lien must be recorded in the office of the register of deeds for each county where the real property to which the improvement was made is located.

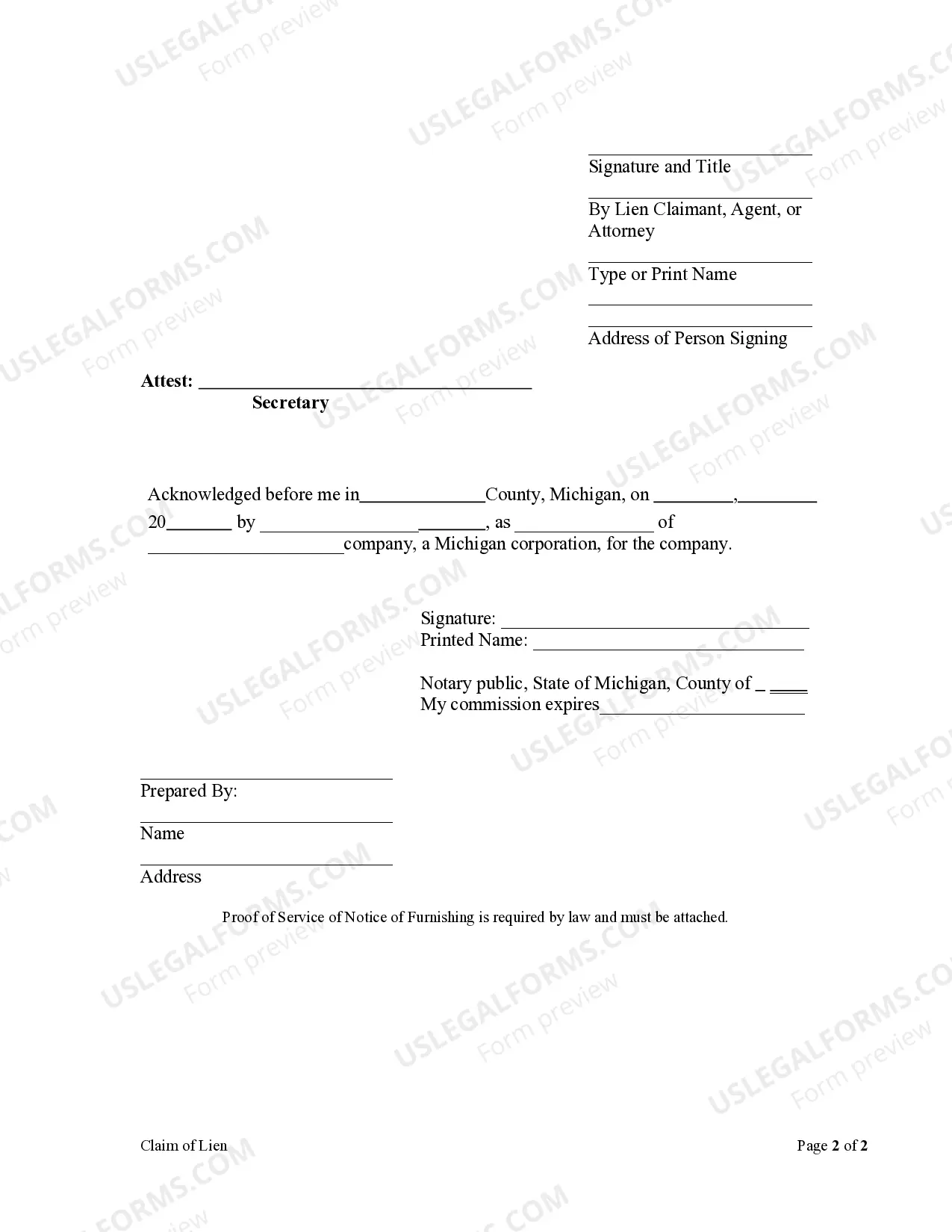

Detroit Michigan Claim of Lien — Corporation or LLC is a legal document filed by a corporation or limited liability company (LLC) in the city of Detroit, Michigan. This claim of lien is used to establish a creditor's right to claim a lien against a property owned by the debtor in order to secure the repayment of a debt owed to the corporation or LLC. The claim of lien provides a legal notice to third parties, such as potential buyers or lenders, that there is an outstanding debt on the property and prevents the debtor from freely transferring their interest in the property until the debt is paid off. There may be different types of Detroit Michigan Claim of Lien — Corporation or LLC, depending on the specific nature of the debt and the property involved. Examples include tax liens, mechanic's liens, and judgment liens. These liens can arise from various reasons such as unpaid taxes, debts related to construction or repairs done on the property, or a court judgment ruling in favor of the corporation or LLC. To file a Detroit Michigan Claim of Lien — Corporation or LLC, the creditor must typically provide certain information, including the name and address of the debtor, a description of the property subject to the lien, the amount of the debt owed, and any supporting documents or evidence that substantiates the debt. The claim must be filed with the appropriate office or authority, usually the county clerk's office, and a fee may be required. Once the claim of lien is filed, it becomes a matter of public record, allowing interested parties to access information about the debt and the property. This helps protect the creditor's interests and provides transparency to potential investors or other entities that may consider engaging in transactions involving the property. It is important to note that filing a claim of lien does not automatically guarantee the repayment of the debt. The creditor may still need to pursue legal action to enforce the lien and recover the debt. Additionally, the debtor has the right to challenge the validity of the lien or negotiate a resolution with the creditor. In summary, the Detroit Michigan Claim of Lien — Corporation or LLC is a legal tool used by corporations or LCS to secure their debts against a property owned by a debtor. It serves as a public notice of the debt and provides protection to the creditor's rights. Various types of liens can be filed depending on the nature of the debt, and proper