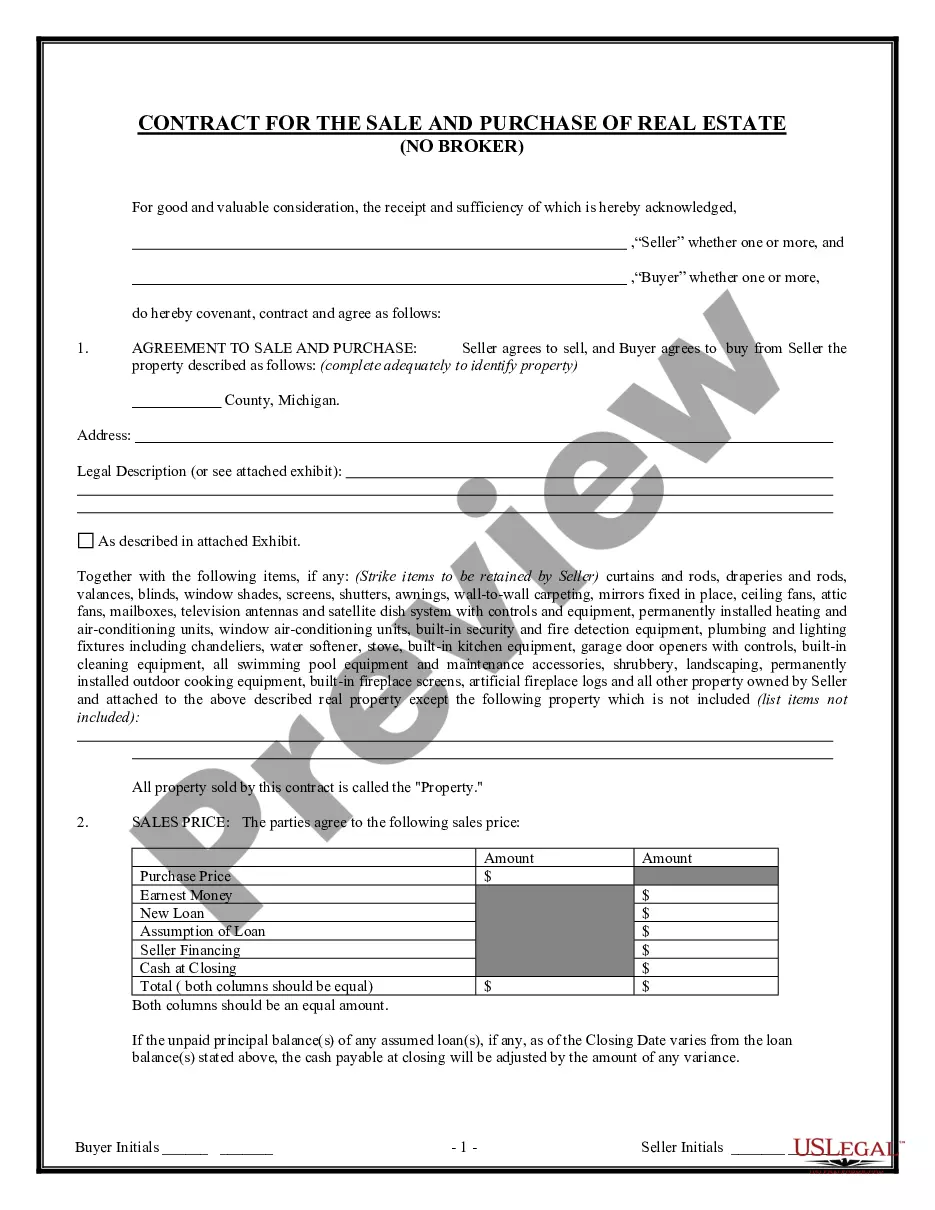

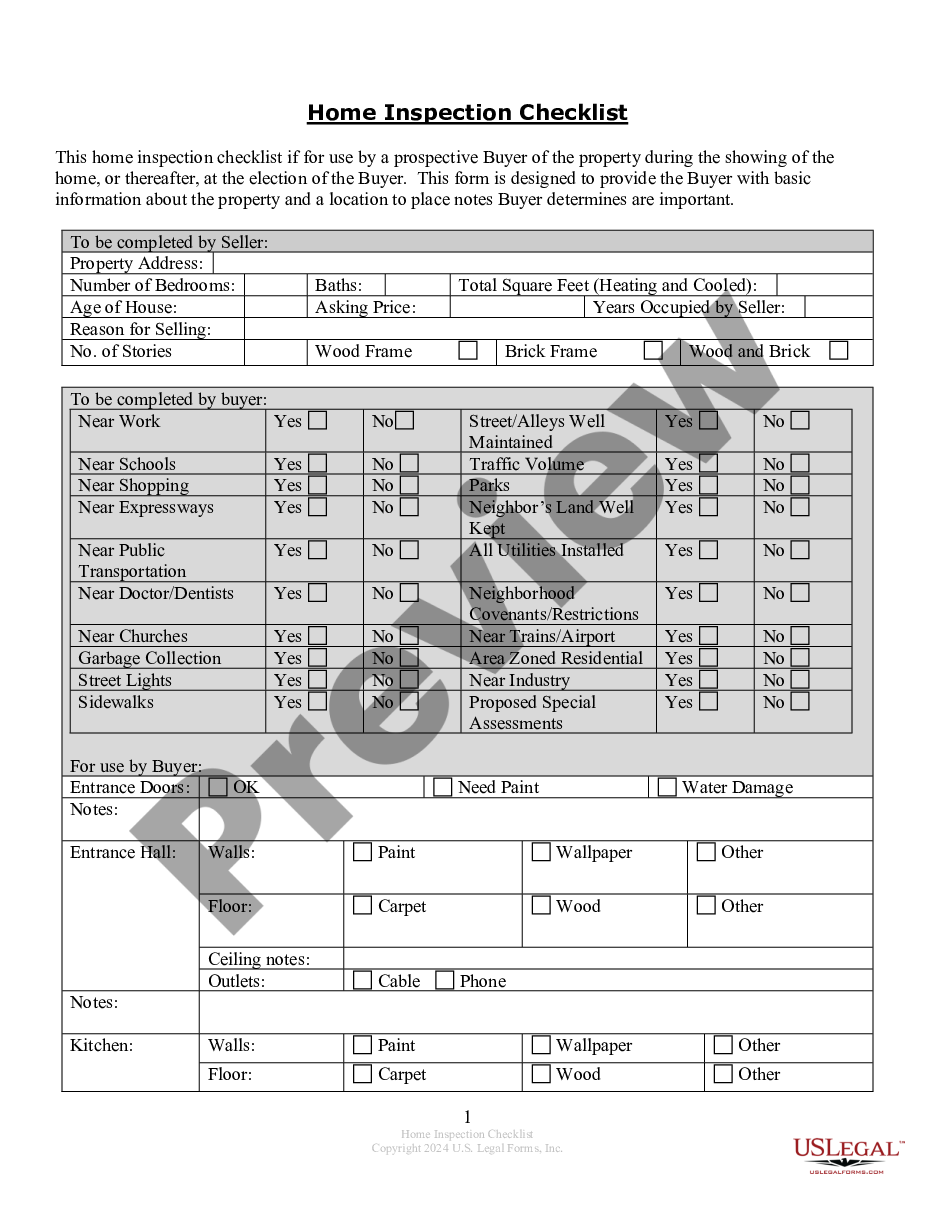

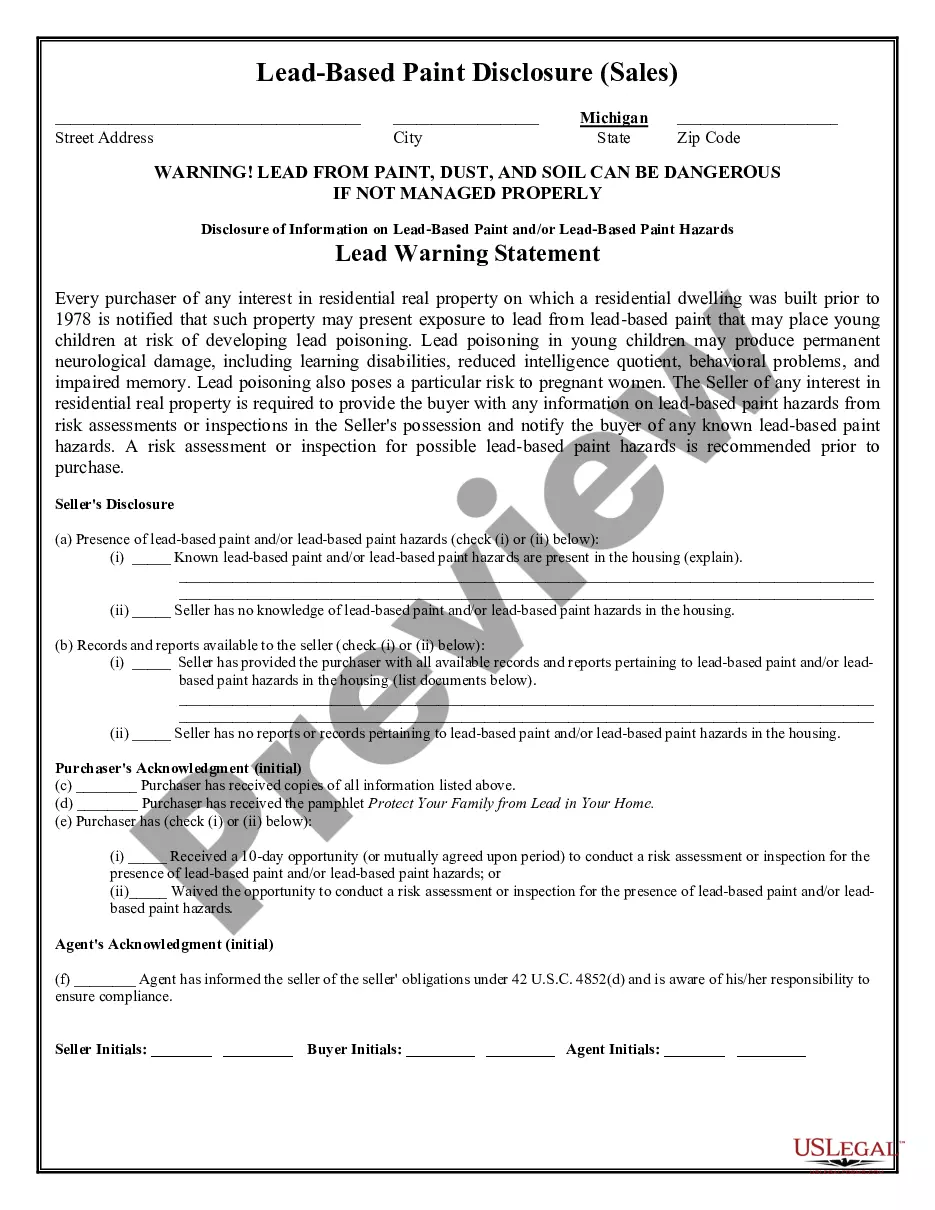

The Oakland Michigan Residential Real Estate Sales Disclosure Statement is a critical legal document that must be completed during the residential real estate sales process in Oakland County, Michigan. It serves as a necessary disclosure agreement between the seller and the buyer, ensuring transparency in the transaction. This disclosure statement is designed to provide potential buyers with important information about the property they are considering purchasing. It covers a variety of areas, including but not limited to the physical condition of the property, known defects, past repairs or renovations, and any environmental or hazardous conditions that might affect the property. By disclosing such information, the seller aims to provide the buyer with a comprehensive understanding of the property's condition and any potential concerns or issues. This helps the buyer make an informed decision before acquiring the property and eliminates the risk of legal disputes arising from undisclosed defects or problems. Some relevant keywords for the Oakland Michigan Residential Real Estate Sales Disclosure Statement include: real estate sales, disclosure statement, Oakland County, residential property, transparency, legal document, buyer, seller, physical condition, defects, repairs, renovations, environmental conditions, hazardous conditions, property condition, informed