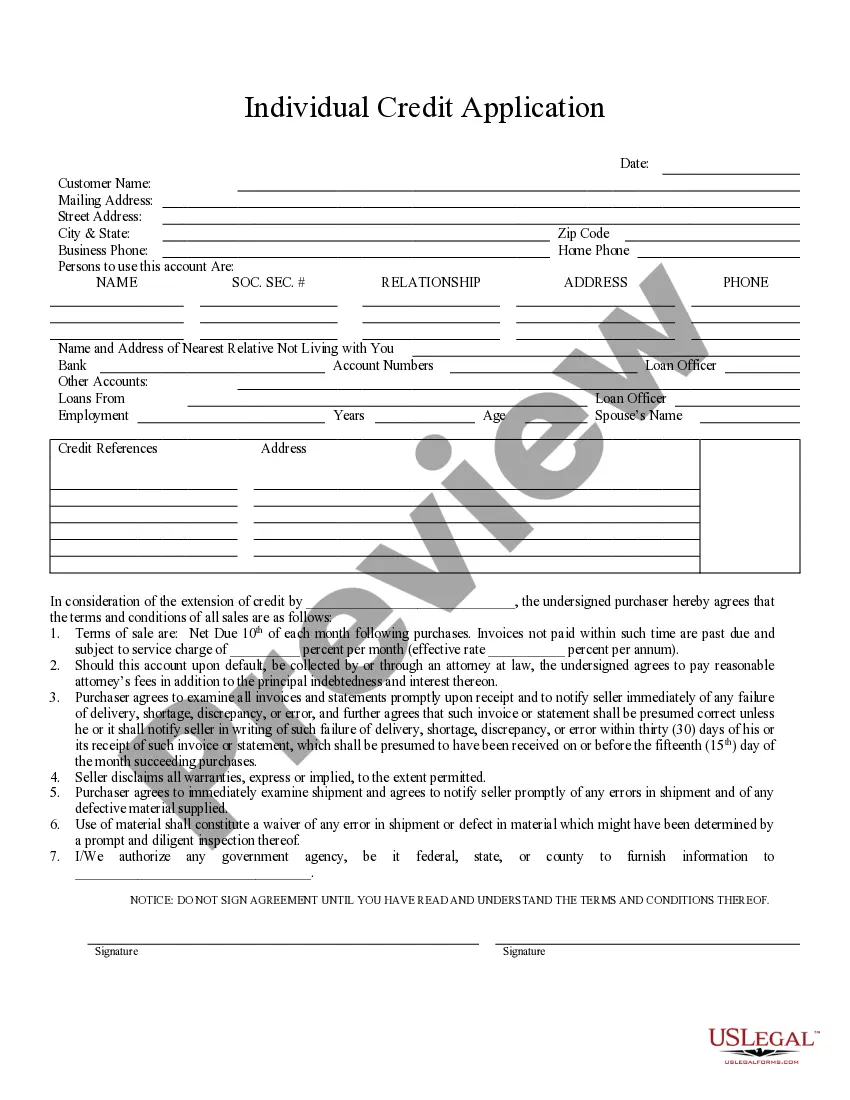

The Detroit Michigan Individual Credit Application is a formal document used by individuals residing in Detroit, Michigan, who wish to apply for credit from a financial institution or lender. This application is specifically designed to collect relevant information from the applicant, which helps the lender assess the applicant's creditworthiness and make informed decisions regarding the extension of credit. The Detroit Michigan Individual Credit Application typically consists of several sections to gather comprehensive information about the applicant. These sections may include personal details such as the applicant's full name, address, contact information, and social security number. Additionally, employment details such as occupation, current employer, and length of employment may be requested. Furthermore, the application may require the applicant to disclose their financial information, including income, assets, and existing debts. This information assists the lender in evaluating the applicant's ability to repay the requested credit and helps determine the credit limit or terms that can be offered. The Detroit Michigan Individual Credit Application also includes legal statements and disclosures regarding the applicant's consent to the lender accessing their credit report and sharing the information provided with relevant parties involved in the credit evaluation process. It is worth noting that different types of credit applications might be available in Detroit, Michigan, to cater to specific credit needs of individuals. Examples of these may include: 1. Auto Loan Credit Application: Specifically designed for individuals seeking credit to purchase a vehicle. This application may include additional fields to collect vehicle-specific information, such as make, model, and desired loan amount. 2. Mortgage Credit Application: Primarily used by individuals applying for a home loan or mortgage. This application requires detailed information about the property being financed, such as its address, purchase price, and loan amount. 3. Personal Loan Credit Application: This application is suitable for individuals looking for unsecured credit for personal expenses such as medical bills, vacations, or debt consolidation. It may focus more on the applicant's income, expenses, and credit history. In conclusion, the Detroit Michigan Individual Credit Application is a comprehensive document that allows individuals in Detroit, Michigan, to apply for credit. It assists lenders in assessing an applicant's creditworthiness and helps determine the type and terms of credit that can be offered. Various variations of this application exist to cater to different credit needs, such as auto loans, mortgages, and personal loans.

Detroit Michigan Individual Credit Application

Description

How to fill out Detroit Michigan Individual Credit Application?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Detroit Michigan Individual Credit Application or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Detroit Michigan Individual Credit Application complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Detroit Michigan Individual Credit Application is proper for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!