The Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder refers to the legal process by which a mortgage held by a corporate entity is transferred or assigned to another party. This assignment allows the new party to assume all rights and responsibilities associated with the mortgage, including the collection of payments and potential legal action for non-payment. Keywords: Ann Arbor Michigan, Assignment of Mortgage, Corporate Mortgage Holder There are different types of Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder, including: 1. Voluntary Assignment: In this type of assignment, the corporate mortgage holder voluntarily transfers the mortgage to another party. This could occur when the mortgage holder wants to reduce their portfolio or when there is a change in ownership or business strategy. 2. Involuntary Assignment: Sometimes, the assignment of mortgage is not voluntary but occurs as a result of legal action or foreclosure proceedings. This may happen when the borrower defaults on the mortgage, and the corporate mortgage holder seeks to recover their investment. 3. Complete Assignment: The complete assignment refers to the transfer of the entire mortgage to another party. In this case, the assignee becomes the new mortgage holder and assumes all rights and responsibilities associated with the mortgage. 4. Partial Assignment: In certain situations, a corporate mortgage holder might choose to assign only a portion of the mortgage to another party. This could occur if the mortgage is too large for a single entity to handle, or if the mortgage holder wants to diversify their investment portfolio. 5. Assignment with Recourse: When an assignment of mortgage is made with recourse, the corporate mortgage holder retains liability for the mortgage, even after it has been transferred to another party. This means that if the new mortgage holder incurs any losses or damages due to the mortgage, they can seek compensation from the original mortgage holder. 6. Assignment without Recourse: In contrast to assignment with recourse, assignment without recourse relieves the corporate mortgage holder from any liability associated with the mortgage after the transfer. The new mortgage holder assumes full responsibility, including any risks or potential losses. The Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder is an essential legal process that facilitates the transfer of mortgage rights and responsibilities to another party. Whether it is a voluntary or involuntary assignment, complete or partial, or made with or without recourse, this process allows for the efficient management of mortgages in Ann Arbor, Michigan.

Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder

State:

Michigan

City:

Ann Arbor

Control #:

MI-121RE

Format:

Word;