decision, legal disputes. It is important to note that while the Oakland Michigan Residential Real Estate Sales Disclosure Statement is the primary disclosure document used in the county, there may be variations or additional disclosure statements based on specific property types or circumstances. These could include disclosures related to condos, townhouses, historic properties, or properties within specific subdivisions or communities. The specific types of disclosure statements required may vary depending on the property's characteristics and Oakland County's regulations. It is recommended that buyers and sellers consult with a real estate professional or legal advisor familiar with the laws and regulations in Oakland County, Michigan, to ensure compliance with all necessary disclosure requirements and to properly complete the Residential Real Estate Sales Disclosure Statement.

Oakland Michigan Residential Real Estate Sales Disclosure Statement

Description

How to fill out Oakland Michigan Residential Real Estate Sales Disclosure Statement?

Take advantage of the US Legal Forms and obtain immediate access to any form you require. Our useful platform with thousands of document templates makes it easy to find and obtain virtually any document sample you need. You are able to export, complete, and certify the Oakland Michigan Residential Real Estate Sales Disclosure Statement in a few minutes instead of surfing the Net for several hours seeking a proper template.

Utilizing our catalog is an excellent strategy to raise the safety of your record filing. Our experienced legal professionals regularly check all the records to make sure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How can you obtain the Oakland Michigan Residential Real Estate Sales Disclosure Statement? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

- Open the page with the form you require. Make sure that it is the template you were hoping to find: check its name and description, and use the Preview option if it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading process. Select Buy Now and choose the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Export the document. Choose the format to obtain the Oakland Michigan Residential Real Estate Sales Disclosure Statement and change and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable form libraries on the web. Our company is always ready to help you in virtually any legal case, even if it is just downloading the Oakland Michigan Residential Real Estate Sales Disclosure Statement.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

In Michigan, the seller of a residential property has an obligation to disclose certain information to the buyer of the property in what is commonly referred to as a ?Seller's Disclosure Statement.? The Seller Disclosure Act, MCL 565.951, et seq.

YES. e law requires an agency disclosure form only if the property in question includes one to four residential dwelling units or a residential building site.

In Michigan, the seller of a residential property has an obligation to disclose certain information to the buyer of the property in what is commonly referred to as a ?Seller's Disclosure Statement.? The Seller Disclosure Act, MCL 565.951, et seq.

Michigan Seller's Disclosure Exemptions Sr. No.Exemption6.The transferee is a spouse or a person in the lineal line of consanguinity7.Transfer arising from a divorce, maintenance or property settlement between spouses8.The transfer is made to or from a government entity6 more rows

Although a seller's broker in Michigan has no legal obligation to disclose property defect information to the buyer, and is not liable for the seller's misrepresentations about the property, there is still a possibility that the broker may have some legal liability. (Alfiero v. Bertorelli, 295 N.W.

Important and relevant issues which need disclosing are: Flooding issues, whether current or historic. Any known structural issues concerning the property. Proposals for nearby development and construction (if applicable)

A Michigan property disclosure statement is a form through which sellers must report the condition of their residential real estate to potential buyers. The items specified may include pending legal cases, unpaid fees, property defects, or damage from flooding or fires.

Michigan requires sellers to use a standardized form for property disclosures, called the Seller Disclosure Statement, and sets forth the language for it within the actual law.