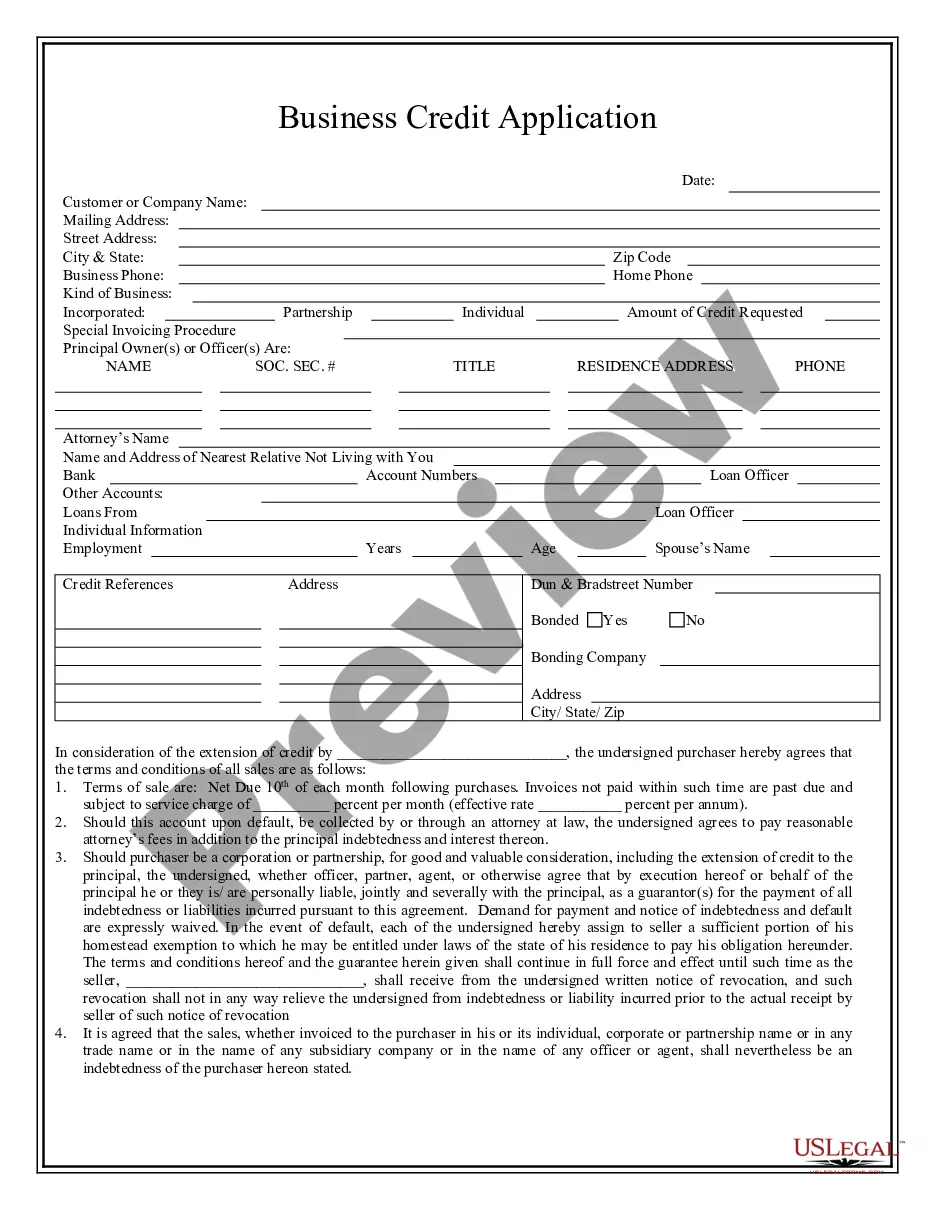

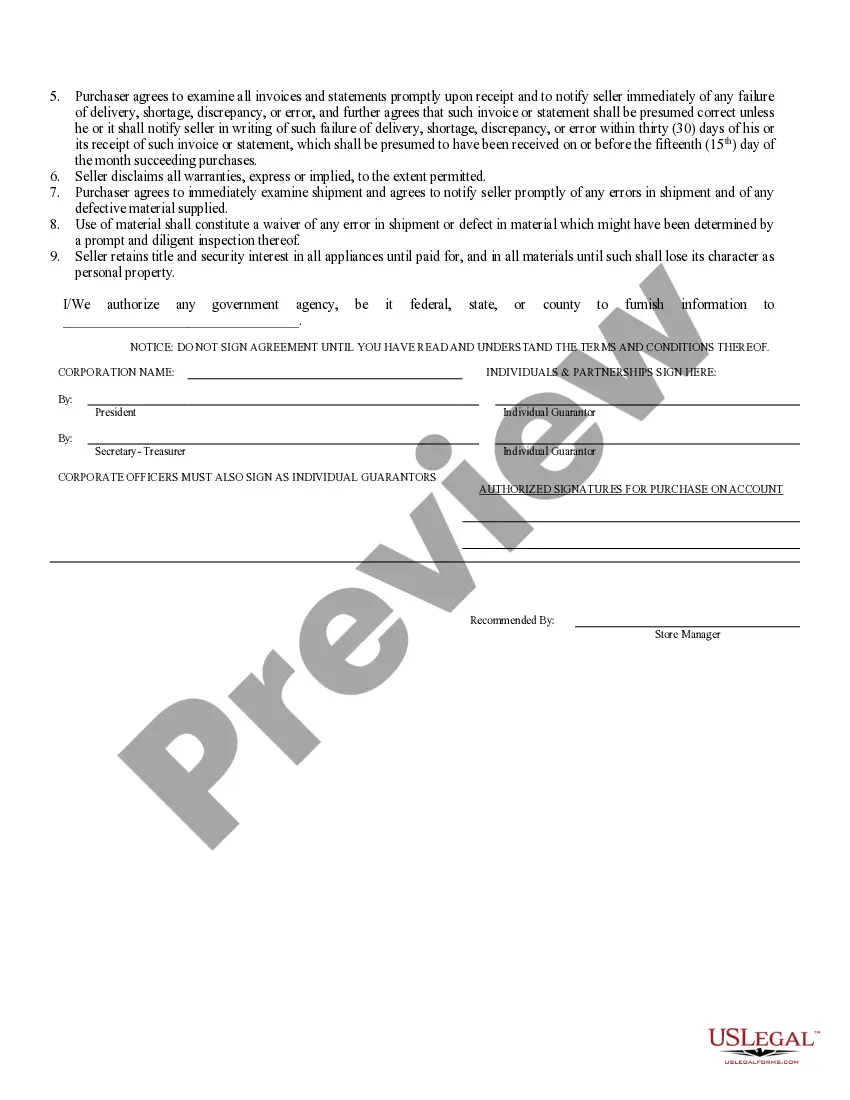

Lansing Michigan Business Credit Application: A Comprehensive Guide to Accessing Financial Support In Lansing, Michigan, businesses seeking financial assistance can apply for the Lansing Michigan Business Credit Application to access potential funds and support their growth and expansion plans. This detailed description will outline the key features and purposes of the Lansing Michigan Business Credit Application, shedding light on different types available and relevant keywords. Keywords: Lansing Michigan, business credit application, financial assistance, funds, growth, expansion, support. The Lansing Michigan Business Credit Application serves as a crucial avenue for businesses in Lansing, Michigan, to secure the necessary financial support for their operations. This application acts as a gateway to potential funds, helping entrepreneurs and companies achieve their growth objectives and expand their enterprises. The Lansing Michigan Business Credit Application offers various types and options catered to different business requirements and circumstances: 1. Small Business Credit Application: — Designed for startups and small businesses in Lansing, Michigan, aiming to establish or stabilize their operations. — Provides access to a range of financial resources tailored to small-scale enterprises. — Keywords: small business, startup, financial resources, stability. 2. Expansion Credit Application: — Geared towards established businesses in Lansing, Michigan, looking to expand their operations, venture into new markets, or launch additional product lines. — Offers higher credit limits and more extensive financial assistance. — Keywords: expansion, established businesses, new markets, higher credit limits. 