Title: Understanding the Lansing, Michigan Assignment of Mortgage by Corporate Mortgage Holder Introduction: In the realm of real estate, a mortgage is a crucial document that grants the lender a security interest in the given property. However, circumstances may arise when the mortgage holder, typically a corporation, wishes to transfer their interest to another party. In Lansing, Michigan, such transfers are facilitated through the Assignment of Mortgage. This article delves into the intricacies of Lansing Michigan's Assignment of Mortgage by Corporate Mortgage Holder, highlighting its purpose, process, and potential types. Keywords (primary): Lansing, Michigan, Assignment of Mortgage, Corporate Mortgage Holder Keywords (secondary): types, purpose, process, real estate, property, transaction 1. Purpose of Lansing Michigan Assignment of Mortgage: The primary objective of the Lansing Michigan Assignment of Mortgage by a Corporate Mortgage Holder is to transfer the rights and interests associated with a mortgage from the original lender (corporation) to another party. This transfer may occur due to various reasons, such as selling the mortgage, debt restructuring, or mergers/acquisitions within the corporate mortgage holder's structure. 2. Process of Lansing Michigan Assignment of Mortgage: a) Identification of Parties: The assignment requires three main parties involved — the original mortgage holder, the assignee (new party), and the mortgagee (borrower). b) Drafting a Legal Document: The assignment document is prepared, including specific details such as the mortgage details, names of involved parties, and terms of transfer. c) Execution and Notarization: Both the original mortgage holder and the assignee must sign the assignment document. The document is notarized to ensure its authenticity and legal validity. d) Filing with County Recorder's Office: The assignment document is typically filed with the County Recorder's Office in Lansing, Michigan, to provide public notice of the transfer, ensuring transparency and preventing conflicting claims. 3. Types of Lansing Michigan Assignment of Mortgage by Corporate Mortgage Holder: a) Partial Assignment: In a partial assignment, the corporate mortgage holder transfers only a portion of the mortgage to a new party. This may occur when multiple investors or lenders are involved in financing the mortgage and wish to divide their interests. b) Full Assignment: A full assignment involves the complete transfer of the mortgage and all associated rights and obligations to a new party, thereby severing any ties between the original mortgage holder and the mortgage. c) Assignment in Connection with Assumption: This type of assignment occurs when the corporate mortgage holder transfers the mortgage to a new party who also assumes the borrower's obligation to repay the debt. It is often seen during the sale of real estate properties. Conclusion: The Lansing, Michigan Assignment of Mortgage by a Corporate Mortgage Holder provides an avenue for the transfer of mortgage rights and interests from the original lender to a new party. Through this process, whether through a partial or full assignment, lenders can efficiently navigate complex real estate transactions. As with any legal matter, it is advisable to seek professional assistance to ensure compliance with the specific requirements and regulations governing Assignment of Mortgages in Lansing, Michigan.

