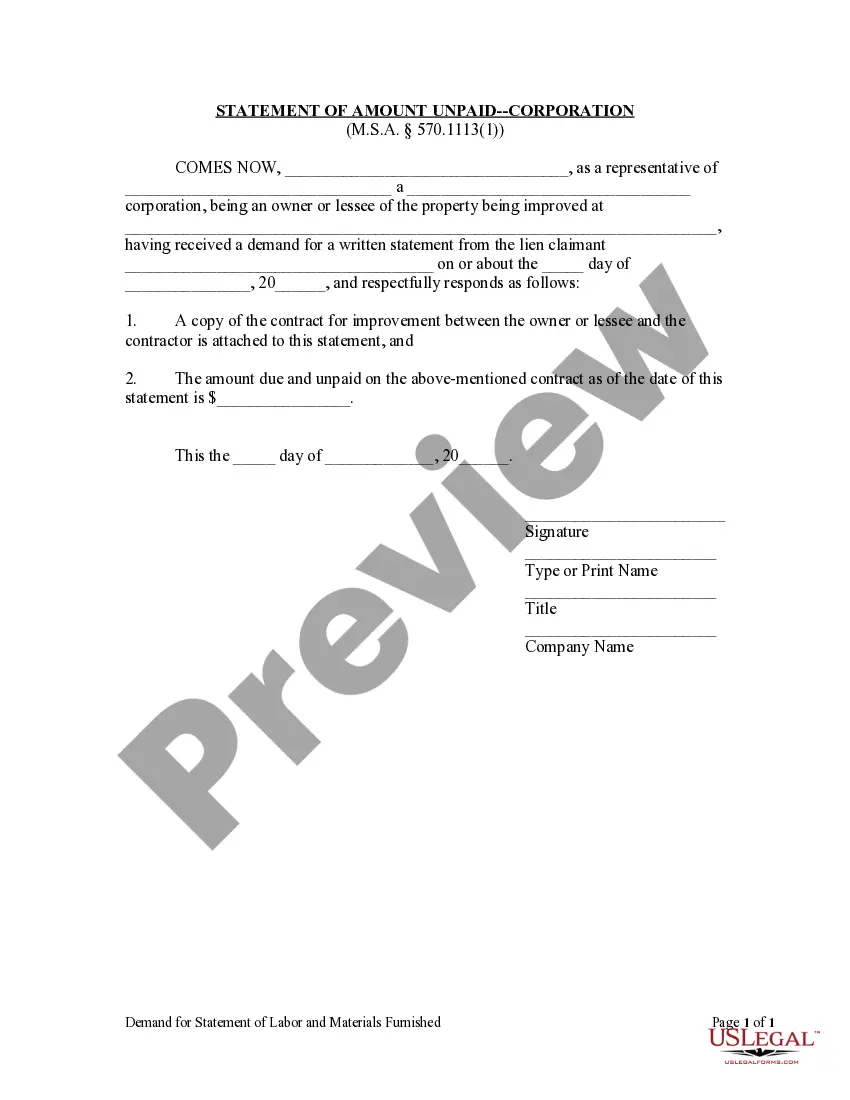

The Detroit Michigan Statement of Amount Unpaid — Corporation or LLC is a legal document that provides a comprehensive and detailed record of any outstanding debts or unpaid amounts owed by a corporation or a limited liability company (LLC) in the city of Detroit, Michigan. This statement is essentially a financial statement that is prepared by the corporation or LLC and submitted to the appropriate authorities in Detroit as required by law. It serves as a declaration of all outstanding debts, liabilities, or obligations that the entity has not yet settled. The Statement of Amount Unpaid contains relevant keywords such as the legal name of the corporation or LLC, its registered office address, and its identification number (such as the Federal Employer Identification Number or State Identification Number). Additionally, the statement includes information about the debts owed, such as the nature of the obligation, the amount of money owed, the name of the creditor or person to whom the debt is owed, and the date by which the payment is due. It may also include any penalties or interest that has accrued on the unpaid amount. In Detroit, there might be different types or variations of the Statement of Amount Unpaid, depending on the specific requirements of the local government or regulatory authorities. However, the common types usually include: 1. Detroit Michigan Statement of Amount Unpaid — Corporation: This version is specifically designed for corporations registered and operating in Detroit, Michigan. It contains all the necessary details and financial information pertaining to the corporation's unpaid debts. 2. Detroit Michigan Statement of Amount Unpaid — LLC: This type caters to limited liability companies (LCS) operating in Detroit. It includes similar information as the corporation statement but is tailored to the unique structure and requirements of an LLC. Both types assist in maintaining transparent financial records and ensure compliance with local regulations. By submitting these statements to the relevant authorities, corporations and LCS demonstrate their adherence to financial obligations, which contributes to a more transparent and accountable business environment in Detroit, Michigan.

