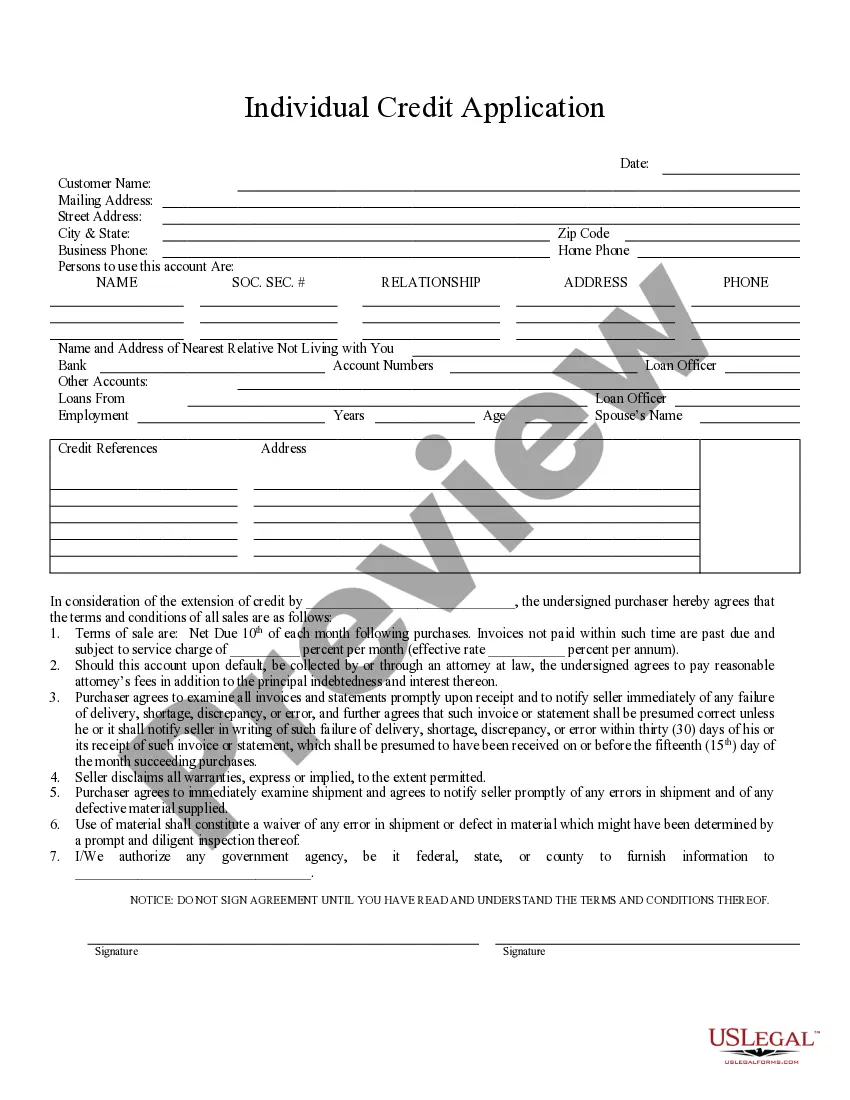

Lansing Michigan Individual Credit Application is a standardized form used by individuals residing in Lansing, Michigan, who are seeking credit from financial institutions or lenders. The application gathers personal and financial information of the individual, allowing lenders to assess the creditworthiness of the applicant. Keywords: Lansing Michigan, Individual Credit Application, financial institutions, lenders, creditworthiness, personal information, financial information. The Lansing Michigan Individual Credit Application is an essential document for potential borrowers looking to secure credit in the city. This form serves as a means for lenders to evaluate the applicant's ability to handle credit obligations responsibly. Various financial institutions and lenders in Lansing, Michigan may have their own version of the Individual Credit Application. However, the overall purpose remains the same — to collect detailed information about the applicant's personal and financial circumstances to determine their eligibility for credit. The Individual Credit Application typically consists of several sections, including personal details, employment information, income and expenses, assets and liabilities, and references. These sections aid the lenders in assessing the applicant's capacity to repay the borrowed funds and manage their financial obligations effectively. When completing the Lansing Michigan Individual Credit Application, applicants are required to provide accurate and up-to-date personal information such as their full name, address, contact details, social security number, and driver's license information. Lenders use this information for identification purposes and to verify the applicant's residency in Lansing, Michigan. The employment section of the application requests details about the applicant's current and previous employment history, including job positions, employers' names, duration of employment, and income. This section helps lenders assess the stability and consistency of the applicant's income source. To determine the applicant's financial standing, the Individual Credit Application asks for a breakdown of monthly income and expenses. This information enables lenders to evaluate the applicant's ability to meet the repayment obligations associated with the requested credit. Additionally, the application requires the disclosure of assets and liabilities, including real estate holdings, vehicles, bank accounts, loans, and credit card debts. These details provide insights into the applicant's overall financial position and help lenders assess their creditworthiness accurately. Lastly, the Individual Credit Application may include a section for personal and professional references. Lenders may contact these references to gather additional information about the applicant's character, reliability, and financial responsibility. Overall, the Lansing Michigan Individual Credit Application ensures that lenders have comprehensive information about the applicant's financial background, responsible credit usage, and ability to repay the loan. By filling out this form accurately, individuals increase their chances of obtaining credit from reputable financial institutions or lenders in Lansing, Michigan. Types of Lansing Michigan Individual Credit Application: — Standard Individual Credit Application: This is the most common type of credit application used by various financial institutions and lenders in Lansing, Michigan. — Online Individual Credit Application: Some lenders may offer an online version of the credit application, allowing applicants to conveniently complete the form digitally. — Specific Lender Credit Application: Certain lenders in Lansing, Michigan may have proprietary credit application forms tailored to their specific requirements and assessment criteria.

Lansing Michigan Individual Credit Application

Description

