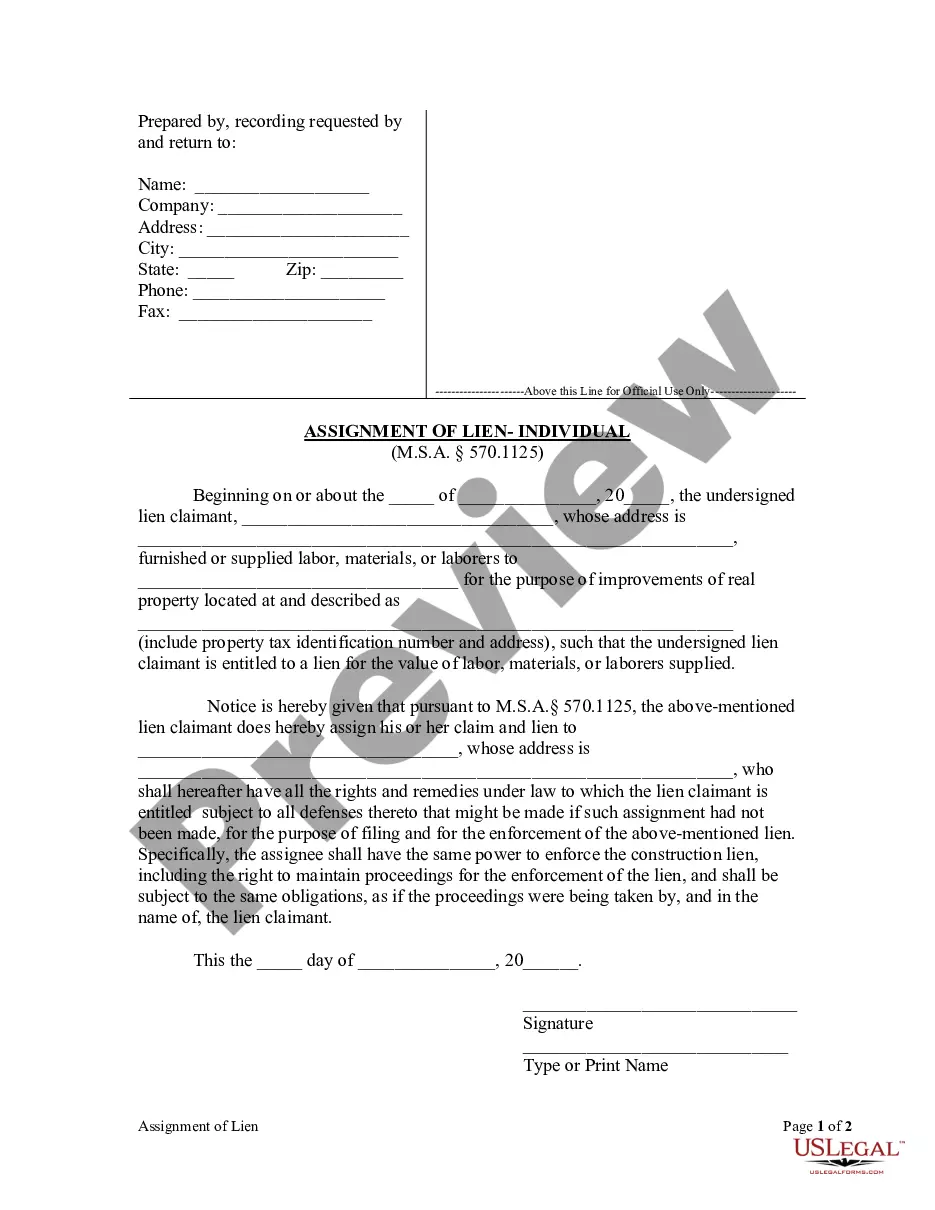

Oakland, Michigan Assignment of Lien — Individual: A Comprehensive Description In Oakland, Michigan, an Assignment of Lien — Individual refers to a legal document that transfers the rights and interests in a lien from one individual to another. This process allows for the transfer of a debt or claim against a property from the original lien holder to a new individual who assumes ownership of the lien. The Assignment of Lien — Individual is a crucial legal instrument used in various scenarios, such as real estate transactions or debt collections. When a property owner fails to pay a debt owed, such as taxes, utility bills, or contractor services, a lien can be placed on the property by the creditor. This lien acts as a form of security, ensuring the debt will eventually be paid. However, if the original lien holder decides to transfer their rights to another individual, the Assignment of Lien — Individual document must be executed. It is important to note that there may be different types of Assignment of Lien — Individual in Oakland, Michigan, depending on the specific circumstances. Here are a few notable examples: 1. Tax Lien Assignment: This type of Assignment of Lien — Individual is commonly used by governmental entities, such as the Oakland County Treasurer's Office, when a property owner fails to pay their property taxes. The tax lien can be assigned to another individual or entity, allowing them to collect the owed taxes or pursue other appropriate legal actions. 2. Contractor's Lien Assignment: When a contractor provides services or materials for a construction or renovation project and does not receive payment, they may file a lien against the property. In some cases, the contractor may choose to assign their lien to another individual who can then pursue legal remedies to collect the outstanding debt. 3. Utility Lien Assignment: Utility companies, such as water, electricity, or gas providers, may also place a lien on a property if the property owner fails to pay their bills. If the utility company decides to transfer the lien to another party, an Assignment of Lien — Individual document would be executed to effectuate the transfer. In conclusion, an Oakland, Michigan Assignment of Lien — Individual is a legal document that facilitates the transfer of a lien from one individual to another. This mechanism is utilized in various scenarios, including tax liens, contractor's liens, and utility liens. Each type of Assignment of Lien — Individual serves a specific purpose, allowing for the transfer of both the rights and responsibilities associated with the lien.

Oakland Michigan Assignment of Lien - Individual

Description

How to fill out Oakland Michigan Assignment Of Lien - Individual?

If you’ve already utilized our service before, log in to your account and save the Oakland Michigan Assignment of Lien - Individual on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Oakland Michigan Assignment of Lien - Individual. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!

Form popularity

FAQ

We do provide notary service at no charge for documents being recorded in the Oakland County Register of Deeds. Recording fees are due at the time a document is recorded. The fee, set forth in state law, is $30 per document.

If you are the person keeping the property, take the deed to the Register of Deeds and record it after your ex-spouse has signed it and delivered it to you. There will be a $30 recording fee.

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.

The statute for bringing a lawsuit based on fraud or on a contract in Michigan is six years. However, if two people claim title to the same property, the statute of limitations is fifteen years.

A quitclaim bill of sale also presents some downsides. Because the bill of sale makes no guarantees at all, a buyer may find themselves owning property that is tied up with liens, or even property the seller didn't actually own at all.

The signature of the grantor is mandatory on the quit claim deed to transfer the property. The grantee is not required to sign the deed in Michigan. The quit claim deed must be signed in front of a notary public, who attests to the fact that you are who you claim to be and that you signed the document.

Statute of Limitations on a Quitclaim Deed in Michigan For example, challenging a quitclaim deed given by a close family member or a court-ordered sale has a five-year statute of limitations.

That it be signed by the grantor; That the grantor's signature be witnessed by a notary, who must acknowledge and seal the deed; That the deed be delivered and accepted by the grantee.

To successfully execute a quitclaim deed in Michigan, the property owner needs to complete a quitclaim deed form and sign it in front of a notary. Then they pay any transfer taxes due and record the deed in the land recorder's office in the county in which the property is located.