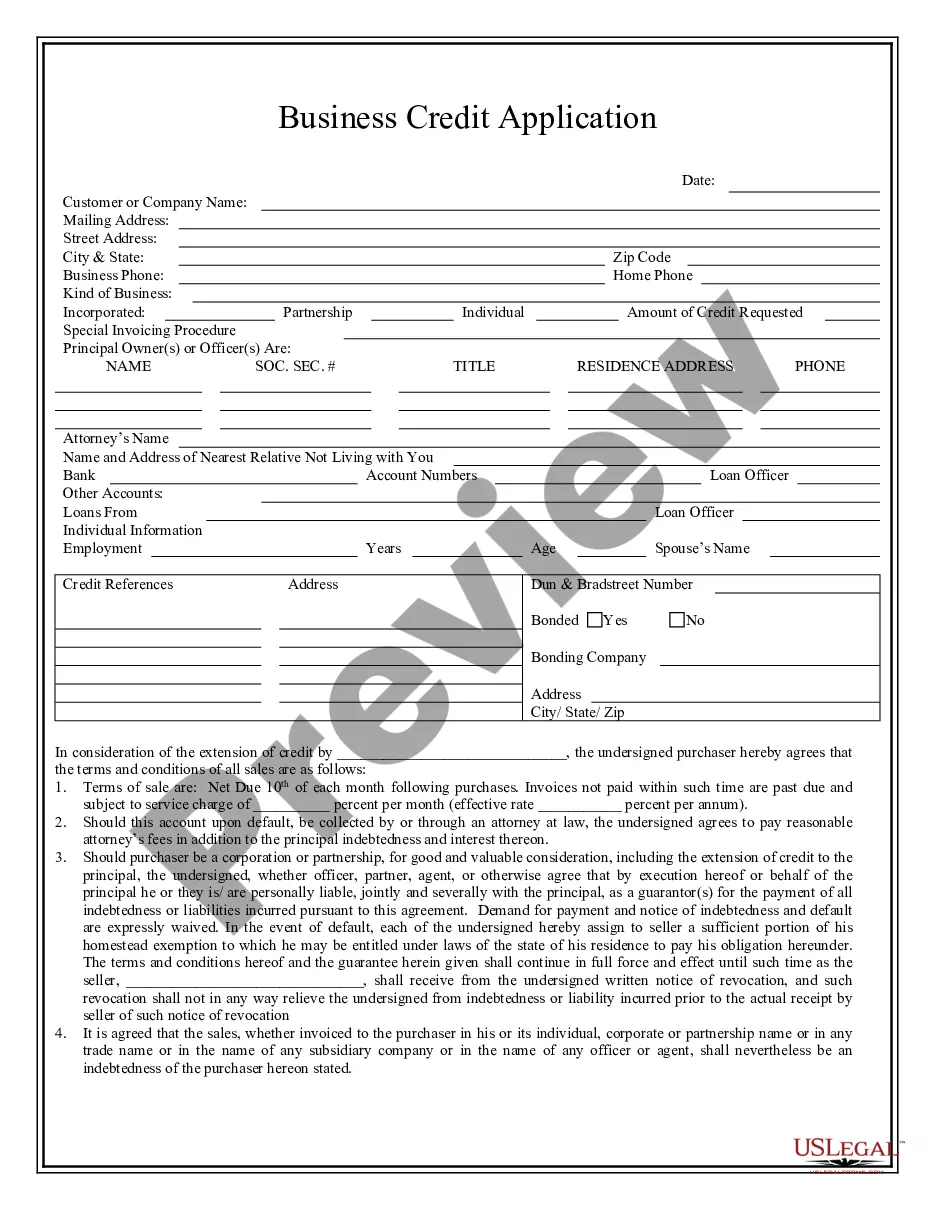

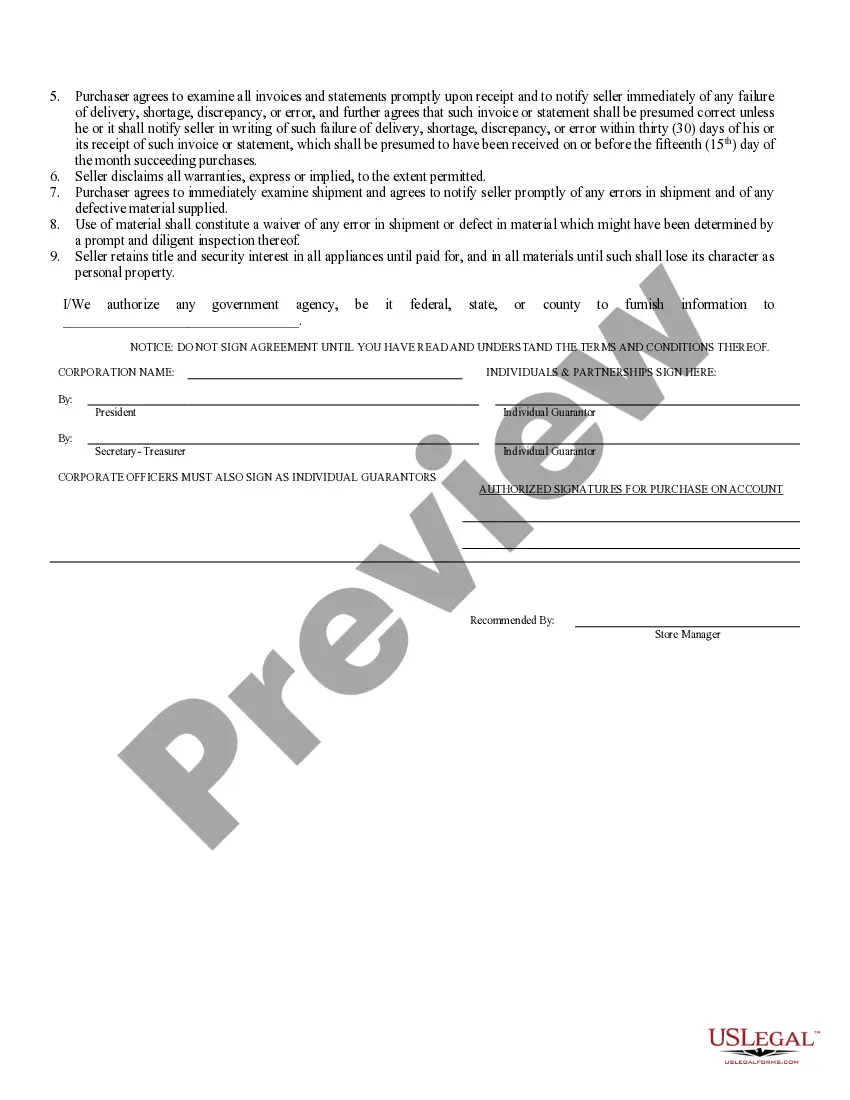

Sterling Heights Michigan Business Credit Application is a comprehensive form specifically designed for businesses operating in Sterling Heights, Michigan, seeking to obtain credit from financial institutions or vendors. This application serves as a pivotal document in the loan approval process that helps lenders evaluate the creditworthiness of the business and determine the amount of credit that can be granted. The Sterling Heights Michigan Business Credit Application encompasses various sections, allowing businesses to provide a detailed overview of their financial standing, operations, and credit history. It typically includes sections asking for general information about the business, such as the legal name, business structure, and contact details. Furthermore, this application requests essential financial information, such as business income, expenses, assets, and liabilities. It requires businesses to provide details on their revenue streams, including sales, profits, and any additional sources of income. Additionally, businesses must disclose their current financial obligations, outstanding loans, and any existing liens against the business. Moreover, Sterling Heights Michigan Business Credit Application comprehensively evaluates a business's payment history, including details of any previous bankruptcies, foreclosures, or delinquencies. It also assesses the credit history of the business owners or principals associated with the company. This thorough investigation ensures that lenders have a clear understanding of the business's financial health and creditworthiness. In Sterling Heights, Michigan, there might be different types of Business Credit Applications catered to specific financing needs. For instance, there could be separate applications for small businesses seeking microloans or start-ups looking for seed funding. Depending on the type of credit required, businesses may encounter specialized credit application forms that focus on distinct industry requirements or target specific loan programs supported by the state or local government. To conclude, Sterling Heights Michigan Business Credit Application is an essential tool for businesses operating in Sterling Heights, enabling them to apply for credit from financial institutions or vendors. By providing detailed financial information, credit history, and other necessary documentation, businesses demonstrate their creditworthiness and increase their chances of accessing the required funding.

