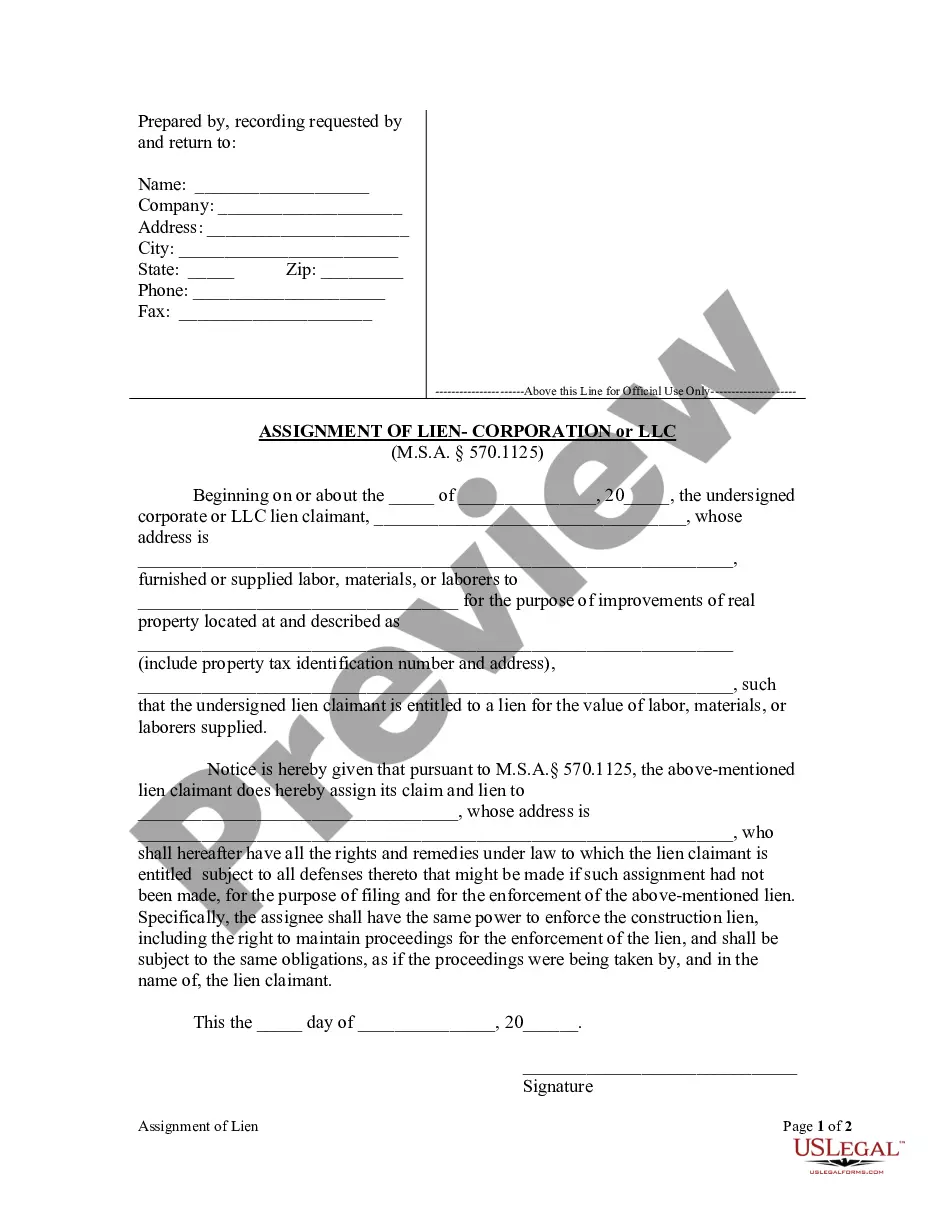

A Detroit Michigan Assignment of Lien — Corporation refers to the legal process by which a corporation transfers or assigns its rights and interests in a lien to another party. In the state of Michigan, a lien is a legal claim that provides security for the payment of a debt, typically resulting from unpaid services, goods, or loans. The assignment of lien involves the transfer of this security interest from one party to another. It is commonly used when a corporation wants to sell or transfer its lien rights to another entity, whether it be an individual, business, or another corporation. This process allows the assignee to step into the assignor's shoes and become the new lien holder, with the same rights, responsibilities, and legal remedies as the original party. The Detroit Michigan Assignment of Lien — Corporation may vary in terms of specific details based on the nature of the underlying debt or lien. There can be different types of liens that can be assigned, such as mechanics' liens, judgment liens, or tax liens. 1. Mechanics' Liens: These are commonly used in the construction industry, where contractors or suppliers can place a lien on a property if they are not paid for their services or materials. An assignment of a mechanics' lien by a corporation would involve the transfer of this lien to another party, allowing them to pursue the debt or claim against the property. 2. Judgment Liens: When a court grants a judgment in favor of a creditor, they may place a judgment lien on the debtor's property as a means of securing payment. A corporation holding a judgment lien can assign it to another party, enabling them to take legal action to collect the debt. 3. Tax Liens: In cases of unpaid taxes, the government may place a tax lien on a property. A corporation with a tax lien can assign it to a third party, allowing them to pursue the outstanding tax debt and potentially foreclose on the property. In all cases of the Detroit Michigan Assignment of Lien — Corporation, it is crucial to follow the proper legal procedures and documentation requirements. The assignment should be in writing, clearly stating the parties involved, the specific lien being assigned, and any terms or conditions of the transfer. This document may need to be recorded with the appropriate authority, such as the county clerk's office, to ensure its validity and protect the assignee's rights.

Detroit Michigan Assignment of Lien - Corporation

Description

How to fill out Detroit Michigan Assignment Of Lien - Corporation?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for legal solutions that, as a rule, are extremely expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Detroit Michigan Assignment of Lien - Corporation or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Detroit Michigan Assignment of Lien - Corporation complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Detroit Michigan Assignment of Lien - Corporation is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!