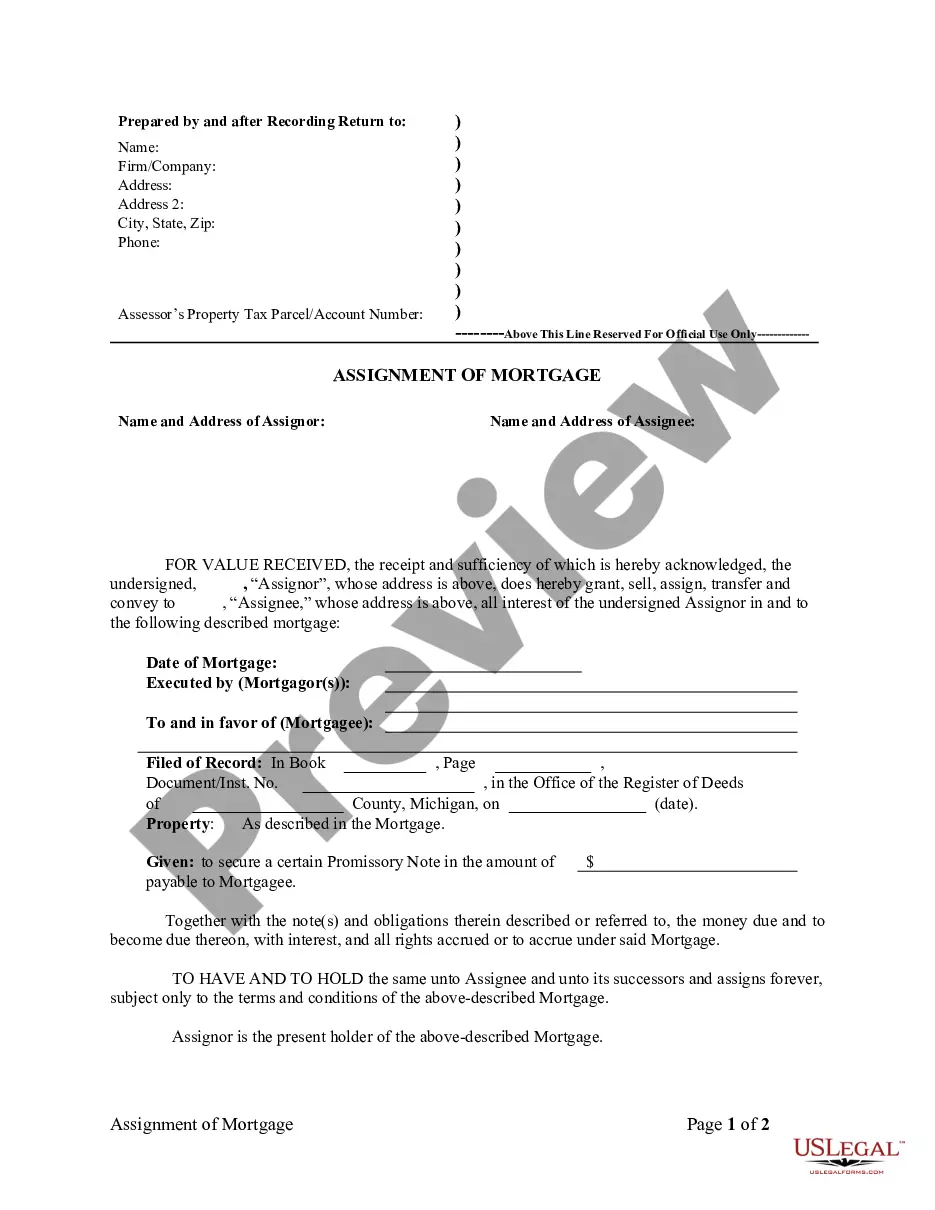

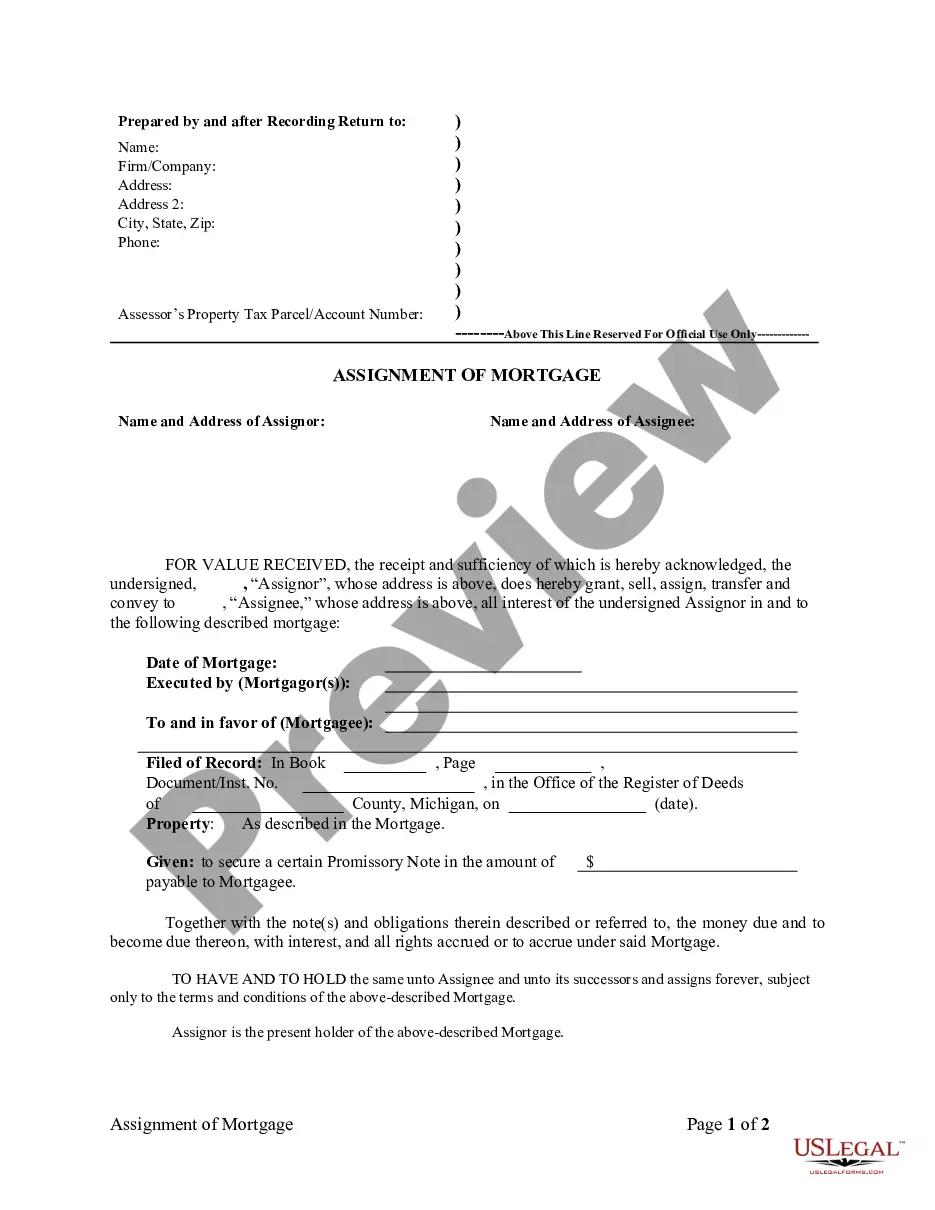

The Detroit Michigan Assignment of Mortgage by Corporate Mortgage Holder refers to a legal document that transfers the ownership and rights of a mortgage loan from a corporate mortgage holder to another entity in Detroit, Michigan. This document is an essential part of the mortgage lending process, allowing the transfer of mortgage debt obligation from one party to another. The assignment of mortgage is typically executed when the original mortgage holder wants to sell, transfer, or assign the rights and benefits associated with the mortgage loan to another entity. This could be due to various reasons, such as consolidating assets, securitization of loans, or financial restructuring. The corporate mortgage holder, which is typically a lending institution or bank, assigns the mortgage to another financial institution or investor. The assignment of mortgage document includes relevant details such as the names of the parties involved, the identification of the mortgage being transferred, the terms and conditions of the assignment, and any additional provisions or clauses. It is crucial for these documents to be meticulously prepared and executed in compliance with state and local laws to ensure their validity. In Detroit, Michigan, there may be different types or variations of assignment of mortgage documents by corporate mortgage holders, including: 1. Simple Assignment: This is the most common type of assignment, where the corporate mortgage holder transfers the ownership of the mortgage loan to another entity. It involves the complete transfer of all rights, benefits, and obligations associated with the mortgage. 2. Assignment with Assumption: In this type, the corporate mortgage holder transfers the mortgage to another entity, but the new borrower assumes the outstanding debt and becomes responsible for future mortgage payments. 3. Assignment in Blank: This form of assignment does not specify the name of the new mortgage holder, allowing for subsequent transfers or assignments without having to change the original document. This is often used in cases involving mortgage-backed securities or when mortgages are bundled into investment portfolios. 