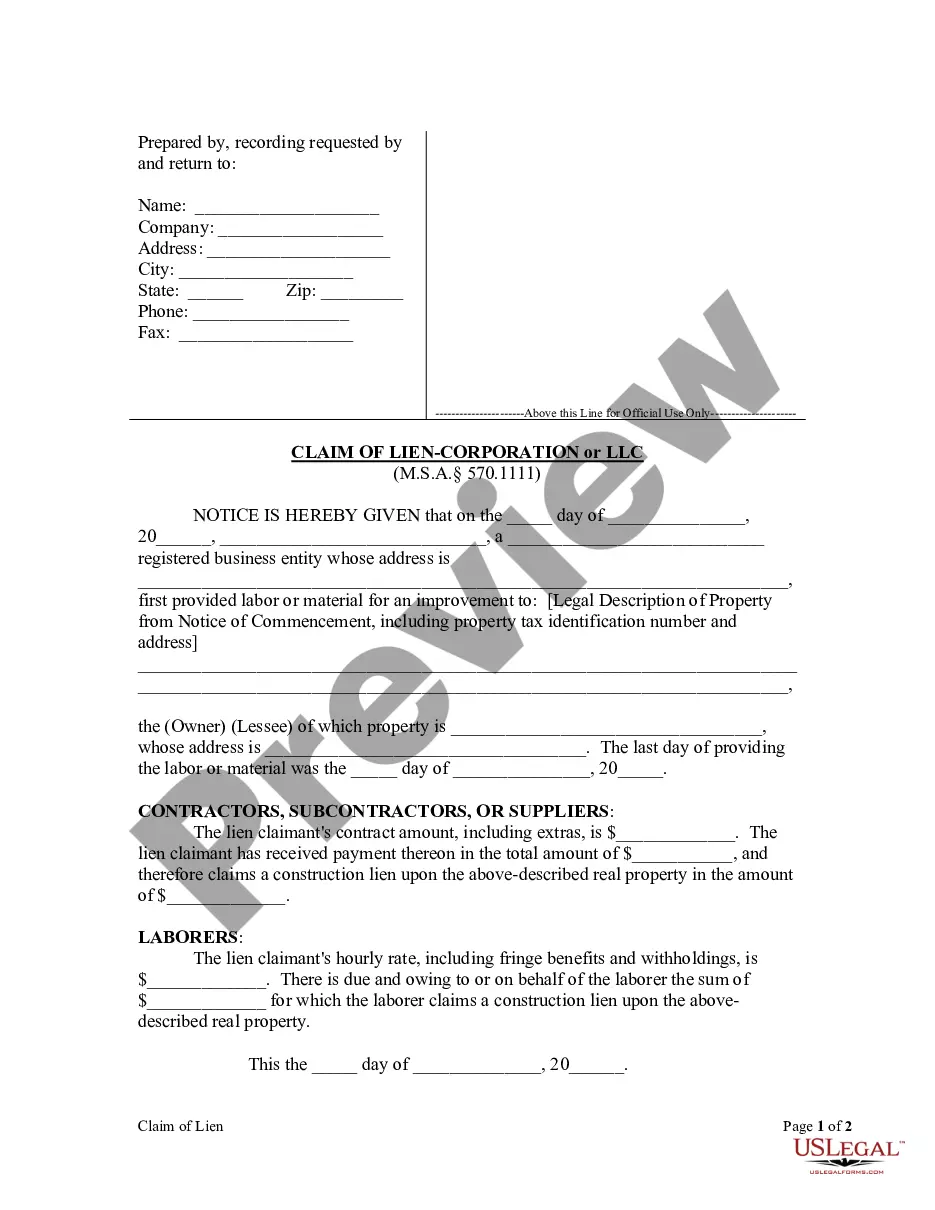

Within ninety (90) days after a corporate or LLC lien claimant's last furnishing of labor or material for the improvement pursuant to the lien claimant's contract, a Claim of Lien must be recorded in the office of the register of deeds for each county where the real property to which the improvement was made is located.

