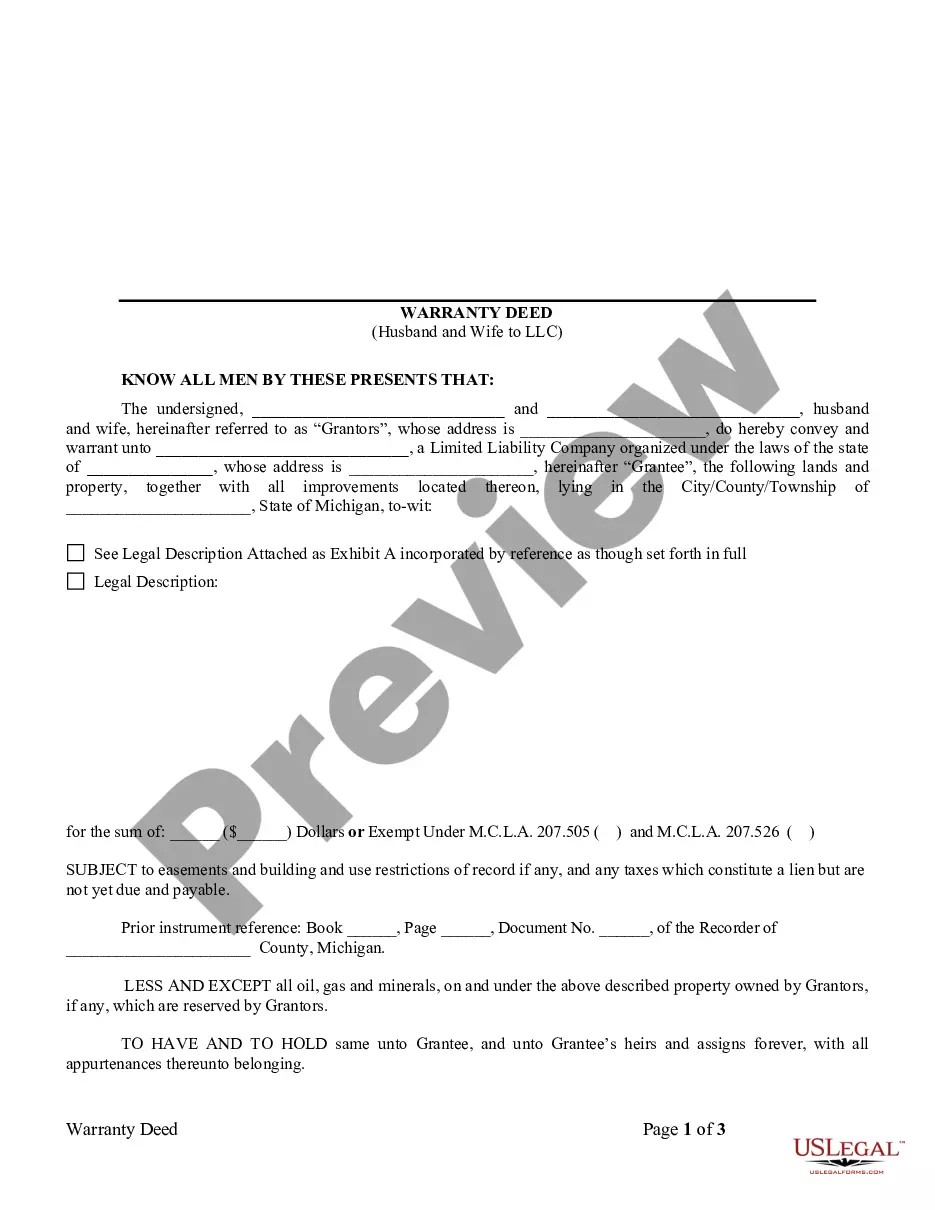

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A warranty deed is a legal document used to transfer ownership of property from one party to another. In the case of Oakland, Michigan, a warranty deed from husband and wife to LLC refers to the transfer of property ownership from a married couple to a limited liability company (LLC). This type of transfer is common when individuals want to protect their personal assets by holding property under the umbrella of an LLC. The Oakland, Michigan warranty deed from husband and wife to LLC ensures that the LLC receives full ownership of the property, free from any defects or claims. By executing this deed, the husband and wife guarantee that they are the rightful owners of the property and have the legal authority to transfer it to the LLC. Some important keywords relevant to this topic include: warranty deed Oakland Michigan, husband and wife warranty deed, LLC property transfer, conveyance of ownership, property protection, asset distribution, deed execution, legal authority, transfer of ownership, property rights, and liability protection. There might be variations or subtypes of Oakland, Michigan warranty deeds from husband and wife to LLC, including: 1. General Warranty Deed: This type of warranty deed provides the highest level of protection to the purchaser, guaranteeing that the property is free from any liens, claims, or encumbrances that arose before the seller acquired the property. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed only provides protection against defects or claims that occurred during the period the husband and wife owned the property. It does not cover any prior claims or encumbrances. 3. Quitclaim Deed: In some cases, a husband and wife may opt for a quitclaim deed when transferring property to an LLC. Unlike warranty deeds, quitclaim deeds do not guarantee ownership or protect against defects or claims. They simply transfer whatever interest the husband and wife have in the property to the LLC. It is essential to consult with a real estate attorney and conduct thorough research to select the most appropriate type of warranty deed when transferring property from a husband and wife to an LLC in Oakland, Michigan. This ensures legal protection, asset preservation, and smooth property ownership transition for all parties involved.A warranty deed is a legal document used to transfer ownership of property from one party to another. In the case of Oakland, Michigan, a warranty deed from husband and wife to LLC refers to the transfer of property ownership from a married couple to a limited liability company (LLC). This type of transfer is common when individuals want to protect their personal assets by holding property under the umbrella of an LLC. The Oakland, Michigan warranty deed from husband and wife to LLC ensures that the LLC receives full ownership of the property, free from any defects or claims. By executing this deed, the husband and wife guarantee that they are the rightful owners of the property and have the legal authority to transfer it to the LLC. Some important keywords relevant to this topic include: warranty deed Oakland Michigan, husband and wife warranty deed, LLC property transfer, conveyance of ownership, property protection, asset distribution, deed execution, legal authority, transfer of ownership, property rights, and liability protection. There might be variations or subtypes of Oakland, Michigan warranty deeds from husband and wife to LLC, including: 1. General Warranty Deed: This type of warranty deed provides the highest level of protection to the purchaser, guaranteeing that the property is free from any liens, claims, or encumbrances that arose before the seller acquired the property. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed only provides protection against defects or claims that occurred during the period the husband and wife owned the property. It does not cover any prior claims or encumbrances. 3. Quitclaim Deed: In some cases, a husband and wife may opt for a quitclaim deed when transferring property to an LLC. Unlike warranty deeds, quitclaim deeds do not guarantee ownership or protect against defects or claims. They simply transfer whatever interest the husband and wife have in the property to the LLC. It is essential to consult with a real estate attorney and conduct thorough research to select the most appropriate type of warranty deed when transferring property from a husband and wife to an LLC in Oakland, Michigan. This ensures legal protection, asset preservation, and smooth property ownership transition for all parties involved.