Sterling Heights Michigan Business Credit Application

Description

How to fill out Sterling Heights Michigan Business Credit Application?

If you have previously utilized our service, Log In to your account and download the Sterling Heights Michigan Business Credit Application to your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional requirements!

- Verify that you’ve found an appropriate document. Browse the description and utilize the Preview option, if available, to determine if it satisfies your requirements. If it does not fit your needs, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Sterling Heights Michigan Business Credit Application. Choose the file format for your document and save it to your device.

- Complete your document. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Getting business credit with a low personal credit score can be challenging, but it's not impossible. Start by establishing a strong business profile and ensuring your business is registered with the appropriate state and federal agencies. Additionally, consider applying for credit cards or loans specifically designed for businesses, such as the Sterling Heights Michigan Business Credit Application, which can help you build credit based on your business's financial health rather than personal credit. Lastly, forming positive relationships with vendors who report to credit bureaus can help improve your business credit score over time.

The fastest way to secure business credit for your LLC involves initiating relationships with financial institutions and vendors. By quickly submitting a detailed Sterling Heights Michigan Business Credit Application, you can present your LLC's credentials effectively. Consider working with lending platforms that expedite the approval process and always ensure your credit information is accurate and up to date.

Generally, a personal credit score of 680 or higher is often recommended to secure business credit. However, requirements can vary by lender, and some may be more flexible. When you complete a Sterling Heights Michigan Business Credit Application, your personal credit score may be a factor in determining approval. Maintaining a healthy personal credit profile can, therefore, benefit your LLC in the credit application process.

An LLC does not start with a specific credit score. Instead, its creditworthiness will depend on several factors, including payment history, credit usage, and credit inquiries. After applying for a Sterling Heights Michigan Business Credit Application, your LLC will gradually establish a credit score as it engages in financial transactions. The score will reflect the credit history that builds over time.

To obtain business credit for your LLC, first, ensure that your business is registered and has an Employer Identification Number (EIN). Next, complete a Sterling Heights Michigan Business Credit Application with the necessary details. You should also build credit with vendors and open a business bank account, which helps establish your credibility. Monitoring your business credit report regularly can also provide insights into your standing.

To quickly secure business credit, start by establishing your business identity and creditworthiness. Fill out a Sterling Heights Michigan Business Credit Application with accurate details about your LLC. Consider applying with lenders that specialize in fast approvals, as they often streamline the process. It's also beneficial to set up accounts with suppliers that report payments to credit bureaus.

Yes, LLCs can obtain a business line of credit through various lenders. Typically, you will need to provide your business information along with your Sterling Heights Michigan Business Credit Application. Building a solid business credit profile can enhance your chances of approval. Additionally, having a good relationship with a financial institution may facilitate this process.

To complete a business credit card application, gather the necessary information related to your business, such as your EIN, revenue details, and years in operation. Be honest and thorough when answering each section. A well-prepared Sterling Heights Michigan Business Credit Application can enhance your credibility and improve your chances of approval.

Yes, a new Limited Liability Company (LLC) can obtain business credit. After registering your LLC and obtaining an EIN, you can start building your credit profile right away. Completing a Sterling Heights Michigan Business Credit Application is an excellent first step to acquiring the financing resources that can help your business thrive.

The time it takes to establish business credit can vary. Typically, you may start seeing credit results within a few months after you begin building your credit profile. As you submit your Sterling Heights Michigan Business Credit Application, focusing on timely bill payments and maintaining a good credit utilization ratio can significantly speed up the development of your business credit.