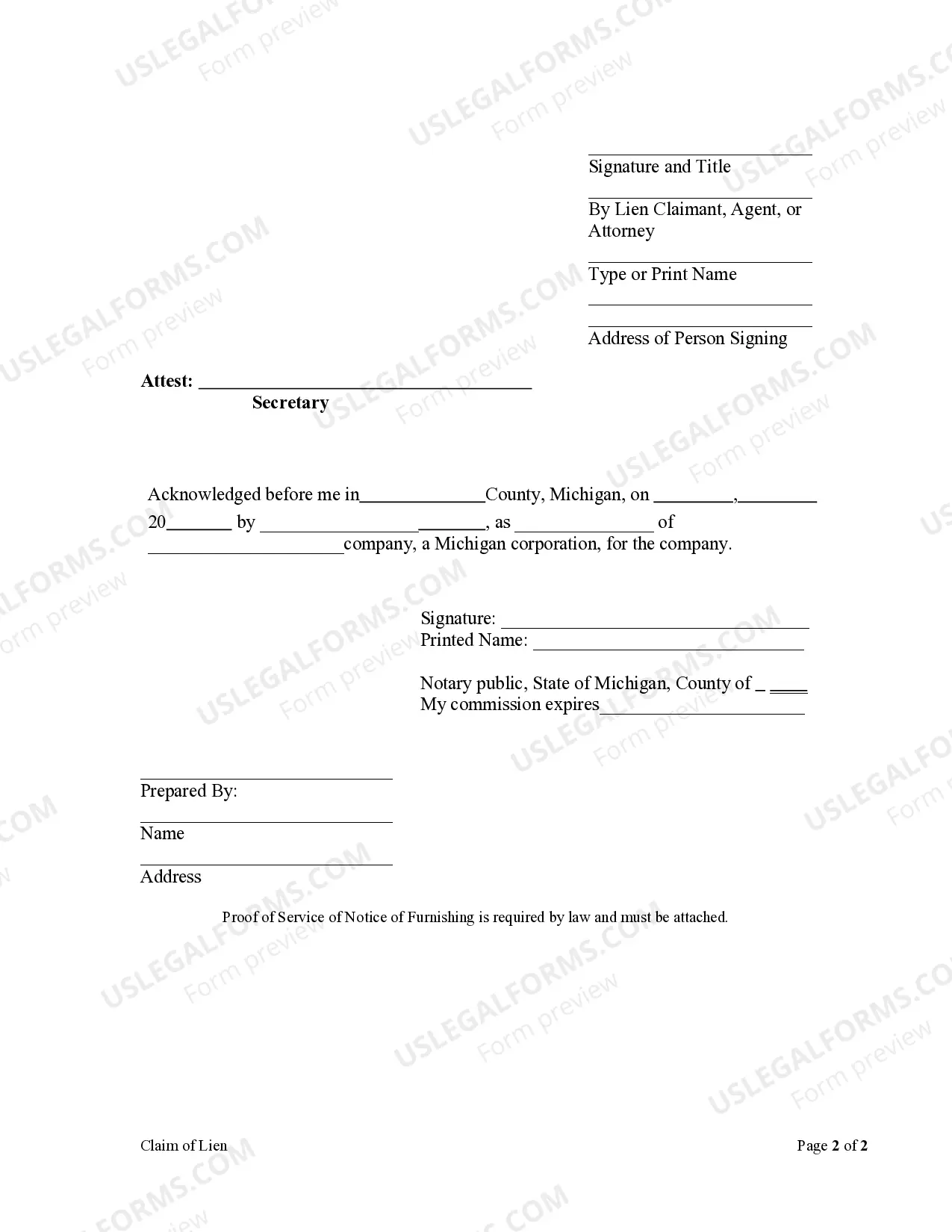

Oakland Michigan Claim of Lien — Corporation or LLC: A Detailed Description In Oakland, Michigan, claiming a lien against a corporation or limited liability company (LLC) involves a legal process to secure outstanding debts or obligations. A claim of lien is an important tool that ensures creditors have a legal right to recover their dues when the corporation or LLC fails to fulfill its obligations. Understanding the various types of lien claims is essential for both creditors and debtors involved in business transactions. So, let's take a closer look at the Oakland Michigan Claim of Lien — Corporation or LLC. Types of Oakland Michigan Claim of Lien — Corporation or LLC: 1. Mechanic's Lien: A mechanic's lien is a claim filed by contractors, subcontractors, or suppliers who have performed labor, provided materials, or provided services for improving real property owned by a corporation or LLC. This type of lien ensures that the claimants' right to payment is recognized even if the property owner fails to honor the financial obligations associated with the work performed. 2. Judgment Lien: A judgment lien is filed when a creditor obtains a court judgment against a corporation or LLC. This type of lien gives the creditor the right to claim the debtor's property or assets to satisfy the outstanding debt or judgment. By filing a judgment lien, the creditor secures its position and ensures that its claim is prioritized over other unsecured debts the debtor may have. 3. Tax Lien: A tax lien is filed by the government or taxing authorities against a corporation or LLC when there are unpaid taxes. When a business fails to pay its taxes, the government can place a lien on its assets, including real estate, vehicles, and bank accounts. This ensures that the government receives its due payment before other creditors. 4. Writ of Attachment Lien: A writ of attachment lien is filed to secure a claim prior to obtaining a judgment. This lien type allows the creditor to legally seize the debtor's property or assets in anticipation of a judgment. By attaching the property, the creditor ensures that it will be able to recover its dues even if the debtor tries to dispose of assets to avoid payment. When filing any type of Oakland Michigan Claim of Lien — Corporation or LLC, it is crucial to follow the legal procedures accurately. This includes properly identifying the debtor, providing relevant documentation, and adhering to statutory timelines. Failure to comply with these regulations may result in the claim being deemed invalid or unenforceable, adversely affecting the creditor's ability to recover the outstanding amount. Having a comprehensive understanding of different types of lien claims available in Oakland, Michigan, for corporations or LCS is essential for both creditors and debtors. Creditors can protect their rights and increase their chances of recovering outstanding debts, while debtors can ensure they are aware of the potential consequences of not meeting their financial obligations. Ultimately, a proper understanding of the Oakland Michigan Claim of Lien — Corporation or LLC process can help facilitate fair and transparent business dealings