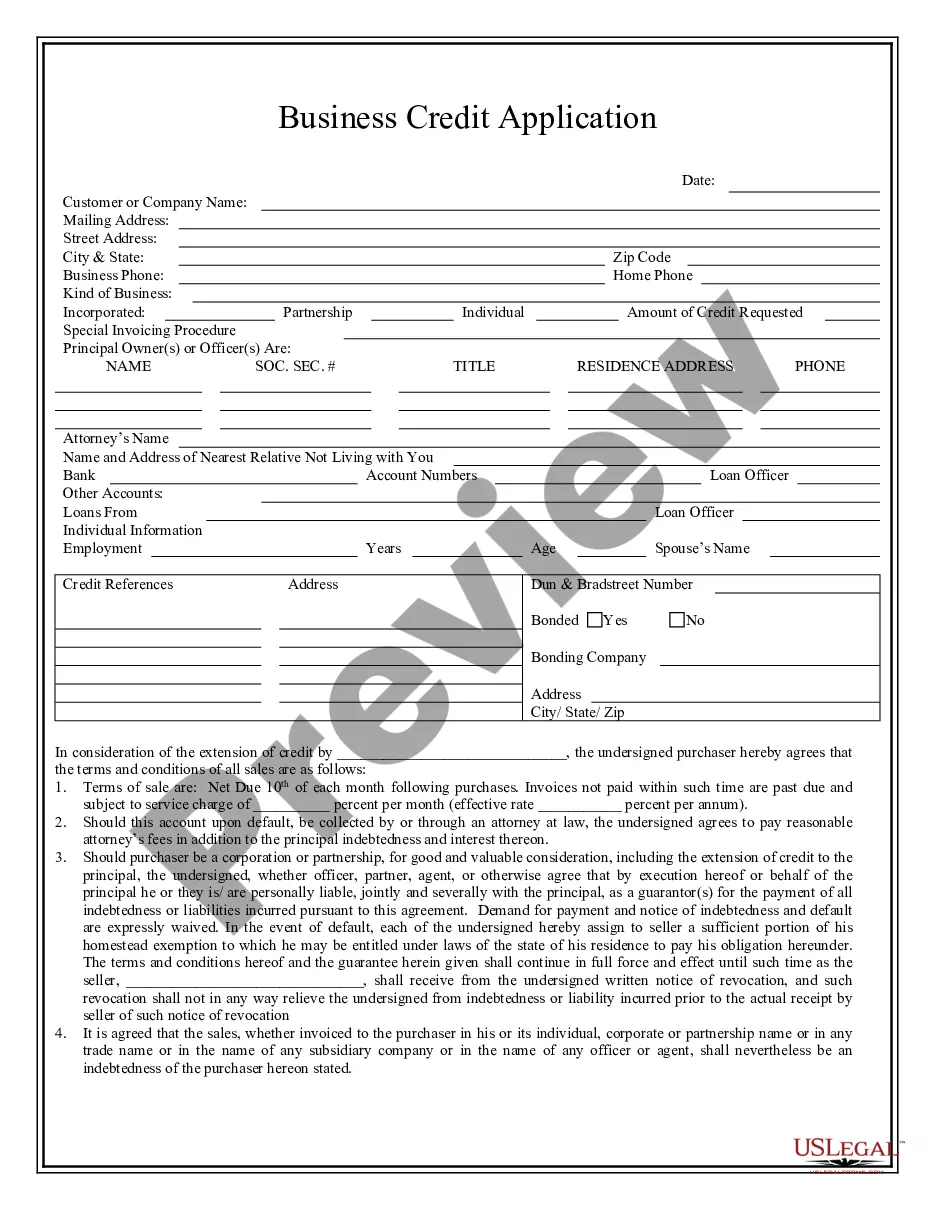

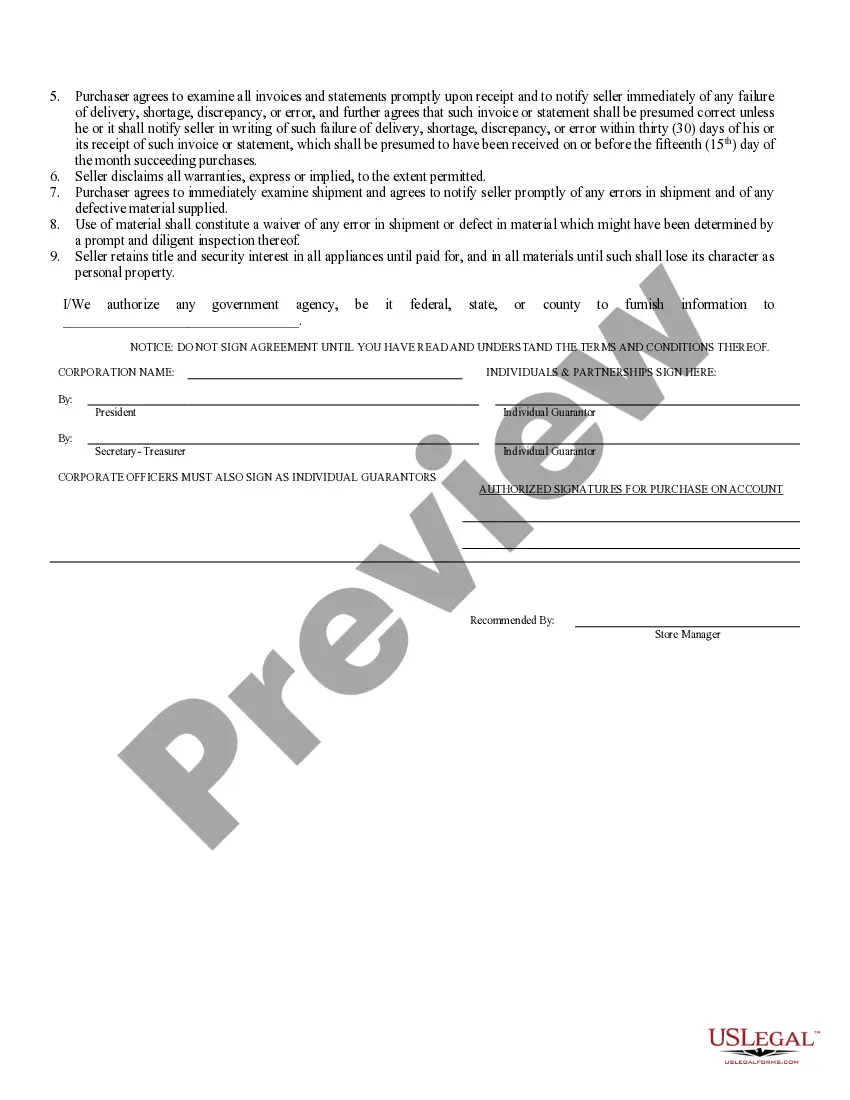

The Detroit Michigan Business Credit Application is a formal document used by businesses in Detroit, Michigan to apply for credit from financial institutions or other credit providers. This application is an essential tool for businesses seeking financial assistance to support their operations, expand, or invest in various opportunities. The Detroit Michigan Business Credit Application gathers crucial information about the business, such as its legal name, address, contact details, and ownership structure. It may also include details about the business's industry, years in operation, and annual revenue. This information provides a comprehensive overview of the business's background and helps credit providers assess its creditworthiness. Additionally, the Detroit Michigan Business Credit Application includes financial information about the business, such as its annual profit and loss statements, balance sheets, and cash flow statements. These financial documents enable credit providers to evaluate the business's financial stability, liquidity, and ability to repay any credit granted. Furthermore, the application may require the business to provide references or trade credit information, showcasing its payment history and relationships with other suppliers or vendors. This further assists credit providers in verifying the business's creditworthiness and evaluating its reliability as a borrower. Moreover, the Detroit Michigan Business Credit Application may offer different types or variations designed to cater to the diverse needs of businesses. These variations may include: 1. Small Business Credit Application: Tailored for small businesses seeking credit to support their daily operations, fund inventory purchases, or manage seasonal fluctuations in cash flow. 2. Start-up Business Credit Application: Specifically crafted for newly established businesses looking for funding to launch their operations, purchase equipment, or develop their initial infrastructure. 