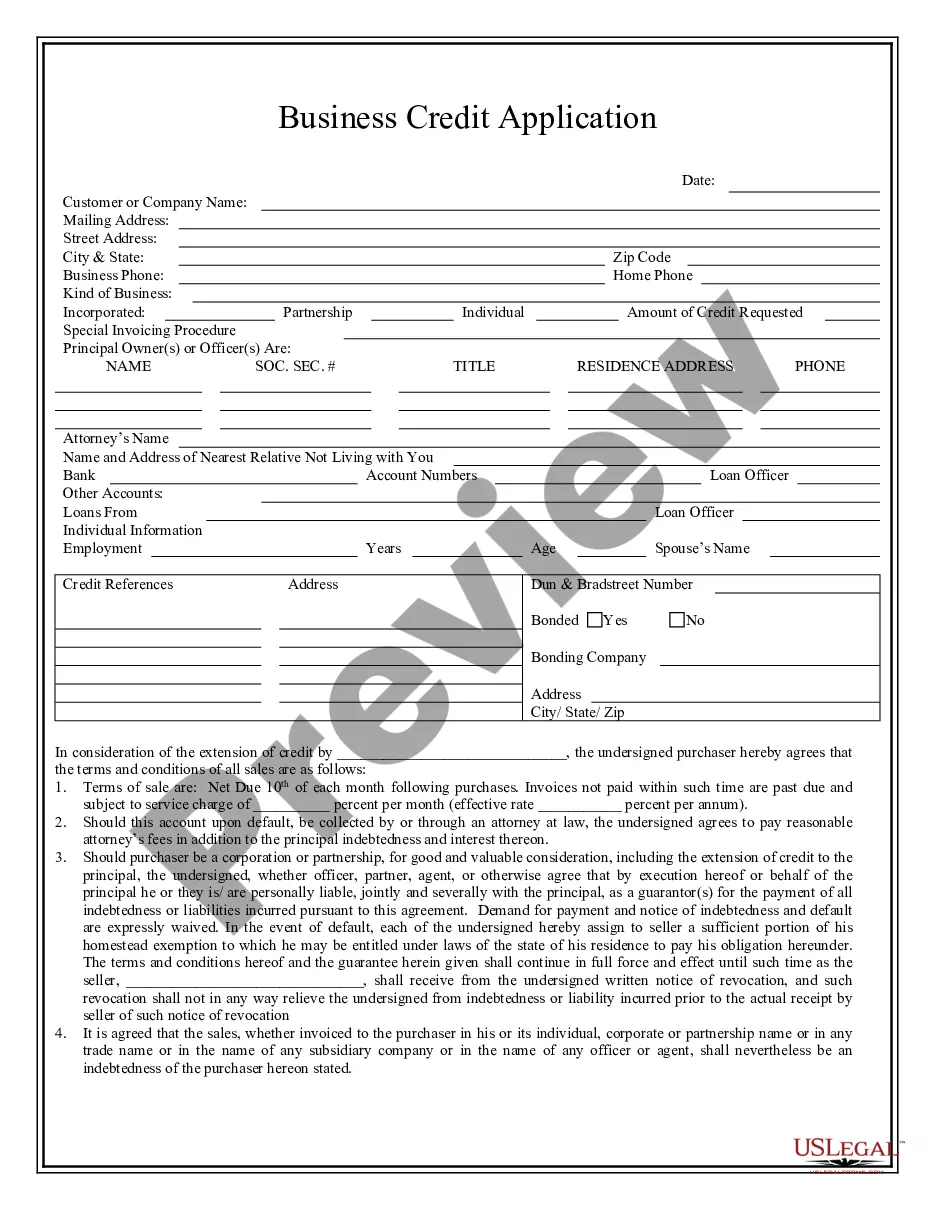

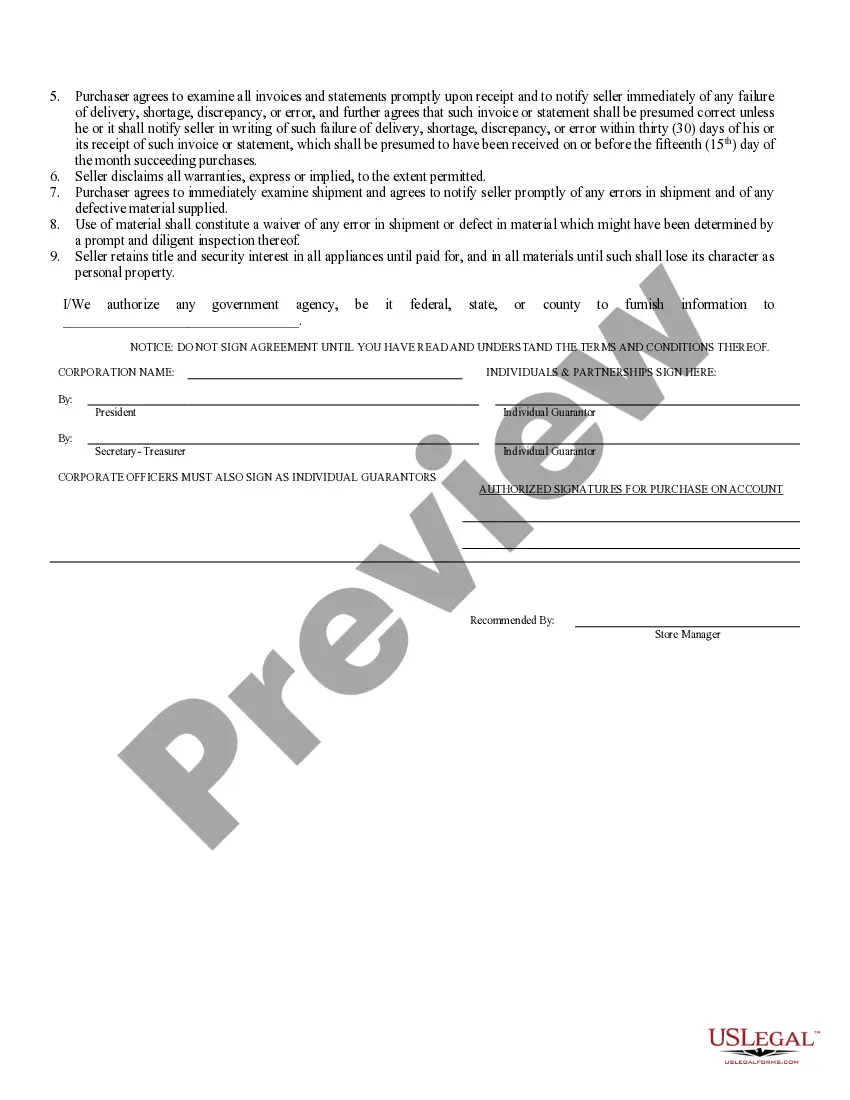

Oakland Michigan Business Credit Application is an essential document that businesses based in Oakland County, Michigan needs to submit to a financial institution or creditor to request credit. This application plays a crucial role in assessing the creditworthiness and financial stability of a business before granting any credit facilities. The Oakland Michigan Business Credit Application typically requires various details and information about the business, its owners, and financial status. This information includes the company's legal name, address, contact details, and industry classification. The application may also ask for the type of business entity (sole proprietorship, partnership, corporation, etc.) and the number of years the business has been operating. To assess the creditworthiness of the business, the application may require details about the company's financial statements, including income statements, balance sheets, and cash flow statements. Moreover, the application may seek information about the business's current outstanding debts or existing credit facilities. This helps the creditor evaluate the repayment capacity of the business and its ability to handle additional credit. Additionally, the Oakland Michigan Business Credit Application might request specific financial ratios or key performance indicators, such as the debt-to-equity ratio, current ratio, or profitability metrics. These ratios provide insights into the business's financial health and its ability to meet its financial obligations. Some financial institutions or creditors might have specialized Oakland Michigan Business Credit Applications designed for specific industries. For instance, there might be separate applications for manufacturing businesses, retail businesses, or service-based enterprises. These specialized applications cater to the unique financial characteristics and requirements of each industry. Moreover, businesses seeking credit for different purposes might encounter distinct Oakland Michigan Business Credit Applications. For example, there could be separate applications for working capital loans, equipment financing, or business expansion loans. These variations ensure that the application process aligns with the specific needs and goals of each business seeking credit. In conclusion, the Oakland Michigan Business Credit Application is a comprehensive and detailed document that enables financial institutions and creditors to assess the creditworthiness and financial stability of businesses seeking credit in Oakland County, Michigan. By providing comprehensive information about the business, its financial statements, and credit requirements, this application assists creditors in making informed decisions regarding the extension of credit facilities.

Oakland Michigan Business Credit Application

Description

How to fill out Oakland Michigan Business Credit Application?

