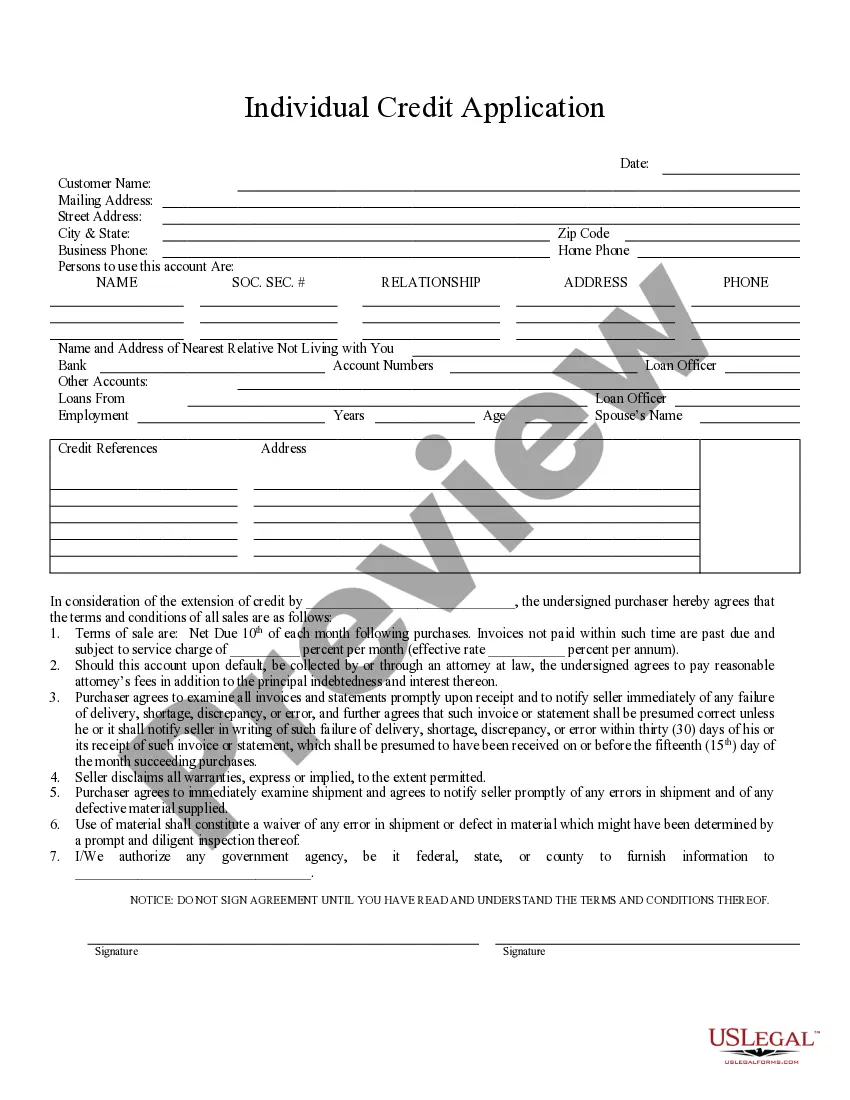

Ann Arbor Michigan Individual Credit Application is a comprehensive form that individuals can fill out when applying for credit in the city of Ann Arbor, Michigan. This application serves as a means to assess an individual's creditworthiness and financial standing when seeking credit from financial institutions, banks, or lenders in Ann Arbor. The Ann Arbor Michigan Individual Credit Application is designed to gather important information about the applicant's personal and financial background. Key components of the application typically include personal details such as name, address, contact information, social security number, and date of birth. Furthermore, the credit application form requires details about the applicant's employment history, including current and previous employers, job titles, duration of employment, and monthly income. This information helps lenders evaluate the stability of an applicant's income source and determine their ability to repay borrowed funds. Additionally, the Ann Arbor Michigan Individual Credit Application may require applicants to provide details about their existing liabilities, such as outstanding loans, mortgages, credit card debt, or other financial obligations. This assists lenders in assessing the applicant's debt-to-income ratio and overall financial health. Moreover, the credit application form might include a section for the applicant to list their personal assets, such as real estate, vehicles, investments, or other valuable possessions. This information is crucial as it helps lenders understand an individual's net worth and collateral, which can be considered when granting credit. It is important to note that there may be different types of Ann Arbor Michigan Individual Credit Applications, each tailored for specific financial products or institutions. For example, there might be separate credit applications for mortgage loans, auto loans, personal loans, or credit cards. These various application forms request specific details relevant to the corresponding credit type, ensuring lenders receive the necessary information to assess an applicant's eligibility. In conclusion, the Ann Arbor Michigan Individual Credit Application is an essential document required when applying for credit in Ann Arbor, Michigan. By providing thorough personal, financial, and employment information, applicants enable lenders to evaluate their creditworthiness and make informed decisions regarding credit approval and terms.

Ann Arbor Michigan Individual Credit Application

Description

How to fill out Ann Arbor Michigan Individual Credit Application?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney solutions that, usually, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Ann Arbor Michigan Individual Credit Application or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Ann Arbor Michigan Individual Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Ann Arbor Michigan Individual Credit Application is proper for your case, you can select the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!