3. Expansion Business Credit Application: Designed for businesses undergoing expansion plans, seeking credit to invest in new locations, acquire additional equipment, or employ more staff to support growth. 4. Industry-Specific Credit Application: Customized credit applications catering to specific industries such as manufacturing, retail, healthcare, or technology, which may have unique credit requirements and evaluation criteria. The Detroit Michigan Business Credit Application serves as a vital tool in the credit evaluation process, allowing financial institutions and other credit providers to assess the creditworthiness and risk profile of businesses operating in Detroit, Michigan.

Detroit Michigan Business Credit Application

Description

How to fill out Detroit Michigan Business Credit Application?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person without any law education to draft such paperwork cfrom the ground up, mainly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a massive library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Detroit Michigan Business Credit Application or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Detroit Michigan Business Credit Application quickly employing our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, if you are unfamiliar with our library, make sure to follow these steps prior to obtaining the Detroit Michigan Business Credit Application:

- Ensure the form you have found is good for your area since the rules of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if available) of cases the document can be used for.

- If the one you chosen doesn’t meet your needs, you can start again and look for the suitable form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account login information or create one from scratch.

- Choose the payment gateway and proceed to download the Detroit Michigan Business Credit Application as soon as the payment is completed.

You’re all set! Now you can proceed to print out the form or fill it out online. In case you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.