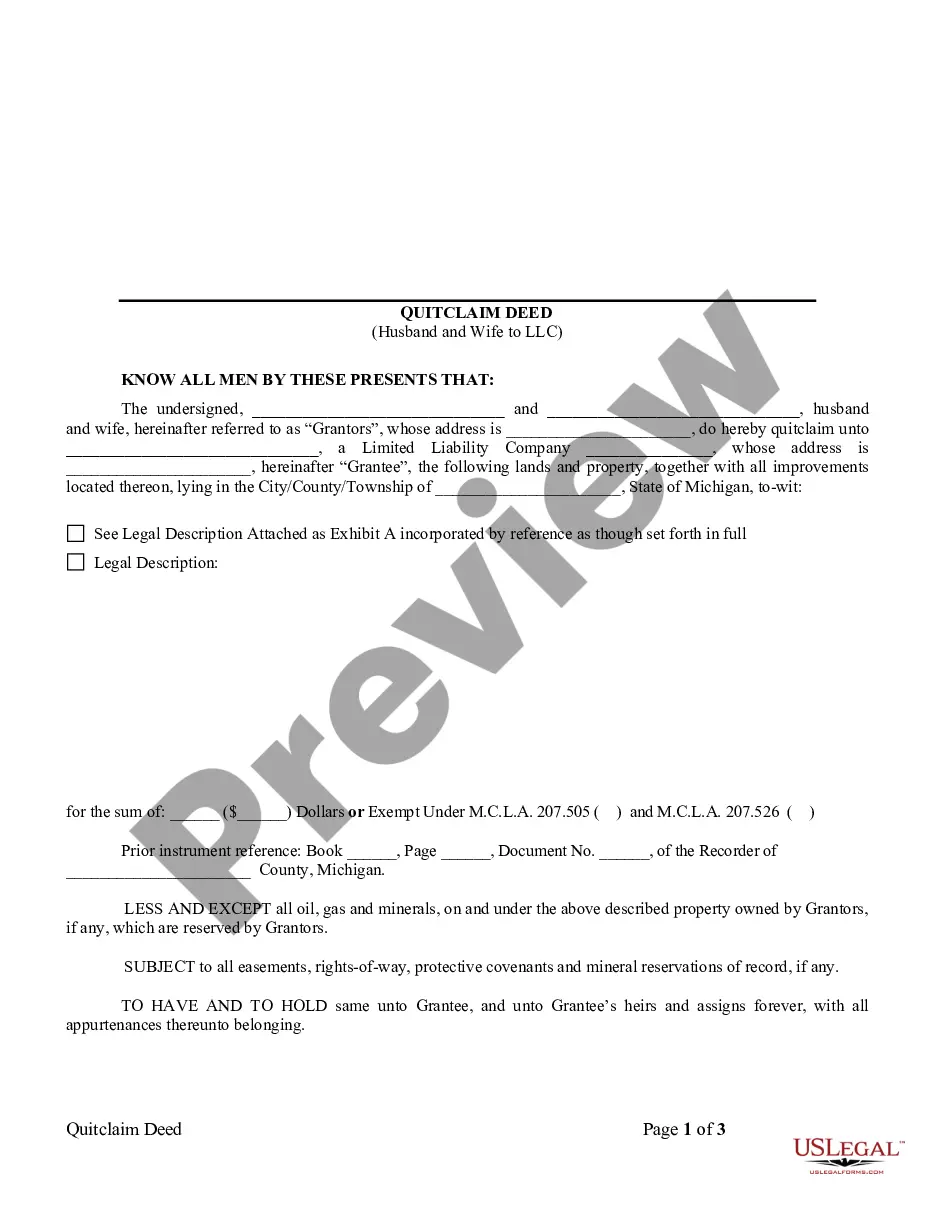

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Quitclaim Deed is a legal document used to transfer ownership of a property from one party to another. In the case of a Quitclaim Deed from Husband and Wife to LLC in Oakland, Michigan, it refers to the transfer of property ownership from a married couple to their limited liability company (LLC) in the Oakland County area. This type of quitclaim deed is commonly used when a couple who jointly owns a property wants to transfer it into their LLC, which is a separate legal entity that offers asset protection and other benefits. By doing so, the property becomes an asset of the LLC rather than the individuals, providing liability protection for the couple's personal assets and allowing the LLC to manage and control the property. Oakland County, Michigan, offers several variations of Quitclaim Deeds from Husband and Wife to LLC, including: 1. Oakland Michigan Husband and Wife Quitclaim Deed to Single-Member LLC: This type of quitclaim deed involves the transfer of property owned by a husband and wife to an LLC owned by only one of them. It allows the LLC to hold full ownership and control over the property. 2. Oakland Michigan Joint Husband and Wife Quitclaim Deed to Multi-Member LLC: In this scenario, a husband and wife transfer ownership of their property to an LLC with multiple members/partners. This type of quitclaim deed is suitable when multiple individuals, including the couple, are involved in the LLC ownership and management. 3. Oakland Michigan Spousal Quitclaim Deed to LLC: This quitclaim deed option is used when only one spouse intends to transfer their ownership interest in the property to the LLC, while the other spouse retains their ownership rights. This situation may arise in cases of divorce or when one spouse wants to protect their personal assets from potential liabilities associated with the property. It is crucial to consult with a qualified real estate attorney or a professional familiar with the laws and regulations of Oakland County, Michigan, to ensure the proper drafting and execution of the specific Quitclaim Deed from Husband and Wife to LLC that aligns with the couple's intentions and requirements.A Quitclaim Deed is a legal document used to transfer ownership of a property from one party to another. In the case of a Quitclaim Deed from Husband and Wife to LLC in Oakland, Michigan, it refers to the transfer of property ownership from a married couple to their limited liability company (LLC) in the Oakland County area. This type of quitclaim deed is commonly used when a couple who jointly owns a property wants to transfer it into their LLC, which is a separate legal entity that offers asset protection and other benefits. By doing so, the property becomes an asset of the LLC rather than the individuals, providing liability protection for the couple's personal assets and allowing the LLC to manage and control the property. Oakland County, Michigan, offers several variations of Quitclaim Deeds from Husband and Wife to LLC, including: 1. Oakland Michigan Husband and Wife Quitclaim Deed to Single-Member LLC: This type of quitclaim deed involves the transfer of property owned by a husband and wife to an LLC owned by only one of them. It allows the LLC to hold full ownership and control over the property. 2. Oakland Michigan Joint Husband and Wife Quitclaim Deed to Multi-Member LLC: In this scenario, a husband and wife transfer ownership of their property to an LLC with multiple members/partners. This type of quitclaim deed is suitable when multiple individuals, including the couple, are involved in the LLC ownership and management. 3. Oakland Michigan Spousal Quitclaim Deed to LLC: This quitclaim deed option is used when only one spouse intends to transfer their ownership interest in the property to the LLC, while the other spouse retains their ownership rights. This situation may arise in cases of divorce or when one spouse wants to protect their personal assets from potential liabilities associated with the property. It is crucial to consult with a qualified real estate attorney or a professional familiar with the laws and regulations of Oakland County, Michigan, to ensure the proper drafting and execution of the specific Quitclaim Deed from Husband and Wife to LLC that aligns with the couple's intentions and requirements.