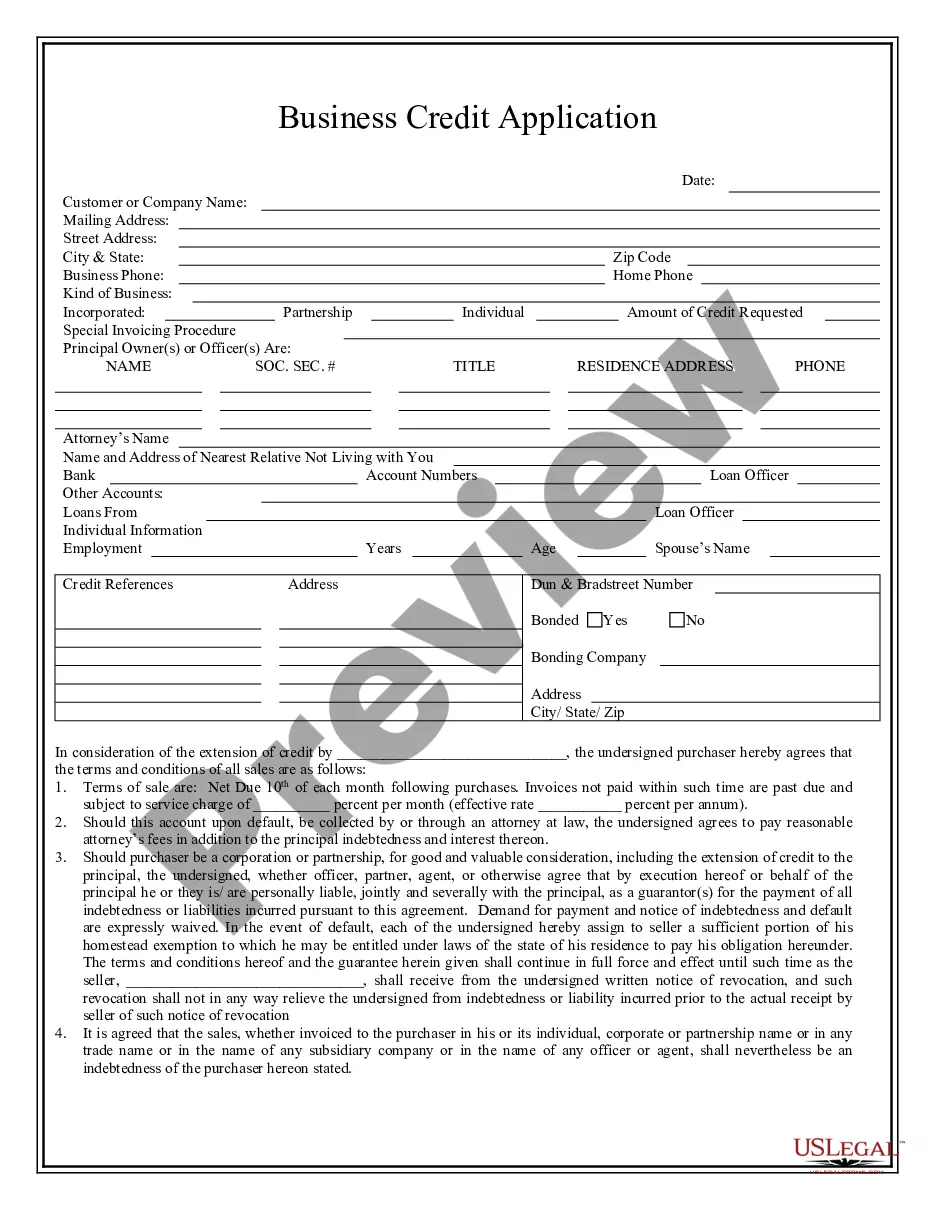

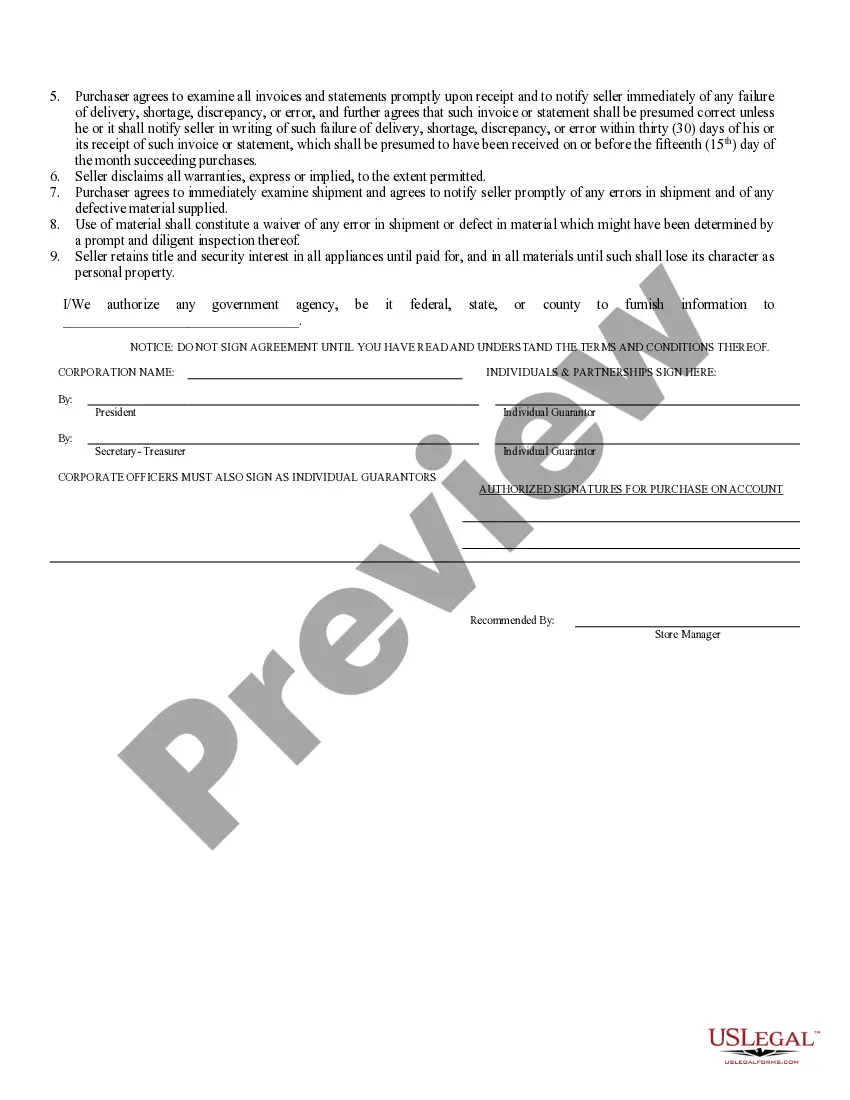

Wayne Michigan Business Credit Application is a comprehensive and structured form utilized by businesses in Wayne, Michigan, to apply for credit services offered by various financial institutions and lenders. This application serves as a crucial document that allows lenders to evaluate the creditworthiness of businesses seeking credit facilities. The Wayne Michigan Business Credit Application captures essential information about the business entity applying for credit, including its legal name, business address, contact details, and tax identification number. Additionally, the application may require specific details such as the date of establishment, ownership structure, and the nature of the business. These details help lenders gain a thorough understanding of the applicant's background and organizational structure. The application form often includes sections to provide financial information, such as annual revenue, net income, and details about the company's assets. This financial data helps lenders assess the business's financial health and its ability to repay any credit extended. Furthermore, the application may inquire about the existing debt obligations, including outstanding loans, credit lines, or any other liabilities. Depending on the lender, there might be various types of Wayne Michigan Business Credit Applications available to cater to different credit needs. Some common types of credit applications include: 1. Small Business Loan Application: Specifically designed for small businesses, this application focuses on requirements for loans to fund operations, expansion, equipment purchases, or working capital requirements. 2. Business Credit Card Application: Geared towards businesses looking for credit cards to streamline their expenses, this type of application helps establish credit lines for purchasing goods and services while keeping personal and business expenses separate. 3. Line of Credit Application: Ideal for businesses requiring flexible access to funds, a line of credit application allows businesses to draw funds as needed and only pay interest on the amount utilized. 4. Equipment Financing Application: Meant for businesses seeking financing to acquire or upgrade equipment, this application focuses on the specific financing and leasing options available for machinery, vehicles, or technology investments. When completing any Wayne Michigan Business Credit Application, it is crucial to provide accurate and up-to-date information to enhance the chances of credit approval. Additionally, businesses should have supporting documents, such as financial statements, tax returns, and business plans, readily available to strengthen their application and showcase their creditworthiness. Overall, the Wayne Michigan Business Credit Application is a vital tool for businesses in the region to access credit and funding opportunities, enabling them to grow, expand, and thrive in their respective industries.

Wayne Michigan Business Credit Application

Description

How to fill out Wayne Michigan Business Credit Application?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Wayne Michigan Business Credit Application gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Wayne Michigan Business Credit Application takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Wayne Michigan Business Credit Application. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!