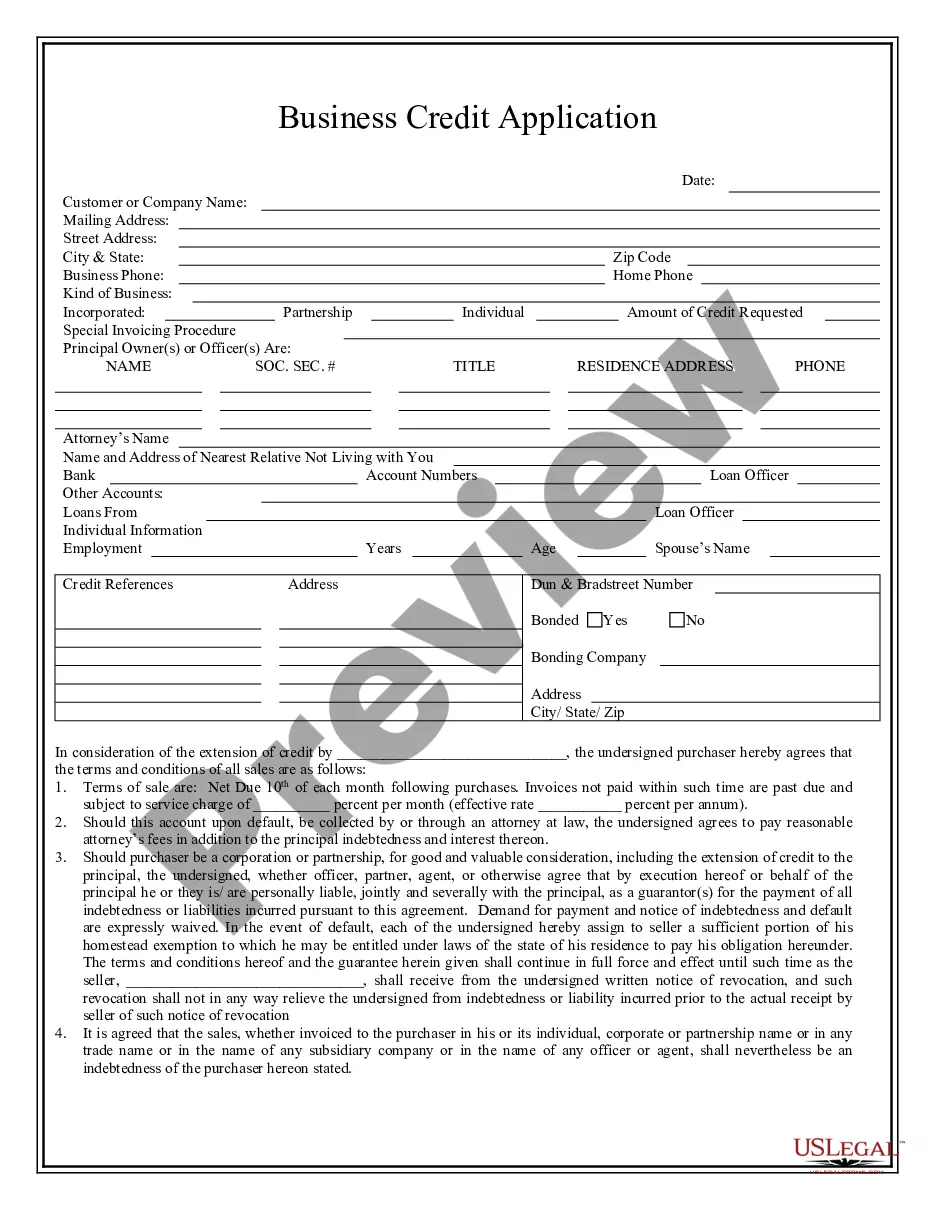

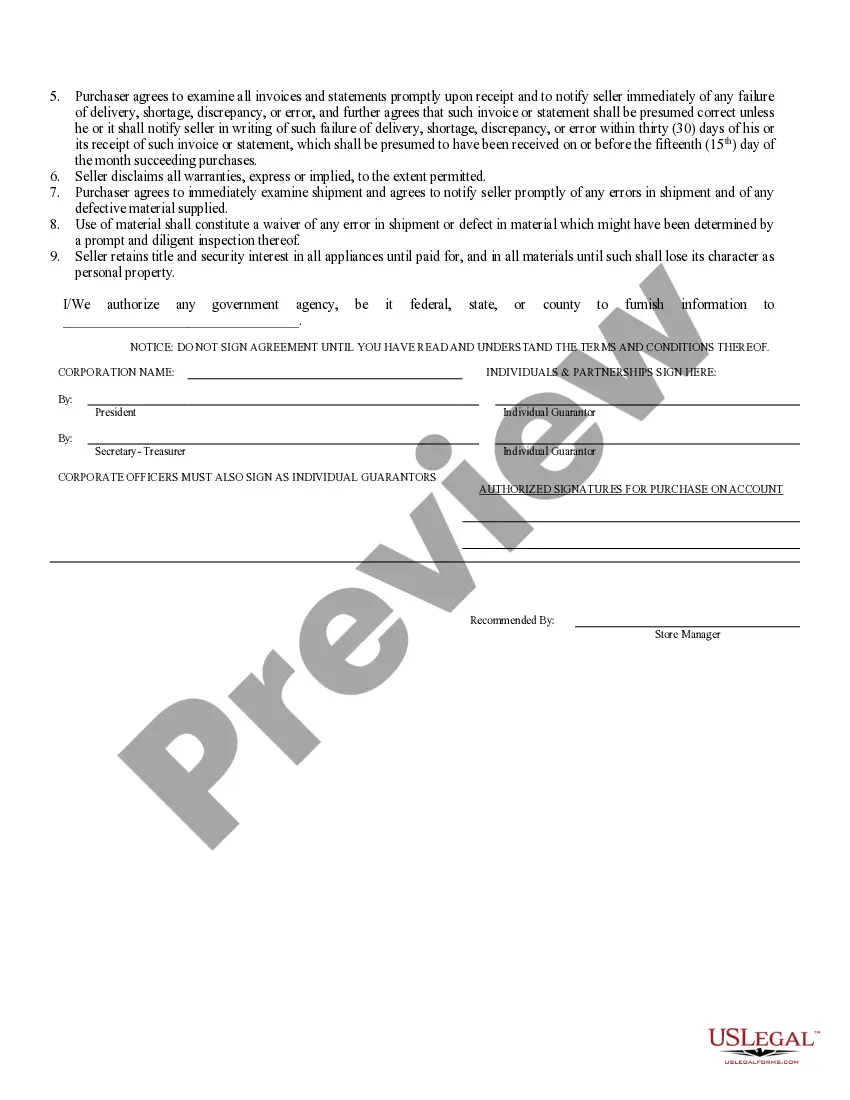

Grand Rapids Michigan Business Credit Application is a comprehensive form that businesses in Grand Rapids, Michigan, can use to apply for credit lines and financing options. The application is designed to gather detailed information about the business, allowing financial institutions and lenders to assess the creditworthiness and evaluate the risk associated with extending credit to the applicant. The Grand Rapids Michigan Business Credit Application includes various sections that collect essential information about the business entity, its owners, and financial details. The form typically consists of the following sections: 1. Business Information: This section requires the applicant to provide basic details about the business, such as its legal name, address, phone number, and type of business entity (sole proprietorship, partnership, LLC, etc.). It may also include questions about the number of employees, years in operation, and the industry in which the business operates. 2. Ownership Details: Here, the application captures information about the business's ownership structure. This includes names, addresses, and contact details of the owners, partners, or shareholders. Additionally, details about ownership percentages and any other businesses owned by the applicants may be required. 3. Financial Information: This section aims to gather financial data about the business. It typically includes questions about revenue, expenses, assets, liabilities, and outstanding debts. Businesses may need to provide income statements, balance sheets, and cash flow statements to support the financial information provided. 4. Banking and Credit References: Applicants are often required to list their current banking relationships and credit references. This information helps lenders assess the applicant's prior credit history and their ability to handle various financial obligations responsibly. 