Rich Text

Instant download

Description

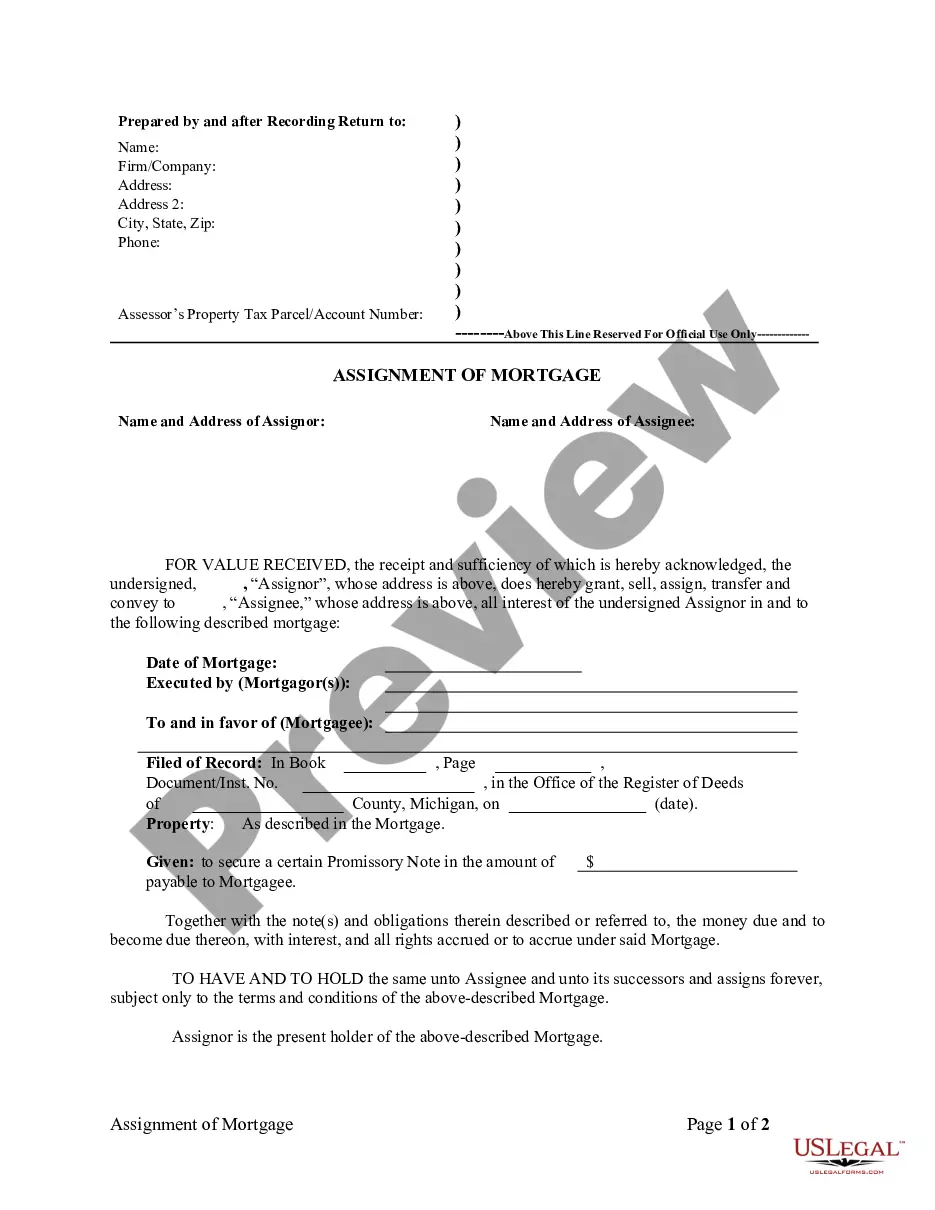

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

The Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder refers to the legal process by which a mortgage held by a corporate entity is transferred or assigned to another party. This assignment allows the new party to assume all rights and responsibilities associated with the mortgage, including the collection of payments and potential legal action for non-payment. Keywords: Ann Arbor Michigan, Assignment of Mortgage, Corporate Mortgage Holder There are different types of Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder, including: 1. Voluntary Assignment: In this type of assignment, the corporate mortgage holder voluntarily transfers the mortgage to another party. This could occur when the mortgage holder wants to reduce their portfolio or when there is a change in ownership or business strategy. 2. Involuntary Assignment: Sometimes, the assignment of mortgage is not voluntary but occurs as a result of legal action or foreclosure proceedings. This may happen when the borrower defaults on the mortgage, and the corporate mortgage holder seeks to recover their investment. 3. Complete Assignment: The complete assignment refers to the transfer of the entire mortgage to another party. In this case, the assignee becomes the new mortgage holder and assumes all rights and responsibilities associated with the mortgage. 4. Partial Assignment: In certain situations, a corporate mortgage holder might choose to assign only a portion of the mortgage to another party. This could occur if the mortgage is too large for a single entity to handle, or if the mortgage holder wants to diversify their investment portfolio. 5. Assignment with Recourse: When an assignment of mortgage is made with recourse, the corporate mortgage holder retains liability for the mortgage, even after it has been transferred to another party. This means that if the new mortgage holder incurs any losses or damages due to the mortgage, they can seek compensation from the original mortgage holder. 6. Assignment without Recourse: In contrast to assignment with recourse, assignment without recourse relieves the corporate mortgage holder from any liability associated with the mortgage after the transfer. The new mortgage holder assumes full responsibility, including any risks or potential losses. The Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder is an essential legal process that facilitates the transfer of mortgage rights and responsibilities to another party. Whether it is a voluntary or involuntary assignment, complete or partial, or made with or without recourse, this process allows for the efficient management of mortgages in Ann Arbor, Michigan.

Free preview

How to fill out Ann Arbor Michigan Assignment Of Mortgage By Corporate Mortgage Holder?

If you’ve already used our service before, log in to your account and download the Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Ann Arbor Michigan Assignment of Mortgage by Corporate Mortgage Holder. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!