Lansing Michigan Assignment of Mortgage by Corporate Mortgage Holder

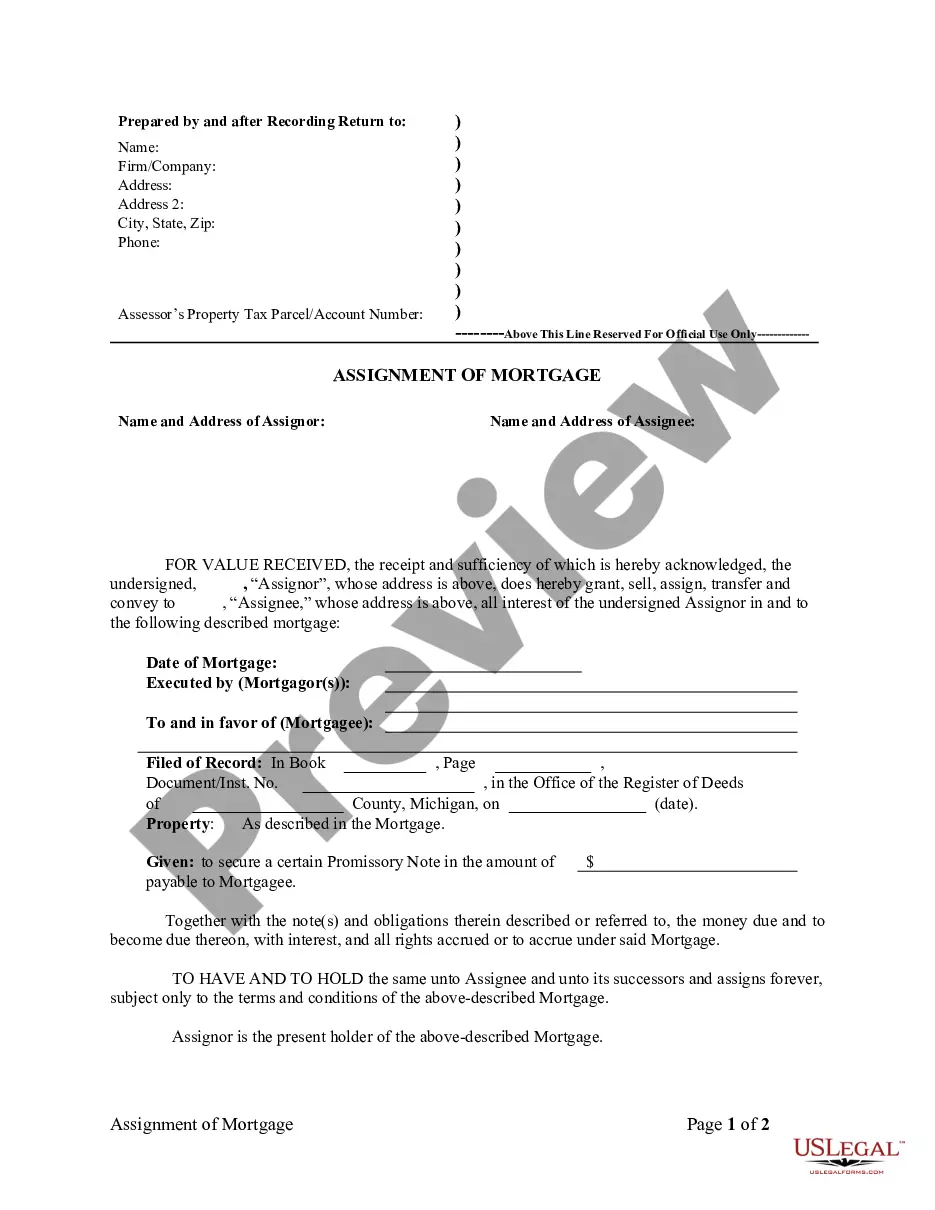

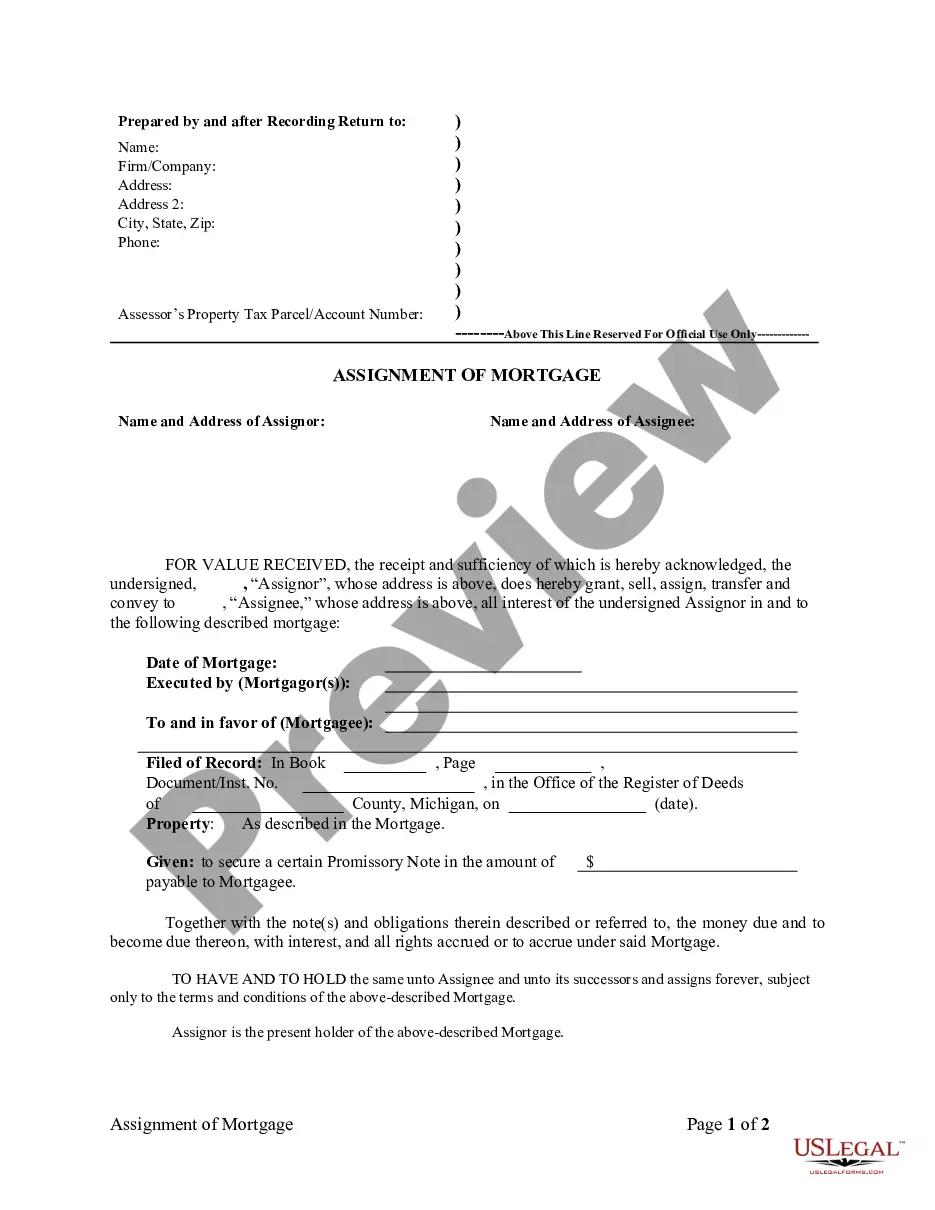

Description

How to fill out Lansing Michigan Assignment Of Mortgage By Corporate Mortgage Holder?

If you are looking for a valid form, it’s difficult to choose a more convenient place than the US Legal Forms site – one of the most comprehensive online libraries. With this library, you can find thousands of templates for business and individual purposes by types and regions, or keywords. With the advanced search option, getting the newest Lansing Michigan Assignment of Mortgage by Corporate Mortgage Holder is as elementary as 1-2-3. Furthermore, the relevance of each and every file is confirmed by a group of skilled lawyers that on a regular basis check the templates on our website and revise them according to the latest state and county laws.

If you already know about our platform and have a registered account, all you should do to receive the Lansing Michigan Assignment of Mortgage by Corporate Mortgage Holder is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the form you want. Look at its information and make use of the Preview feature (if available) to see its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to find the proper record.

- Affirm your selection. Select the Buy now button. After that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Lansing Michigan Assignment of Mortgage by Corporate Mortgage Holder.

Each form you add to your profile does not have an expiration date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you want to receive an additional version for editing or printing, you may come back and export it once more at any time.

Take advantage of the US Legal Forms professional collection to gain access to the Lansing Michigan Assignment of Mortgage by Corporate Mortgage Holder you were seeking and thousands of other professional and state-specific templates on a single website!