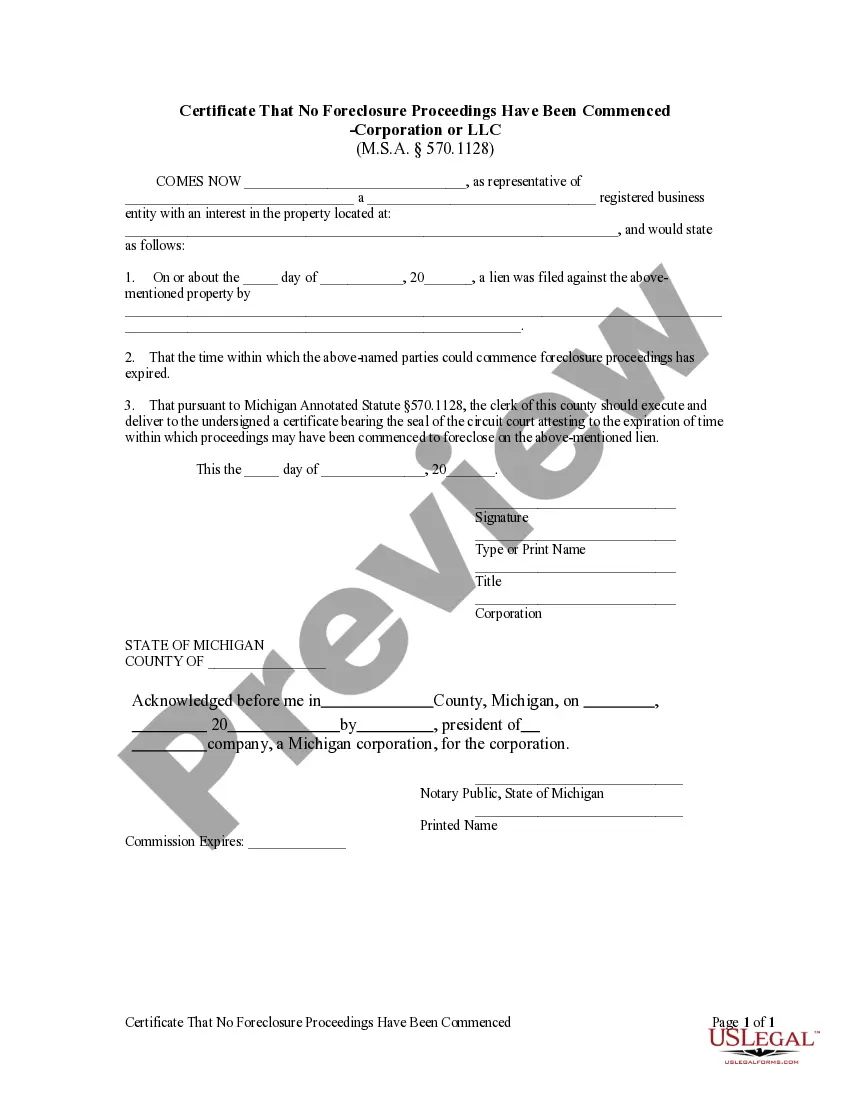

Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced — Corporation or LLC is a legal document that provides official proof that no foreclosure proceedings have been initiated against a corporation or limited liability company (LLC) in Oakland County, Michigan. This certificate is crucial for businesses seeking to establish their financial stability and credibility in the local market. It ensures potential partners, clients, and stakeholders that the corporation or LLC is not at risk of losing its assets due to foreclosure. Keywords: Oakland Michigan, Certificate, No Foreclosure Proceedings, Commenced, Corporation, LLC. Types of Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced — Corporation or LLC: 1. Standard Certificate: This type of certificate is issued to corporations or LCS in Oakland County, Michigan, stating that no foreclosure proceedings have been initiated against them. It serves as an official confirmation of the company's financial stability, reassuring clients, investors, and other business entities. 2. Expedited Certificate: Oakland County also provides an expedited version of the certificate for corporations or LCS needing immediate validation of their foreclosure-free status. This option is useful when businesses are in urgent need of the certificate for potential business deals, loans, or partnerships. 3. Annual Recertification: Corporations or LCS may be required to renew their Certificate That No Foreclosure Proceedings Have Been Commenced annually. This recertification ensures that the information provided on the certificate remains accurate and up to date. It helps maintain transparency and credibility for businesses operating in Oakland County. 4. Certified Copy: A certified copy of the Certificate That No Foreclosure Proceedings Have Been Commenced is often required when dealing with governmental, financial, or legal entities. This copy has an official seal and is attested by the authority issuing the certificate, providing irrefutable evidence of the company's foreclosure-free status. Corporations and LCS operating in Oakland County, Michigan, must obtain the Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced. This document plays a vital role in establishing trust and confidence in the business's financial stability, enhancing its prospects for growth and success in the local market.

Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation or LLC

Description

How to fill out Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation Or LLC?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no law background to draft this sort of papers cfrom the ground up, mainly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive library with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation or LLC or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation or LLC in minutes employing our trusted service. If you are already an existing customer, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are unfamiliar with our platform, ensure that you follow these steps prior to obtaining the Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation or LLC:

- Ensure the template you have chosen is suitable for your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a short description (if available) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your requirements, you can start again and look for the suitable form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Select the payment method and proceed to download the Oakland Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation or LLC as soon as the payment is done.

You’re all set! Now you can proceed to print out the form or complete it online. Should you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

In some states, the payment of property taxes by a person claiming adverse possession can be used to establish legal title. However, there is no such statutory requirement in Michigan. Paying taxes is not, of itself, sufficient to constitute adverse possession.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Property Tax Exemption Pursuant to MCL 211.7u, eligible low-income homeowners may apply for an exemption from property taxes. An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards.

Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200.

Real property tax delinquency entails a three-year forfeiture and foreclosure process in Michigan. Parcels are forfeited to the county treasurers when the real property taxes are in the second year of delinquency.

To check for liens in Michigan, an individual may approach the public agency with custody of the record or conduct an online search via the agency's website. The Friend of the Court (FOC) is one of the government agencies that a person can approach to check for liens in Michigan.

To establish adverse possession, an individual must demonstrate possession of the real property for a period of fifteen (15) years and that the possession has been actual, visible, open, notorious, exclusive, continuous, hostile, and under a cover or claim of right.

Tax rates in Michigan are expressed as mill rates. A mill is equal to $1 of tax for every $1,000 of taxable value. For example, if your total tax rate is 20 mills and your taxable value is $50,000, your taxes owed would be $1,000 annually.

The 6 year period, known as the statute of limitations, may be extended by certain actions such as a court judgment. By law, the Department may use a variety of actions to collect your past-due tax, penalty and interest and may take these actions at any time during the course of collection.

Generally speaking, if you have been occupying lands that you do not own, rent or otherwise have permission to use in excess of 12 years (or in the case of Crown lands 30 years), without any objection from the registered owner, you can claim what is known as ?adverse possession?.