Title: Understanding Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holder: A Comprehensive Guide Keywords: Grand Rapids Michigan, Assignment of Mortgage, Corporate Mortgage Holder, types of assignment Introduction: The Assignment of Mortgage process is a crucial aspect of real estate transactions, particularly in Grand Rapids, Michigan. In this article, we will delve into the details of Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holders. We will explore its types and provide a comprehensive understanding of the process. 1. What is Assignment of Mortgage? Assignment of Mortgage refers to the legal transfer of a mortgage from one party (the original lender) to another party (the corporate mortgage holder). It enables the corporate mortgage holder to gain the rights to collect mortgage payments and enforce the terms and conditions set forth in the original mortgage agreement. 2. Importance of Corporate Mortgage Holders: Corporate Mortgage Holders are institutional lenders, such as banks or financial institutions, who hold various mortgages. They may choose to assign mortgages to other entities or investors as part of their portfolio management or financial strategies. 3. Process of Assignment of Mortgage: The Assignment of Mortgage typically involves the following steps: a) Identification of Intent: The corporate mortgage holder decides to assign a particular mortgage to another party. b) Preparation of Assignment Document: A legally binding document, the Assignment of Mortgage, is drafted. It includes details such as the names of the parties involved, recording references, and the terms of assignment. c) Execution of Document: The corporate mortgage holder must sign the Assignment of Mortgage document, along with any necessary witnesses, to make it legally valid. d) Recording: The assignment document is recorded with the appropriate county agency to establish public notice of the transfer. 4. Types of Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holder: a) Whole Mortgage Assignment: In this type, the corporate mortgage holder transfers the entire mortgage amount to another party, including both principal and interest. b) Partial Mortgage Assignment: Here, only a portion of the mortgage is transferred to another party. This could involve assigning the rights to receive partial payments or transferring a specific percentage of the entire mortgage. c) Temporary Assignment: In some cases, the corporate mortgage holder assigns the mortgage temporarily to another party (such as a servicing company) to handle mortgage collection and related tasks on their behalf. After a specific period, the mortgage is reassigned back to the original holder. Conclusion: Understanding the Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holders is crucial for both parties involved in a real estate transaction. Whether it's a whole or partial assignment or a temporary transfer, the legal process ensures the smooth transfer of mortgage rights. By adhering to the relevant legal requirements, corporate mortgage holders maintain transparency and protect the interests of all parties.

Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holder

Description

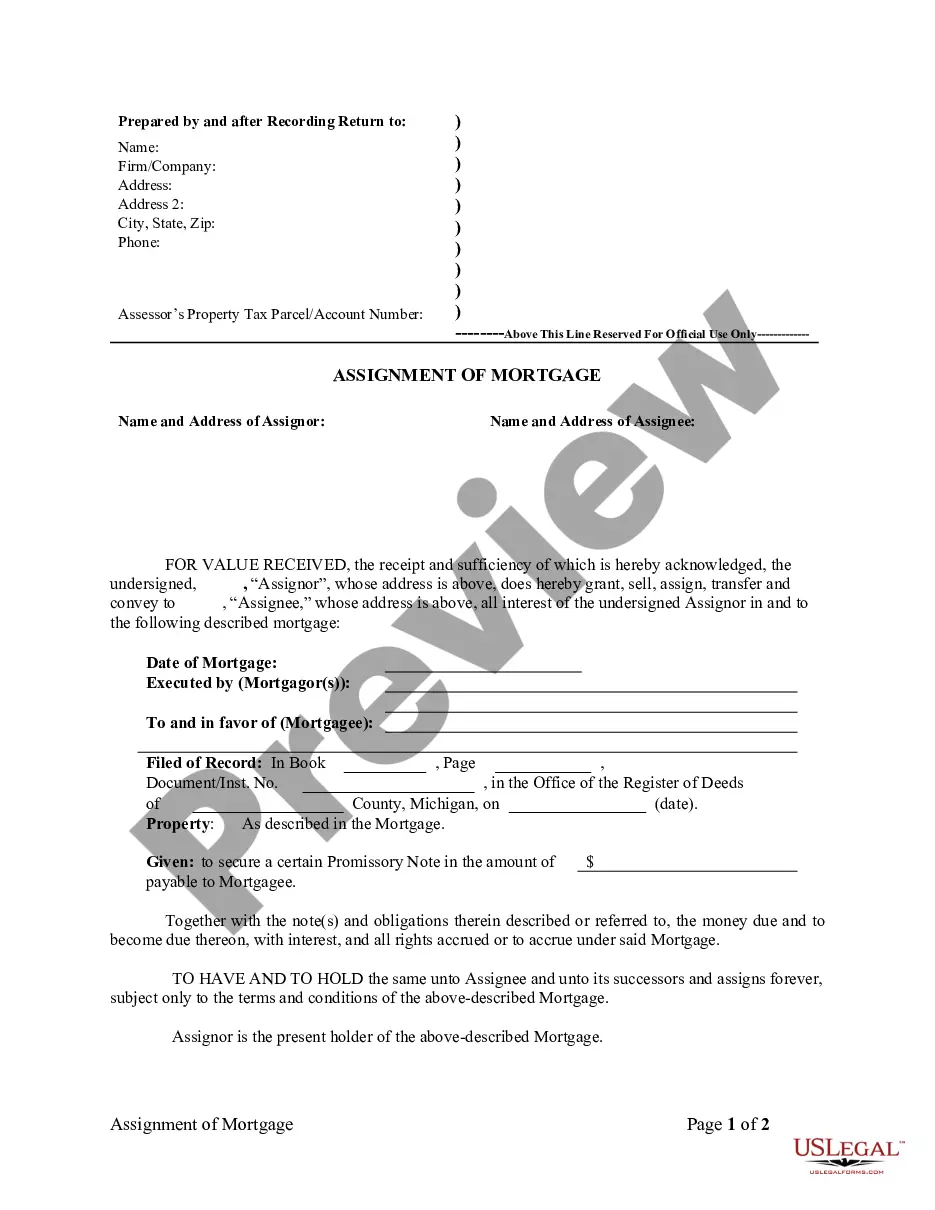

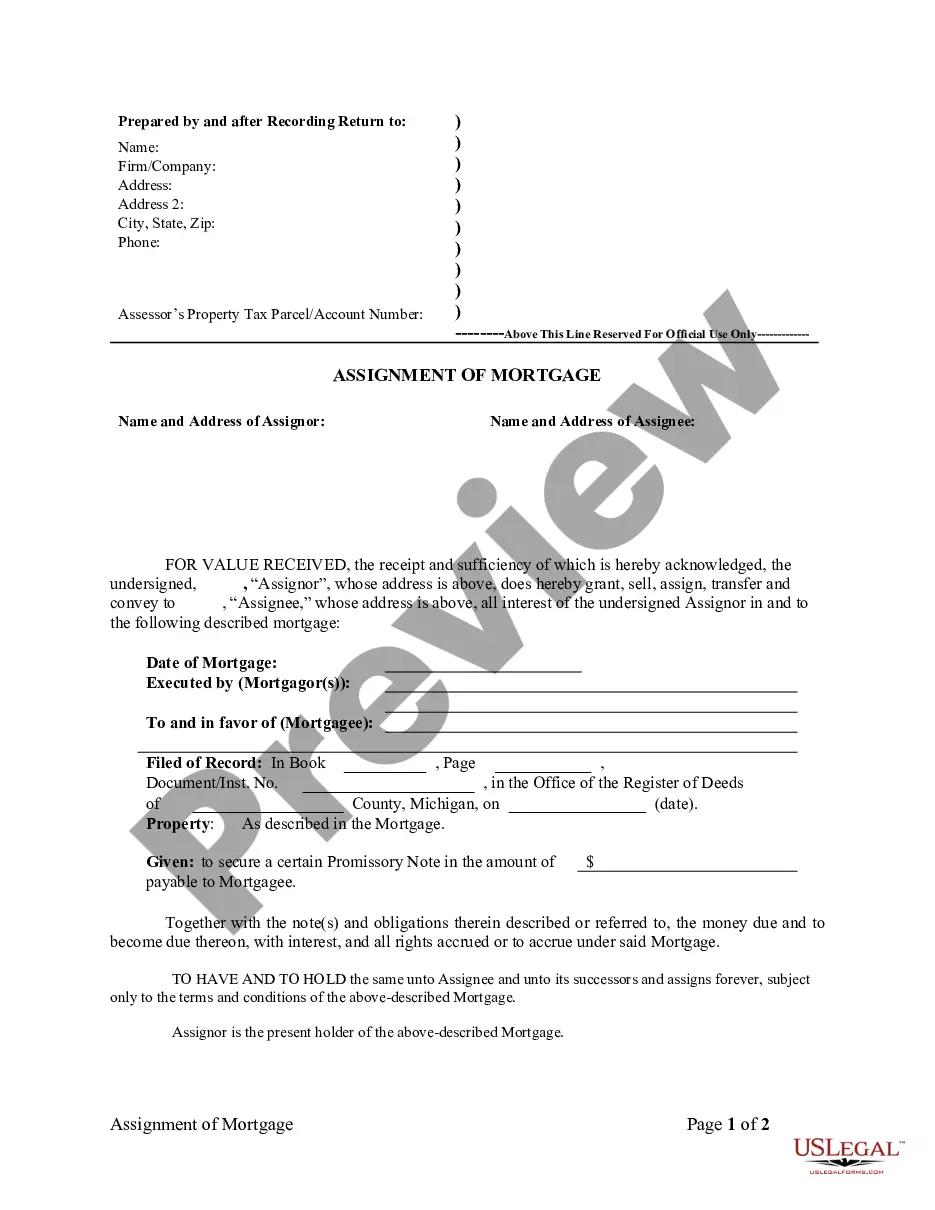

How to fill out Grand Rapids Michigan Assignment Of Mortgage By Corporate Mortgage Holder?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holder becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holder takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Grand Rapids Michigan Assignment of Mortgage by Corporate Mortgage Holder. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!