Detroit Michigan Statement of Amount Unpaid - Corporation or LLC

Description

How to fill out Detroit Michigan Statement Of Amount Unpaid - Corporation Or LLC?

Regardless of social or professional standing, finalizing law-related paperwork is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly impossible for someone without legal training to generate such documents from the ground up, primarily due to the complex terminology and legal subtleties they entail.

This is where US Legal Forms comes into play.

Ensure the template you've found is appropriate for your area since the laws of one state or region may not apply to another.

Examine the document and read a brief overview (if available) of the situations the form can address.

- Our platform provides a vast collection with over 85,000 ready-to-use state-specific forms that cater to nearly any legal circumstance.

- US Legal Forms also acts as a valuable tool for associates or legal advisors looking to enhance their time efficiency through our DIY documents.

- Whether you require the Detroit Michigan Statement of Amount Unpaid - Corporation or LLC or any other forms suitable for your state or region, US Legal Forms makes everything easily accessible.

- Here’s how you can obtain the Detroit Michigan Statement of Amount Unpaid - Corporation or LLC in just a few minutes using our reliable platform.

- If you’re already a registered user, you can go ahead and Log In to your account to retrieve the required form.

- However, if you are new to our platform, please follow these instructions before acquiring the Detroit Michigan Statement of Amount Unpaid - Corporation or LLC.

Form popularity

FAQ

For federal income tax purposes, there is no such thing as being taxed as an LLC. Instead, an LLC can be taxed like a sole proprietorship, a partnership, a C corporation or?if it qualifies?an S corporation.

LLC's and corporations both have owners, but the form of ownership is different. LLC members have an equity (ownership) interest in the assets of the business because they have made an investment to join the business. Corporate owners are shareholders or stockholders who have shares of stock in the business.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

The state of Michigan requires all business owners of limited liability companies (LLC) and corporations to file an annual report. An annual report is a filing that helps ensure the state's records about a business entity are accurate.

How much does it cost to form an LLC in Michigan? The Michigan Department of Licensing and Regulatory Affairs charges $50 for regular service and $100 for priority rush filing. It will cost $25 to file a name reservation application if you wish to reserve your LLC name prior to filing the Articles of Organization.

A Michigan limited liability company (LLC) is a relatively new type of corporate entity. It is authorized by the Michigan Limited Liability Company Act (Michigan Compiled Laws Section 450.4101) and combines the limited liability advantages of a Michigan corporation with the tax advantages of a general partnership.

How much does it cost to form an LLC in Michigan? The Michigan Department of Licensing and Regulatory Affairs charges $50 for regular service and $100 for priority rush filing. It will cost $25 to file a name reservation application if you wish to reserve your LLC name prior to filing the Articles of Organization.

To register your Michigan LLC, you'll need to file Form 700 - Articles of Organization with the Michigan Corporations Division. You can apply online, by mail, or in person. Now is a good time to determine whether your LLC will be member-managed vs. manager-managed.

You'll need your LLC's state-issued entity ID number to access the online form. Only a few pieces of information, such as the LLC's registered office address and the name and street address of its resident agent, are required to complete the statement. The annual statement filing fee for a Michigan LLC is $25.

A limited liability company (LLC) is neither a corporation nor is it a sole proprietorship. Instead, an LLC is a hybrid business structure that combines the limited liability of a corporation with the simplicity of a partnership or sole proprietorship.