4. Collateral Assignment: This type of assignment involves using the mortgage as collateral for securing another loan or debt, typically in situations where the original mortgage holder needs additional financing. In conclusion, the Detroit Michigan Assignment of Mortgage by Corporate Mortgage Holder is a legal process that facilitates the transfer of mortgage ownership from a corporate mortgage holder to another entity. It plays a vital role in the mortgage lending industry, ensuring the smooth transfer of mortgage debt obligations while complying with legal requirements. Different types of assignments may exist, such as simple assignments, assignments with assumption, assignment in blank, and collateral assignments.

Detroit Michigan Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Detroit Michigan Assignment Of Mortgage By Corporate Mortgage Holder?

Utilize the US Legal Forms and gain immediate access to any template example you desire.

Our user-friendly site with a vast collection of document templates enables you to locate and retrieve nearly any document example you require.

You can download, complete, and sign the Detroit Michigan Assignment of Mortgage by Corporate Mortgage Holder in merely a few minutes instead of spending hours searching online for a suitable template.

Employing our library is an excellent method to enhance the security of your document submissions. Our experienced attorneys regularly review all documents to ensure that the templates are suitable for a specific area and compliant with current laws and regulations.

If you do not have an account yet, please follow the steps below.

Navigate to the page containing the template you require. Ensure it is the correct form you are after: check its title and description, and use the Preview feature if available. If not, use the Search bar to find the correct one.

- How can you obtain the Detroit Michigan Assignment of Mortgage by Corporate Mortgage Holder.

- If you have an account, simply Log In/">Log In to your profile. The Download button will be visible on all the samples you browse.

- Additionally, you can access all your previously saved documents in the My documents section.