How to fill out Lansing Michigan Individual Credit Application?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any legal education to draft such paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our service offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Lansing Michigan Individual Credit Application or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Lansing Michigan Individual Credit Application in minutes using our trustworthy service. If you are already an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Lansing Michigan Individual Credit Application:

- Be sure the form you have chosen is specific to your location considering that the regulations of one state or county do not work for another state or county.

- Review the document and read a quick outline (if provided) of cases the paper can be used for.

- If the form you picked doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment method and proceed to download the Lansing Michigan Individual Credit Application once the payment is through.

You’re good to go! Now you can go ahead and print out the document or fill it out online. If you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

Applying for home heating credit in Michigan online is straightforward. You will need to gather necessary documents and access the online application portal provided by the state. Using the Lansing Michigan Individual Credit Application can simplify this process, guiding you through each required step to ensure your application is complete.

The amount of home heating credit in Michigan varies based on your income and household size. On average, the credit can significantly reduce your heating costs. By completing the Lansing Michigan Individual Credit Application, you can estimate your credit and ensure that you gain the benefits available.

Eligibility for the Michigan home heating credit is generally determined by your income level and household circumstances. Homeowners and renters who meet specific criteria may apply. To see how the Lansing Michigan Individual Credit Application can assist you in this process, take the time to check your eligibility.

Yes, you can file city of Detroit taxes electronically. The city offers an online portal designed for easy tax filing. By using the Lansing Michigan Individual Credit Application, you gain access to user-friendly tools that help you navigate the tax process with ease.

The deadline for submitting the Michigan homestead property tax credit typically aligns with the state tax return deadline. Generally, this means you need to submit your application by May 1 each year. To avoid any confusion, make sure you submit your Lansing Michigan Individual Credit Application on time.

To determine if you qualify for the Michigan homestead property tax credit, review the eligibility criteria provided by the state. Generally, this credit is available to homeowners who meet specific income and occupancy guidelines. Utilizing the Lansing Michigan Individual Credit Application can help streamline your assessment and ensure that you get the credits you deserve.

Yes, you can file your Michigan taxes online. The state provides various electronic options that simplify the process. By using the Lansing Michigan Individual Credit Application, you can ensure that your submissions are accurate and timely. This will help you complete your taxes without the hassles of paperwork.

Yes, East Lansing does have a city income tax, which applies to residents and non-residents who work in the city. Understanding this tax is essential when preparing your Lansing Michigan Individual Credit Application. Familiarizing yourself with the local tax code will help you avoid mistakes and make your tax filing experience smoother.

To file your East Lansing taxes, start by gathering all necessary documents, including income statements and deductions. You can use the USLegalForms platform to assist you in completing your Lansing Michigan Individual Credit Application correctly. Following the local guidelines will ensure you meet all requirements and deadlines.

The income limit for the Michigan homestead property tax credit varies based on several factors, including your filing status and property type. To stay updated, check the latest information while preparing your Lansing Michigan Individual Credit Application. This credit can help homeowners save significantly, so understanding the limits is beneficial.