5. Purpose of Credit: In this section, applicants explain the intended use of the credit or financing they are applying for. This could include purposes like expansion, working capital, purchasing equipment, or other specific business needs. Different types of Grand Rapids Michigan Business Credit Applications may exist based on the specific financial institution or lender providing the application. For example, some may be tailored to small businesses seeking short-term loans or lines of credit, while others may cater to larger corporations requiring substantial financing for larger-scale projects. In conclusion, the Grand Rapids Michigan Business Credit Application is a crucial tool that helps businesses in Grand Rapids access credit lines and financing options. By providing comprehensive information about the business and its financial standing, the application allows financial institutions to assess creditworthiness and make informed decisions regarding extending credit to business owners.

Grand Rapids Michigan Business Credit Application

Description

How to fill out Grand Rapids Michigan Business Credit Application?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no law background to draft this sort of papers from scratch, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a massive library with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you require the Grand Rapids Michigan Business Credit Application or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Grand Rapids Michigan Business Credit Application in minutes using our trustworthy platform. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, in case you are a novice to our library, make sure to follow these steps before obtaining the Grand Rapids Michigan Business Credit Application:

- Be sure the template you have chosen is specific to your location since the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if available) of cases the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and look for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- with your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Grand Rapids Michigan Business Credit Application as soon as the payment is done.

You’re good to go! Now you can go ahead and print out the form or complete it online. In case you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.