3. Equipment Financing Credit Application: — Targeted specifically at businesses in Lansing, Michigan, requiring financing options to purchase or upgrade equipment necessary for their operations. — Offers flexible terms and specialized support for equipment acquisition and maintenance. — Keywords: equipment financing, equipment purchase, upgrade, specialized support. 4. Working Capital Credit Application: — Designed for businesses in Lansing, Michigan, seeking immediate funds to cover day-to-day operational expenses, manage cash flow, or bridge gaps in funding. — Offers short-term credit options to address temporary financial needs. — Keywords: working capital, operational expenses, cash flow, short-term credit. Applying for the Lansing Michigan Business Credit Application involves a detailed process that typically includes submitting relevant business information, financial statements, and a comprehensive business plan. The application is meticulously reviewed by financial institutions or organizations responsible for administering the credit program. Upon approval, businesses can access the requested funds, which can be utilized for various purposes such as purchasing inventory, expanding facilities, investing in research and development, or hiring additional staff. Overall, the Lansing Michigan Business Credit Application serves as a crucial tool for businesses in Lansing, Michigan, seeking financial support and growth opportunities. Its various types cater to distinct business needs, providing essential resources and assistance to ensure long-term prosperity and sustainability.

Lansing Michigan Business Credit Application

Description

How to fill out Lansing Michigan Business Credit Application?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Lansing Michigan Business Credit Application becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Lansing Michigan Business Credit Application takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Lansing Michigan Business Credit Application. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!