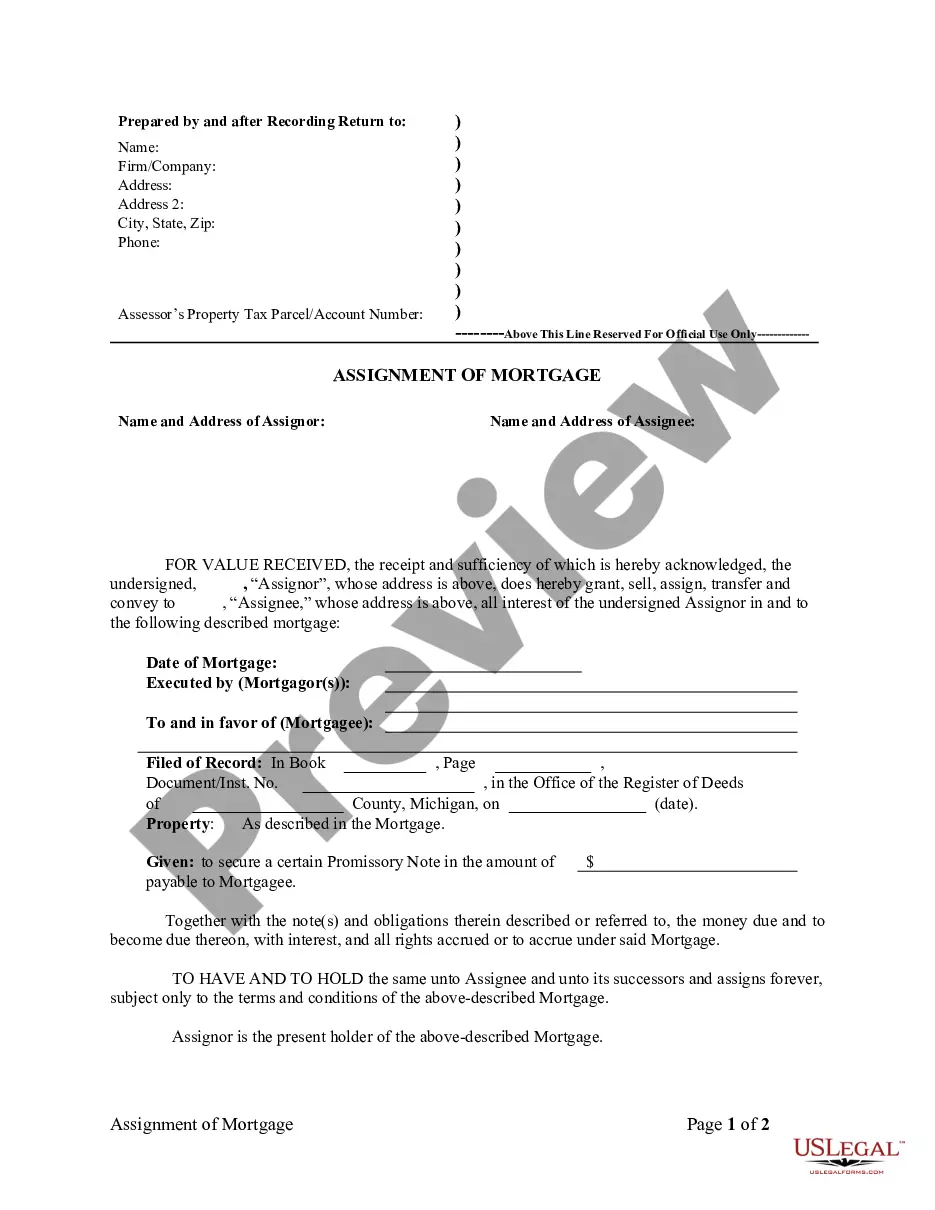

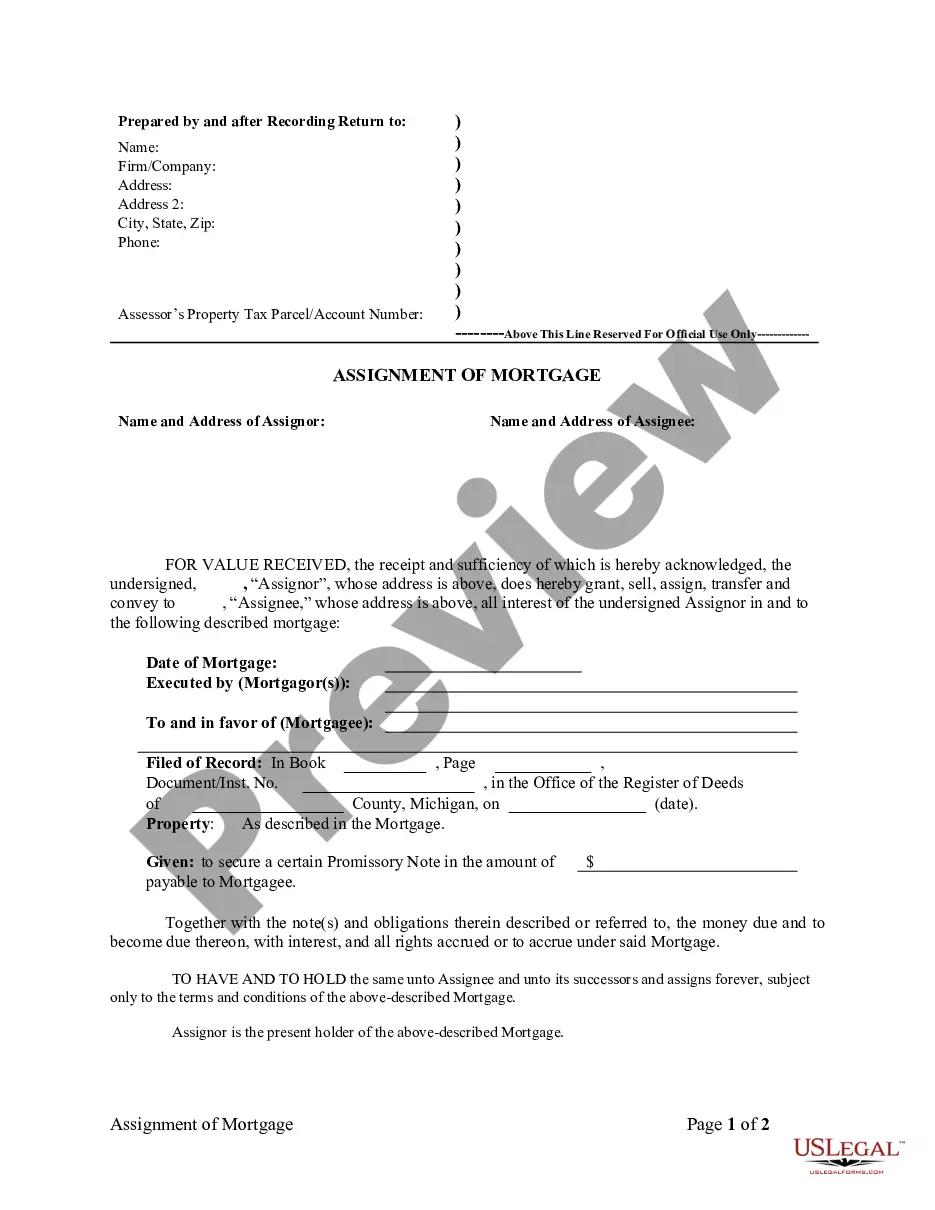

Title: Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder: Explained Introduction: In the state of Wayne, Michigan, an Assignment of Mortgage by Corporate Mortgage Holder refers to a legal process whereby a corporate mortgage holder transfers the rights and interest of a mortgage to another party. This comprehensive description aims to provide an insightful understanding of this process and shed light on its various types. Keywords: Wayne Michigan, Assignment of Mortgage, Corporate Mortgage Holder, legal process, transfer, rights and interest, types. 1. Definition and Purpose: The Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder is a legal instrument intended to transfer the mortgage rights and interest from one holder to another. This process enables the corporate mortgage holder to effectively assign their rights and obligations to a new party, ensuring a smooth transition in the loan agreement. 2. Parties Involved: The assignment typically involves three main parties — the original mortgage holder (assignor), the corporate mortgage holder (assignee), and the new mortgage holder (assignee). The assignee assumes the rights, responsibilities, and interest of the mortgage held by the assignor. 3. Types of Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder: a. Partial Assignment: In some cases, the corporate mortgage holder may choose to assign only a portion of the mortgage to another party. This type of assignment typically occurs when the mortgage amount is divided into multiple parts or when a portion of the mortgage is sold off. b. Full Assignment: A full assignment takes place when the corporate mortgage holder transfers the entire mortgage to another entity. This could be done due to various reasons, such as refinancing or transferring the loan to a third party. c. Assignment for Security: In certain situations, corporate mortgage holders may assign the mortgage as security to another entity or individual. This type of assignment helps secure the repayment of a debt, often as collateral for a loan or investment. d. Assignment by Substitution: In such cases, the corporate mortgage holder can appoint a substitute or successor, usually another corporate entity or individual, to take over the rights and interest of the mortgage. This type of assignment often occurs when there is a merger, acquisition, or corporate restructuring. 