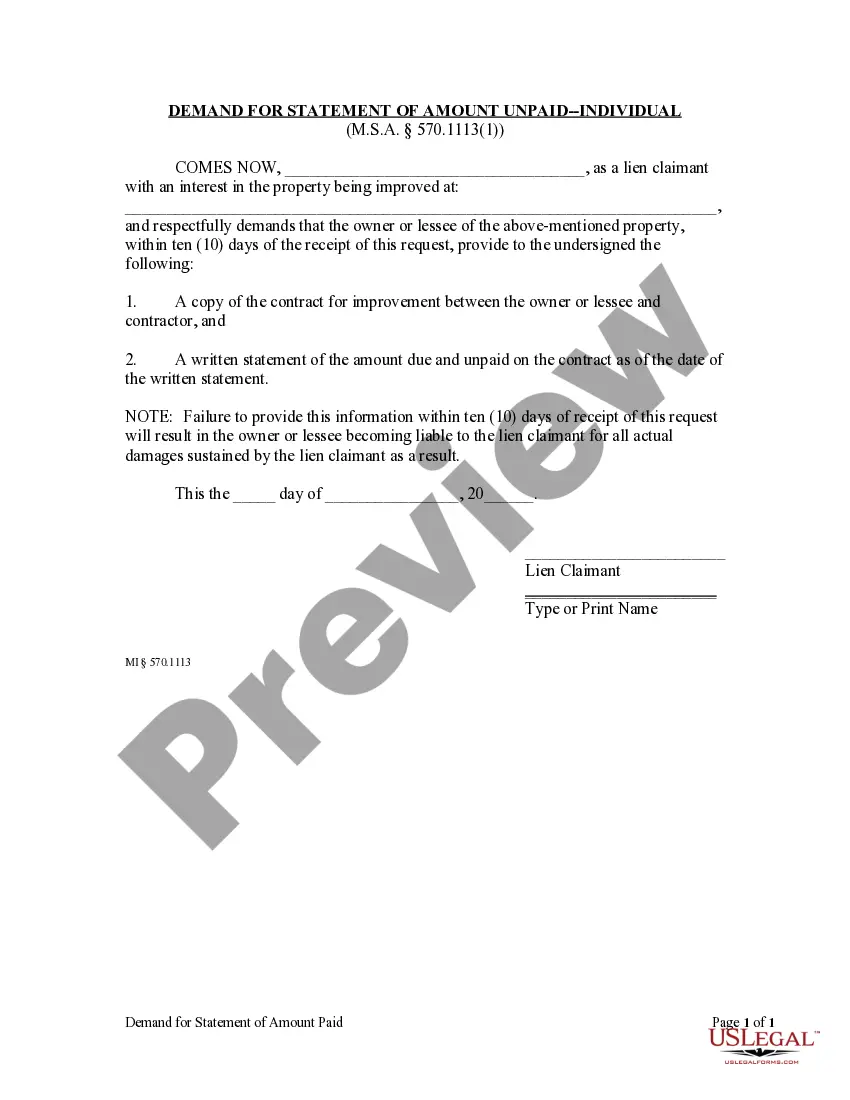

Oakland, Michigan Demand for Statement of Amount Unpaid — Individual is a legal document used in Oakland County, Michigan, to request a statement of any outstanding or unpaid amount owed by an individual. This demand is typically sent by an individual, creditor, or their attorney to the debtor, demanding them to provide a comprehensive statement regarding the unpaid amount owed. There are two main types of Oakland, Michigan Demand for Statement of Amount Unpaid — Individual: 1. Specific Unpaid Amount Demand: This type of demand is used when the creditor or individual has a specific unpaid amount in mind. It requires the debtor to provide a detailed breakdown of the amount owed, including principal, interest, penalties, and any other relevant charges. This demand serves as evidence of the outstanding debt and can be used in court if necessary. 2. General Unpaid Amount Demand: This type of demand is employed when the creditor or individual believes that there is an unpaid amount but is uncertain about the exact figure. It requires the debtor to provide a comprehensive statement of any outstanding amounts, including invoices, contracts, or any other relevant documentation that supports the existence of unpaid debts. This demand is often used as a preliminary step before pursuing legal action to recover the unpaid amount. Keywords: Oakland Michigan, Demand for Statement of Amount Unpaid — Individual, legal document, Oakland County, Michigan, outstanding, unpaid amount, individual, creditor, attorney, debtor, specific unpaid amount demand, general unpaid amount demand, breakdown, principal, interest, penalties, charges, evidence, court, outstanding debt, invoices, contracts, legal action.

Oakland Michigan Demand for Statement of Amount Unpaid - Individual

Description

How to fill out Oakland Michigan Demand For Statement Of Amount Unpaid - Individual?

If you’ve already utilized our service before, log in to your account and save the Oakland Michigan Demand for Statement of Amount Unpaid - Individual on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Oakland Michigan Demand for Statement of Amount Unpaid - Individual. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!

Form popularity

FAQ

Internal Revenue Code section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. The collection statute expiration ends the government's right to pursue collection of a liability.

Real property tax delinquency entails a three-year forfeiture and foreclosure process in Michigan. Parcels are forfeited to the county treasurers when the real property taxes are in the second year of delinquency.

A Notice of State Tax Lien may attach to real and/or personal property wherever located in Michigan. A Notice of State Tax Lien will be filed only after: A tax liability has been assessed.

The 24-hour Interactive Voice Response (IVR) System at 877-543-2660 will direct you to your Friend of the Court for: Investigating, modifying or enforcing a court order for custody, parenting time and support. Registering Michigan orders in other states.

The 6 year period, known as the statute of limitations, may be extended by certain actions such as a court judgment. By law, the Department may use a variety of actions to collect your past-due tax, penalty and interest and may take these actions at any time during the course of collection.

Yes. Property owners who had delinquent taxes under the old law could also lose their property, but they had at least four (4) years to pay. Under the new law, if your taxes are delinquent for two (2) years, your property is foreclosed and you lose title to it.

As a general rule, there is a ten year statute of limitations on IRS collections. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. Subject to some important exceptions, once the ten years are up, the IRS has to stop its collection efforts.

In some states, the payment of property taxes by a person claiming adverse possession can be used to establish legal title. However, there is no such statutory requirement in Michigan. Paying taxes is not, of itself, sufficient to constitute adverse possession.

The Michigan Department of Treasury contracts with a private collection agency, GC Services LP, to help us collect the delinquent tax, penalty and interest owed to the State of Michigan.

File the Notice of Hearing and Motion at the Oakland County Clerks Office (ground floor of the courthouse) and pay the appropriate fee. 3. You must serve a copy of this Notice of Hearing and Motion on the other party by mailing it to them at least 9 days before the motion is scheduled to be heard.