in Oakland, Michigan.Oakland Michigan Claim of Lien — Corporation or LLC: A Detailed Description In Oakland, Michigan, claiming a lien against a corporation or limited liability company (LLC) involves a legal process to secure outstanding debts or obligations. A claim of lien is an important tool that ensures creditors have a legal right to recover their dues when the corporation or LLC fails to fulfill its obligations. Understanding the various types of lien claims is essential for both creditors and debtors involved in business transactions. So, let's take a closer look at the Oakland Michigan Claim of Lien — Corporation or LLC. Types of Oakland Michigan Claim of Lien — Corporation or LLC: 1. Mechanic's Lien: A mechanic's lien is a claim filed by contractors, subcontractors, or suppliers who have performed labor, provided materials, or provided services for improving real property owned by a corporation or LLC. This type of lien ensures that the claimants' right to payment is recognized even if the property owner fails to honor the financial obligations associated with the work performed. 2. Judgment Lien: A judgment lien is filed when a creditor obtains a court judgment against a corporation or LLC. This type of lien gives the creditor the right to claim the debtor's property or assets to satisfy the outstanding debt or judgment. By filing a judgment lien, the creditor secures its position and ensures that its claim is prioritized over other unsecured debts the debtor may have. 3. Tax Lien: A tax lien is filed by the government or taxing authorities against a corporation or LLC when there are unpaid taxes. When a business fails to pay its taxes, the government can place a lien on its assets, including real estate, vehicles, and bank accounts. This ensures that the government receives its due payment before other creditors. 4. Writ of Attachment Lien: A writ of attachment lien is filed to secure a claim prior to obtaining a judgment. This lien type allows the creditor to legally seize the debtor's property or assets in anticipation of a judgment. By attaching the property, the creditor ensures that it will be able to recover its dues even if the debtor tries to dispose of assets to avoid payment. When filing any type of Oakland Michigan Claim of Lien — Corporation or LLC, it is crucial to follow the legal procedures accurately. This includes properly identifying the debtor, providing relevant documentation, and adhering to statutory timelines. Failure to comply with these regulations may result in the claim being deemed invalid or unenforceable, adversely affecting the creditor's ability to recover the outstanding amount. Having a comprehensive understanding of different types of lien claims available in Oakland, Michigan, for corporations or LCS is essential for both creditors and debtors. Creditors can protect their rights and increase their chances of recovering outstanding debts, while debtors can ensure they are aware of the potential consequences of not meeting their financial obligations. Ultimately, a proper understanding of the Oakland Michigan Claim of Lien — Corporation or LLC process can help facilitate fair and transparent business dealings in Oakland, Michigan.