documentation and filing procedures must be followed to ensure the effectiveness of the claim.Detroit Michigan Claim of Lien — Corporation or LLC is a legal document filed by a corporation or limited liability company (LLC) in the city of Detroit, Michigan. This claim of lien is used to establish a creditor's right to claim a lien against a property owned by the debtor in order to secure the repayment of a debt owed to the corporation or LLC. The claim of lien provides a legal notice to third parties, such as potential buyers or lenders, that there is an outstanding debt on the property and prevents the debtor from freely transferring their interest in the property until the debt is paid off. There may be different types of Detroit Michigan Claim of Lien — Corporation or LLC, depending on the specific nature of the debt and the property involved. Examples include tax liens, mechanic's liens, and judgment liens. These liens can arise from various reasons such as unpaid taxes, debts related to construction or repairs done on the property, or a court judgment ruling in favor of the corporation or LLC. To file a Detroit Michigan Claim of Lien — Corporation or LLC, the creditor must typically provide certain information, including the name and address of the debtor, a description of the property subject to the lien, the amount of the debt owed, and any supporting documents or evidence that substantiates the debt. The claim must be filed with the appropriate office or authority, usually the county clerk's office, and a fee may be required. Once the claim of lien is filed, it becomes a matter of public record, allowing interested parties to access information about the debt and the property. This helps protect the creditor's interests and provides transparency to potential investors or other entities that may consider engaging in transactions involving the property. It is important to note that filing a claim of lien does not automatically guarantee the repayment of the debt. The creditor may still need to pursue legal action to enforce the lien and recover the debt. Additionally, the debtor has the right to challenge the validity of the lien or negotiate a resolution with the creditor. In summary, the Detroit Michigan Claim of Lien — Corporation or LLC is a legal tool used by corporations or LCS to secure their debts against a property owned by a debtor. It serves as a public notice of the debt and provides protection to the creditor's rights. Various types of liens can be filed depending on the nature of the debt, and proper documentation and filing procedures must be followed to ensure the effectiveness of the claim.