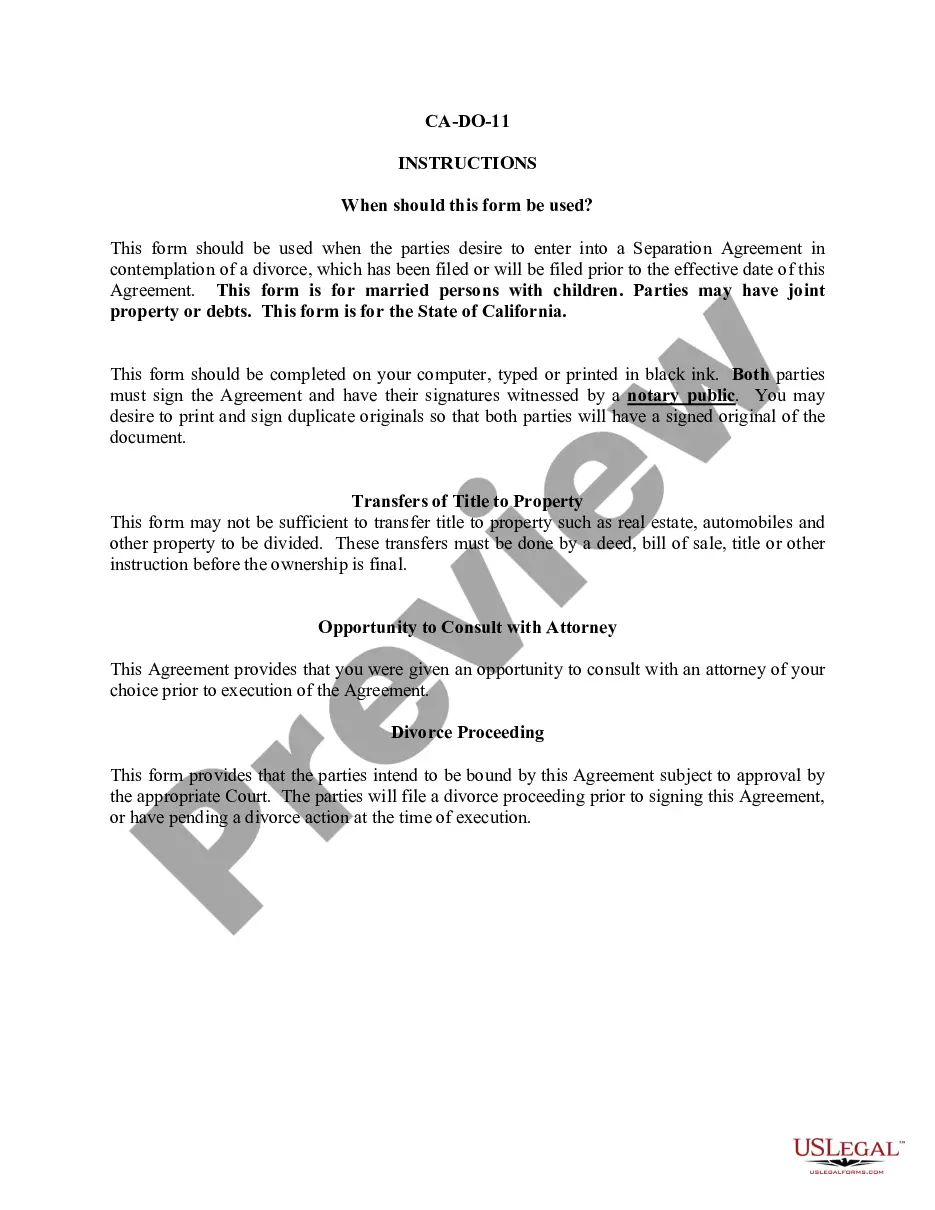

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney services that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Oakland Michigan Business Credit Application or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Oakland Michigan Business Credit Application complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Oakland Michigan Business Credit Application is proper for you, you can select the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Contact the City Treasurer's office for information. The Michigan Department of Treasury offers an Online New Business Registration process. This process is easy, fast, secure, and convenient. This e-Registration process is much faster than registering by mail.

Where can I get a $1 million business loan? Banks, credit unions and online lenders frequently offer loans up to $1 million for established businesses. The Small Business Association (SBA) also backs loans of $1 million, but to apply for funding, you will need to submit an application through an SBA-approved lender.

OnDeck is the best overall small business loan lender for bad credit because it accepts minimum credit scores of 600, and same-day funding is possible. As long as you've been in business for over a year, have a business bank account, and at least $100,000 in annual revenue, you can apply for a loan.

They tend to have higher credit limits than personal cards. Based on 2020 data from Experian, the consumer's credit limit was $31,015, while the average small business credit card limit was $56,100.

Example Monthly Payments on a Million Dollar Business Loan Consider a $1M loan with an interest rate of 4% fixed for 20 years. The monthly payments on that business loan would be $4,774.15.

A good credit score starts at around 700 (credit scores range from 300 to 850). Is it hard to get a startup business loan? The short answer is yes. Because you're just starting a business, you don't have an established track record for banks and other lenders to evaluate.

5 options for startup business loans with no collateral SBA 7(a) loans under $25,000. The United States Small Business Administration (SBA) offers financial assistance for small businesses through the SBA 7(a) loan program.Online business term loans.Merchant cash advances.Unsecured line of credit.Business credit cards.

Where can I get a $2 million business loan? Your business can apply for a $2 million business loan from a bank, credit union or online lender. Banks and credit unions typically have strict requirements ? like higher minimum revenue and more time in business ? than online lenders, but may offer lower rates.

How To Qualify For a 1 Million Dollar Loan - YouTube YouTube Start of suggested clip End of suggested clip So national business capital has helped secure over one billion dollars in financing for businessMoreSo national business capital has helped secure over one billion dollars in financing for business owners just like yourself all across the country in all different industries of all shapes and sizes

Although requirements vary by lender, you'll typically want to have a minimum credit score of 600, at least six months in operation and strong finances to qualify for a startup business loan.