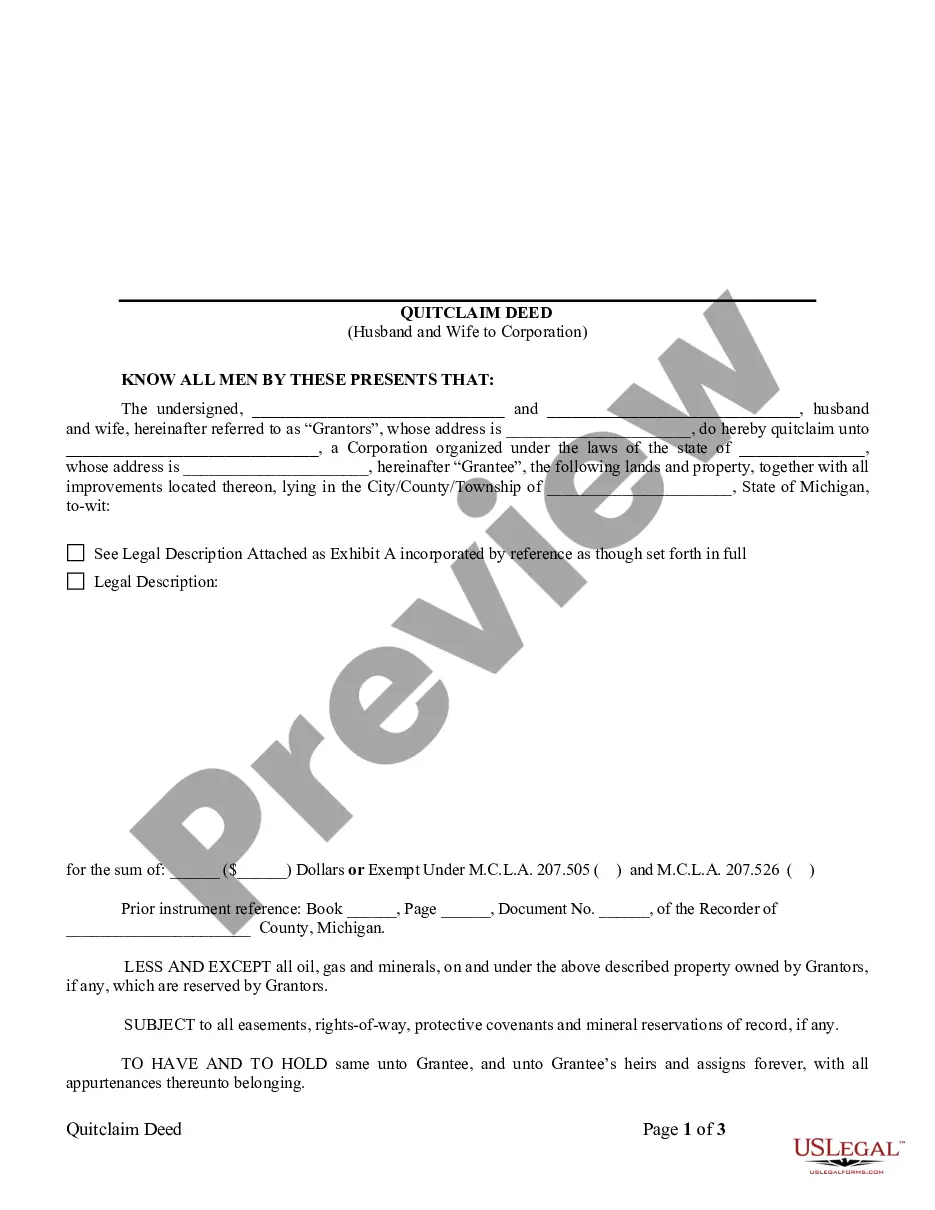

A Sterling Heights Michigan quitclaim deed from husband and wife to a corporation is a legal document that transfers ownership of a property from a married couple to a corporation, using a quitclaim deed format. This type of deed is commonly used when a married couple wishes to transfer property ownership or protect their assets within the corporate structure. It is crucial to have a detailed understanding of the various types of quitclaim deeds associated with this process. The first type of quitclaim deed is the "Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation for Asset Protection." This type of deed is typically utilized when a married couple seeks to shield their personal assets from potential liabilities associated with their property. By transferring the property ownership to a corporation, they can minimize their personal liability and protect their assets. The second type of quitclaim deed is the "Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation for Business Purposes." In this scenario, a married couple transfers property ownership to a corporation to utilize it for business-related activities. This type of deed allows the couple to separate personal and business assets, ensuring clear distinction and protection of each entity. Another type of quitclaim deed is the "Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation for Tax Purposes." This deed is used when a married couple seeks to optimize tax benefits or take advantage of certain tax incentives, such as property tax reliefs or deductions. By transferring ownership to a corporation, the couple may be able to significantly reduce their tax burden or enjoy other tax advantages. Furthermore, there may also be a "Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation for Estate Planning." This type of deed is commonly used when a couple wishes to include their property within their estate plan. By transferring ownership to a corporation, they can facilitate the succession or distribution of their property to designated beneficiaries, simplifying the process and potentially avoiding probate. Overall, a Sterling Heights Michigan quitclaim deed from husband and wife to a corporation serves as a transfer instrument to ensure legal ownership and protection of property within a corporate framework. It is essential to consult with a legal professional specializing in real estate law to ensure compliance with specific regulations and to determine the most suitable type of quitclaim deed based on the couple's goals and circumstances.

Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Sterling Heights Michigan Quitclaim Deed From Husband And Wife To Corporation?

Do you need a trustworthy and affordable legal forms supplier to buy the Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation? US Legal Forms is your go-to choice.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is intended for.

- Restart the search if the form isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Sterling Heights Michigan Quitclaim Deed from Husband and Wife to Corporation in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online for good.