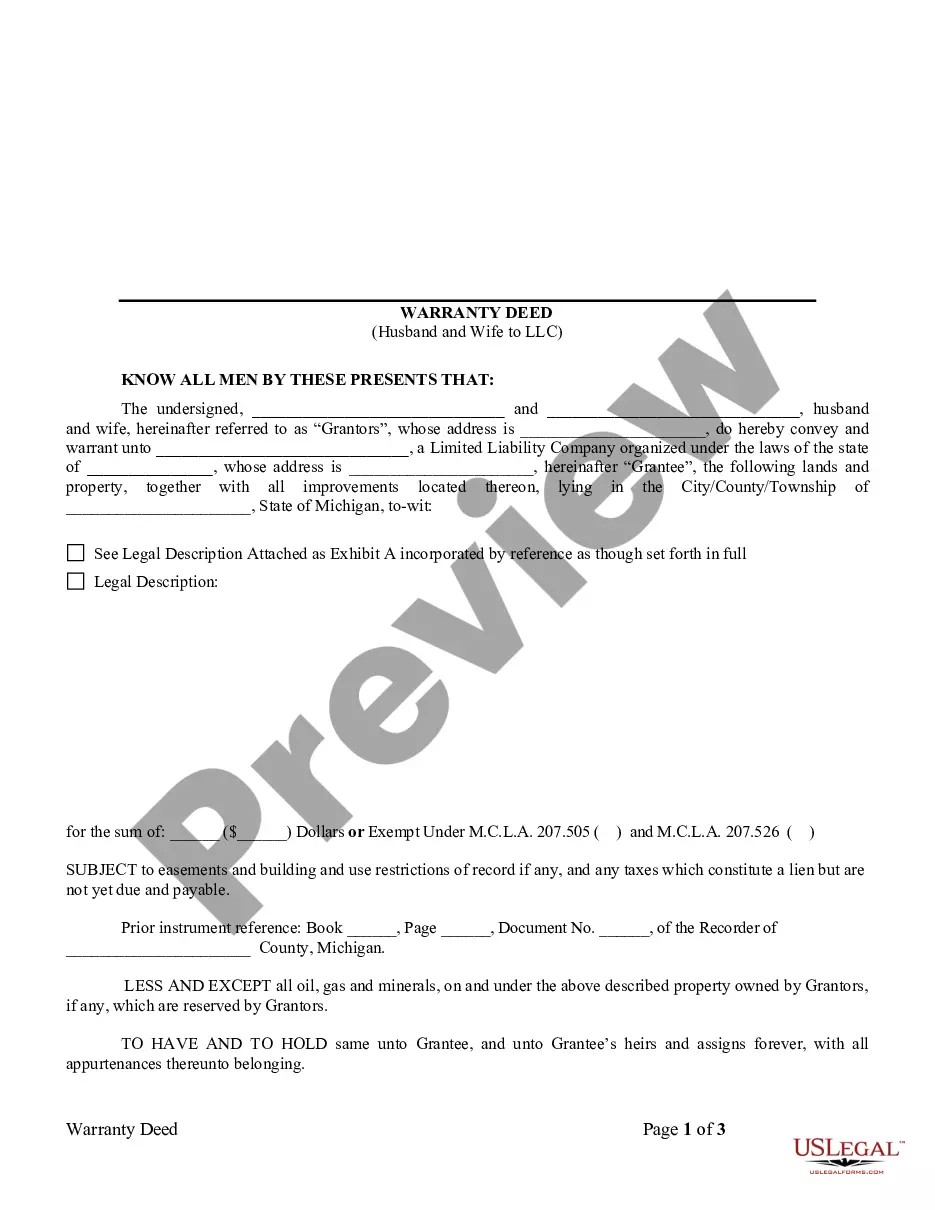

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

In Detroit, Michigan, a Warranty Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate property from a married couple to a limited liability company (LLC) with a promise that the property is free from any encumbrances or title defects. This type of deed provides a guarantee to the LLC that the property being transferred is being done so with a clear and marketable title, and the transferors (husband and wife) affirm that they have full authority to convey the property. There are a few different types of Warranty Deeds that can be used in Detroit, Michigan when transferring property from a Husband and Wife to an LLC: 1. General Warranty Deed: This type of deed provides the broadest form of protection for the LLC, as it includes warranties from the husband and wife against all possible title defects, whether arising from actions before or during their ownership of the property. It guarantees the title for the property's entire history. 2. Special Warranty Deed: This deed also guarantees the title, but only for the period of time that the husband and wife owned the property. It protects the LLC against any defects or claims that may have occurred during their ownership but does not extend to any previous owners. 3. Quitclaim Deed: While not a Warranty Deed in the strictest sense, a Quitclaim Deed is another option for transferring property from a Husband and Wife to an LLC. This type of deed does not offer any warranties or guarantees of a clear title. It simply conveys whatever interest the husband and wife have in the property, without any representation as to the state of the title. When preparing the Detroit Michigan Warranty Deed from Husband and Wife to LLC, it is essential to include specific information such as the names of the husband and wife, their marital status, the legal description of the property being transferred, the name of the LLC, and the consideration or value exchanged for the transfer. The document must also be properly executed, typically in the presence of a notary public, and filed with the appropriate county office for land records. Overall, a Detroit Michigan Warranty Deed from Husband and Wife to LLC is a legally binding document used to transfer real estate ownership from a married couple to an LLC, offering a guarantee of a clear and marketable title. Different types of Warranty Deeds, such as General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds, may be utilized based on the level of guarantee desired and the specific circumstances of the transfer.