Title: Wayne Michigan Statement of Amount Unpaid — Corporation or LLC: A Comprehensive Overview Introduction: In the state of Michigan, corporations or limited liability companies (LCS) are required to file various documents to maintain legal compliance. One such crucial document is the Wayne Michigan Statement of Amount Unpaid — Corporation or LLC. This article provides an in-depth description of this statement, its purpose, and any potential variations that exist. 1. Definition and Purpose: The Wayne Michigan Statement of Amount Unpaid — Corporation or LLC is an official legal document that records the unpaid amount of taxes, fees, penalties, or other outstanding liabilities owed by a corporation or LLC to Wayne County, Michigan. It serves as a comprehensive record of the entity's financial obligations to the county and plays a vital role in accurate accounting and ensuring compliance. 2. Types of Wayne Michigan Statement of Amount Unpaid — Corporation or LLC: a) Annual Statement: This type of statement is filed annually and provides a summary of any unpaid amounts owed by the corporation or LLC to Wayne County. It reflects the outstanding balances for taxes, fees, assessments, or any other obligations incurred during the fiscal year. b) Quarterly Statement: In certain cases, corporations or LCS are required to file quarterly statements, specifically if they have dynamic financial activity or if they are subject to regular tax or fee payments. These statements provide a more frequent update on the amount unpaid within a specific timeframe. c) Amended Statement: If any errors or omissions are discovered within a previously filed statement, an amended statement must be submitted to rectify the information. The amended statement ensures accuracy and provides an updated overview of the entity's unpaid obligations. d) Final Statement: When a corporation or LLC terminates its operations or dissolves, a final statement is required to be filed. This statement reflects all outstanding amounts unpaid at the time of termination and serves as a final record of the entity's liabilities to Wayne County. 3. Filing Process: To file a Wayne Michigan Statement of Amount Unpaid — Corporation or LLC, the entity must follow these steps: — Obtain the necessary form from Wayne County's official website or their designated office. — Complete the form accurately, ensuring that all relevant information is provided. — Include detailed documentation supporting the amounts claimed in the statement (if applicable). — Submit the completed form to the appropriate Wayne County office along with any required fees or supporting documentation. — Retain a copy of the filed statement for record-keeping purposes. Conclusion: The Wayne Michigan Statement of Amount Unpaid — Corporation or LLC is a crucial document that ensures transparency and financial accountability between corporations, LCS, and Wayne County. By accurately recording unpaid amounts and filing the necessary statements, entities can uphold legal compliance while facilitating financial transparency. Understanding the various types of statements and adhering to the proper filing procedures is essential for corporations and LCS operating in Wayne County, Michigan.

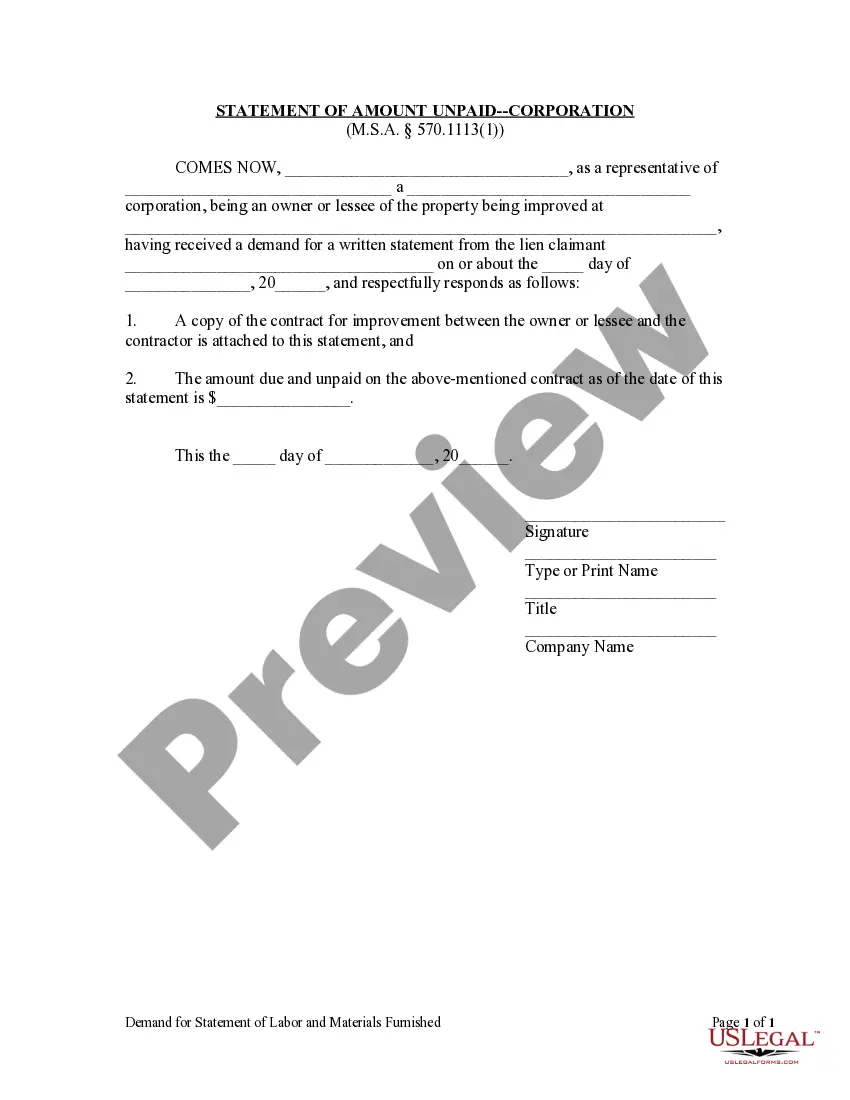

Wayne Michigan Statement of Amount Unpaid - Corporation or LLC

Description

How to fill out Wayne Michigan Statement Of Amount Unpaid - Corporation Or LLC?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Wayne Michigan Statement of Amount Unpaid - Corporation or LLC or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Wayne Michigan Statement of Amount Unpaid - Corporation or LLC adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Wayne Michigan Statement of Amount Unpaid - Corporation or LLC is suitable for you, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!