4. Process: The Wayne Michigan Assignment of Mortgage process typically involves the following steps: — Drafting an Assignment of Mortgage document stating the transfer of rights and obligations. — Properly executing the assignment document and obtaining signatures from the assignor and assignee. — Notarizing the assignment document to ensure its authenticity and legal validity. — Recording the assignment with the appropriate county office or register of deeds to create a public record. Conclusion: The Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder is a crucial legal process that facilitates the transfer of mortgage rights and interest from one entity to another. This process can occur in various forms, such as partial or full assignment, assignment for security, and assignment by substitution. Understanding the different types and procedures involved in Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder is essential for all parties involved in mortgage assignments to ensure compliance with the law and maintain a smooth transition of mortgage responsibility.

Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Wayne Michigan Assignment Of Mortgage By Corporate Mortgage Holder?

Benefit from the US Legal Forms and get instant access to any form sample you need. Our beneficial platform with a huge number of documents simplifies the way to find and get virtually any document sample you want. You can save, complete, and certify the Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder in just a couple of minutes instead of surfing the Net for several hours searching for a proper template.

Utilizing our library is a superb strategy to improve the safety of your record filing. Our professional attorneys on a regular basis check all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you get the Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can find all the previously saved files in the My Forms menu.

If you don’t have a profile yet, follow the tips listed below:

- Find the form you require. Ensure that it is the form you were hoping to find: examine its name and description, and make use of the Preview feature if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Pick the format to get the Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the web. We are always happy to assist you in virtually any legal case, even if it is just downloading the Wayne Michigan Assignment of Mortgage by Corporate Mortgage Holder.

Feel free to take advantage of our service and make your document experience as convenient as possible!