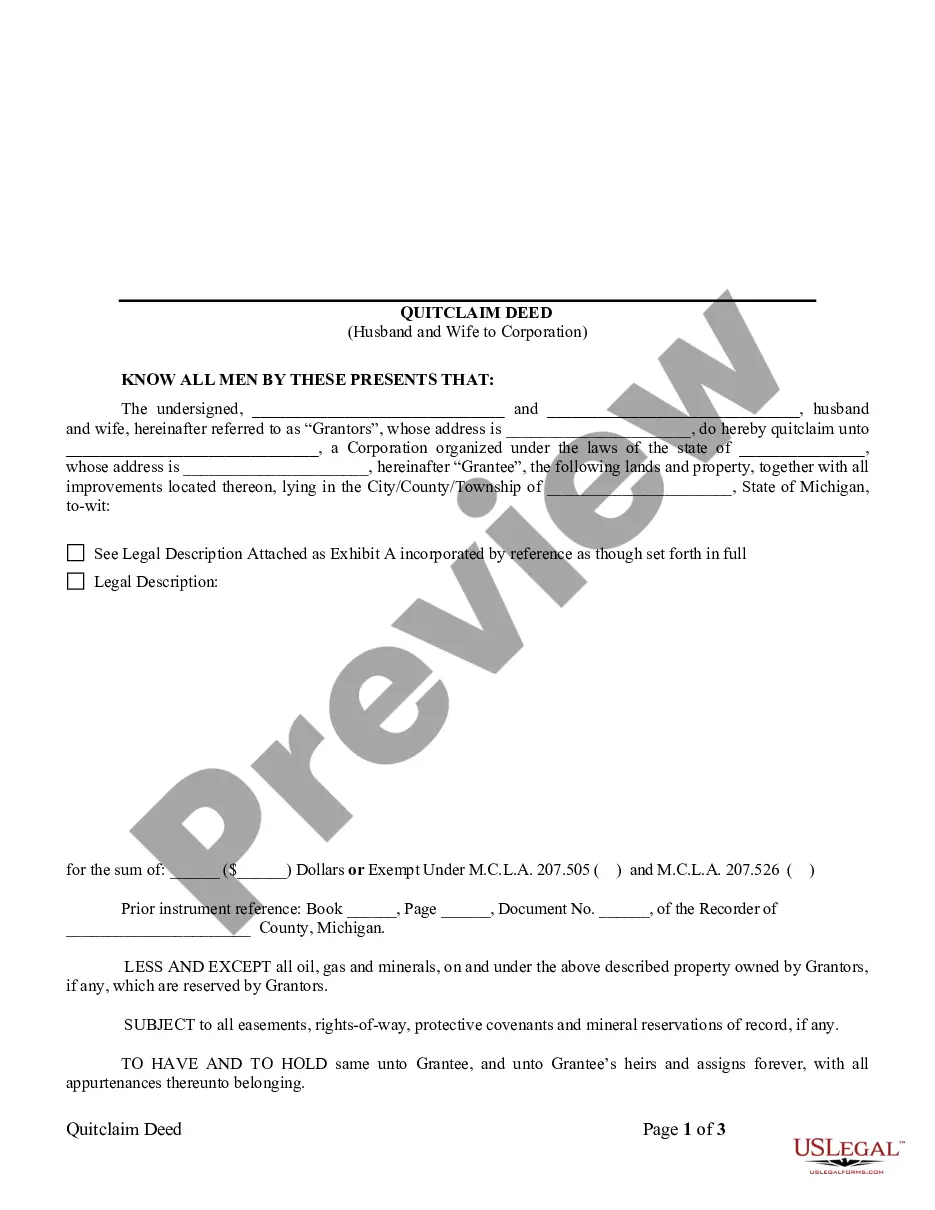

An Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership between a married couple (as granters) and a corporation (as the grantee). This type of deed allows the couple to relinquish any claims they have on the property, clearing the way for the corporation to assume full ownership. In Ann Arbor, Michigan, there are several variations of Quitclaim Deeds from Husband and Wife to Corporation that may be relevant, including: 1. General Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation: This is the standard form used to transfer property ownership from a married couple to a corporation. It provides a straightforward and legally binding method of transferring the title without any warranties or guarantees. 2. Ann Arbor Michigan Enhanced Life Estate Quitclaim Deed from Husband and Wife to Corporation: Also known as a "Ladybird Deed," this type of quitclaim deed allows the couple to retain a life estate, providing them with the right to live on and use the property until their death. Upon their passing, ownership automatically transfers to the corporation, bypassing probate. 3. Ann Arbor Michigan Joint Tenancy with Right of Survivorship Quitclaim Deed from Husband and Wife to Corporation: In this variation, the quitclaim deed establishes joint tenancy between the husband, wife, and the corporation. Upon the death of one spouse, the property ownership automatically transfers to the surviving spouse and corporation without the need for probate. 4. Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation with Restrictive Covenants: This type of quitclaim deed includes specific restrictions or limitations on the property's use, such as zoning regulations, community guidelines, or environmental restrictions. The purpose is to ensure the property is used in compliance with certain requirements outlined by local authorities or organizations. When preparing an Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation, it is advisable to consult with a qualified attorney or real estate professional familiar with Michigan laws to ensure compliance and accuracy. This will help safeguard the interests of both parties involved in the transfer of property ownership.

Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Ann Arbor Michigan Quitclaim Deed From Husband And Wife To Corporation?

Do you need a trustworthy and inexpensive legal forms supplier to get the Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of specific state and county.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is intended for.

- Restart the search in case the template isn’t good for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Ann Arbor Michigan Quitclaim Deed from Husband and Wife to Corporation in any provided format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.